Signs Point to a Potential Upswing for American Lithium Corp. (AMLI)

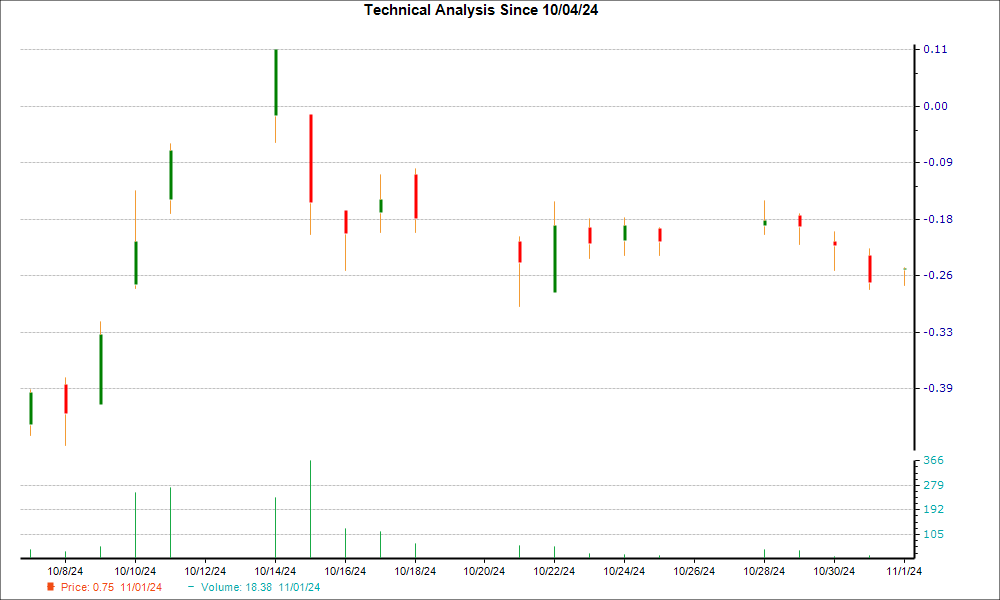

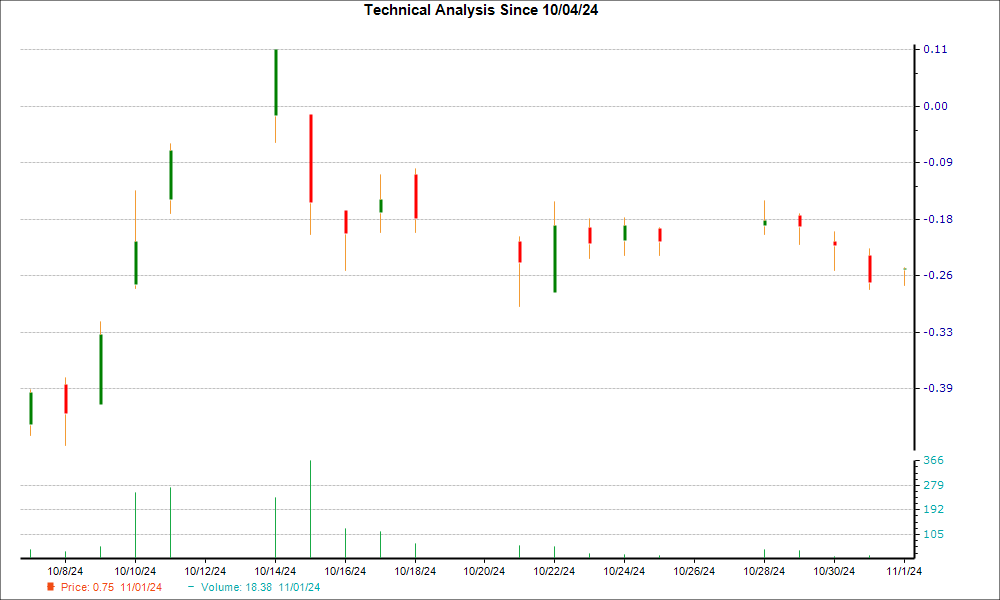

The stock price for American Lithium Corp. (AMLI) has been on a downward trend recently, dropping by 8.3% in the last two weeks. Yet, a hammer chart pattern that emerged during the last trading session suggests that the stock may be poised for a trend reversal, indicating that buyers may be gaining control to establish support.

The hammer pattern serves as a technical signal that the stock could be nearing a low point, showcasing a potential decrease in selling pressure. Furthermore, strong backing from Wall Street analysts who are revising their earnings estimates upwards adds further validity to the possibility of a bullish shift for AMLI.

What Is a Hammer Chart and How to Use It

A hammer chart is a well-known price pattern in candlestick charting. It features a small body with little difference between the opening and closing prices, while a longer lower wick illustrates the volatility of the day. For a candle to qualify as a hammer, the lower wick should be at least twice the length of the body.

In a typical downtrend, the bears dominate as the stock usually opens lower than the previous day’s close, followed by another drop. Upon reaching a new low, the stock finds support and buying interest emerges, resulting in a close close to or slightly above the opening price.

When this pattern appears at a low point during a downtrend, it signifies that selling pressure may be weakening, hinting at a potential reversal in favor of buyers.

Hammer candles can form on various timeframes, appealing to both short-term and long-term investors.

However, like any technical indicator, the hammer pattern has limitations. Its effectiveness can vary based on chart placement, so it is essential to use it alongside other bullish indicators.

Factors That Could Signal a Turnaround for AMLI

Recently, there’s been a surge in earnings estimate revisions for AMLI, which can be seen as a positive sign on the fundamental side. A rising trend in these revisions typically indicates potential price gains in the near term.

In the past month, the consensus earnings per share (EPS) estimate for the current year has climbed by 7.4%. This reflects a broad consensus among analysts that AMLI will exceed previous earnings forecasts.

Additionally, AMLI holds a Zacks Rank of #2 (Buy), placing it in the top 20% of over 4,000 ranked stocks by earnings estimate trends and EPS surprises. Stocks carrying a Zacks Rank of #1 or #2 often outperform the overall market. For those interested, a complete list of today’s Zacks Rank #1 stocks is available here.

The Zacks Rank also serves as an excellent timing tool, guiding investors on when a company’s outlook may be improving. Therefore, the Zacks Rank of 2 for American Lithium could signal a potential turnaround ahead.

A Top Stock Pick with Great Potential

From a selection of thousands of stocks, five Zacks experts have identified their favorite to potentially soar by over +100% in the coming months. Among them, Director of Research Sheraz Mian has chosen one with exceptional upward potential.

This company is focusing on millennial and Gen Z consumers, raking in nearly $1 billion in revenue just last quarter. Its recent stock pullback presents a promising opportunity to invest. Although not all of Zacks’ top picks succeed, this one could exceed the performance of stocks like Nano-X Imaging, which surged +129.6% within just over nine months.

Free: Discover Our Top Stock and Four Contenders

Free Stock Analysis Report for American Lithium Corp. (AMLI)

Read this article on Zacks.com for more information.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.