Utilities and Healthcare Sectors Struggle Amid Market Fluctuations

Constellation Energy and Public Service Enterprise See Significant Losses

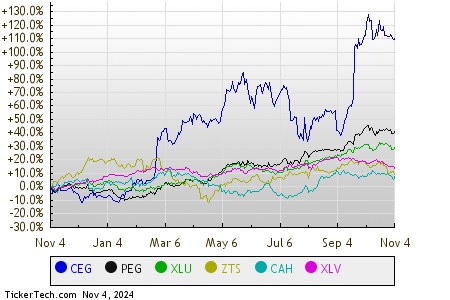

As markets approached midday on Monday, Utilities companies faced significant challenges, showing a decline of 0.8%. Among the larger players, Constellation Energy Corp (Symbol: CEG) fell by 10.6%, while Public Service Enterprise Group Inc (Symbol: PEG) declined by 6.5%. The Utilities Select Sector SPDR ETF (Symbol: XLU), an ETF that tracks this sector, dropped 1.3% but remains up 24.32% since the beginning of the year. Notably, Constellation Energy has surged 98.35% year-to-date, and Public Service Enterprise is up 36.50%. Together, these two stocks constitute roughly 9.6% of XLU’s holdings.

Healthcare Sector Also Declines but Shows Mixed Results Among Key Stocks

The Healthcare sector experienced a slight dip of 0.1%. Zoetis Inc (Symbol: ZTS) and Cardinal Health, Inc. (Symbol: CAH) were among the laggards, with losses of 3.1% and 2.2%, respectively. The Health Care Select Sector SPDR ETF (XLV), which monitors the performance of healthcare stocks, dropped 0.6% during midday trading but is still up 8.87% year-to-date. Zoetis has declined 9.84% in 2023, whereas Cardinal Health has advanced by 14.63%. Collectively, ZTS and CAH represent about 2.0% of XLV’s holdings.

Below is a comparison chart depicting the price performance of selected stocks and ETFs over the past twelve months. Each symbol is denoted in a different color, as labeled in the legend below:

A Look at S&P 500 Sector Performance This Afternoon

In the afternoon trading session, the performance of various sectors within the S&P 500 displayed a clear divide. Six sectors reported gains, while three sectors experienced declines.

| Sector | % Change |

|---|---|

| Energy | +1.6% |

| Materials | +0.6% |

| Consumer Products | +0.4% |

| Services | +0.4% |

| Technology & Communications | +0.4% |

| Industrial | +0.3% |

| Healthcare | -0.1% |

| Financial | -0.1% |

| Utilities | -0.8% |

Additional Resources:

• Dividend Yield

• HCAT Options Chain

• Top Ten Hedge Funds Holding BCAL

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.