“`html

Exxon Mobil Surpasses Earnings Expectations but Faces Challenges Ahead

On Friday, Exxon Mobil Corporation XOM reported third-quarter 2024 earnings that exceeded expectations, driven by cost-cutting measures, high-yield investments, and strategic sales of assets. These factors contribute to a strong outlook for the company. Before diving into the implications for investors, let’s first look at the financial results from the third quarter.

Overview of ExxonMobil’s Q3 Earnings

ExxonMobil posted earnings per share of $1.92 (excluding identified items), surpassing the Zacks Consensus Estimate of $1.91. However, this figure represents a decline from the prior year’s earnings of $2.27.

Total quarterly revenue reached $90 billion, falling short of the Zacks Consensus Estimate of $93.5 billion. This also reflected a drop from last year’s total of $90.8 billion. For more details, check our blog: Exxon Mobil Q3 Earnings Top Estimates on Higher Liquids Production.

Chevron Corporation CVX and BP plc BP are also prominent players in the energy sector, having released their earnings as well.

The Role of Permian and Guyana in ExxonMobil’s Strategy

Focusing on the Permian Basin, ExxonMobil acquired Pioneer Natural Resources Company on May 3. This acquisition expanded the company’s footprint to 1.4 million net acres in the Delaware and Midland basins, with an estimated 16 billion barrels of oil equivalent resources. This move represents significant growth in its upstream operations.

Based on 2023 data, ExxonMobil anticipates that its production from the Permian will more than double to 1.3 million barrels of oil equivalent per day (MMBoE/D). By 2027, the company projects that Permian production will further increase to 2 MMBoE/D.

Alongside its Permian operations, ExxonMobil has a solid pipeline of projects in offshore Guyana. The company is poised to achieve strong returns from both regions due to their low production costs. Favorable oil prices this year are likely to generate substantial cash flows from these operations, which form the bulk of ExxonMobil’s revenues.

Investments in Low-Carbon and Innovation

ExxonMobil is making significant investments in low-carbon ventures, including a hydrogen facility with zero emissions and extensive carbon capture and storage (CCS) initiatives. These efforts underscore the company’s commitment to a diverse portfolio and sustainable energy solutions.

Thanks to its integrated business model, ExxonMobil is better equipped to weather downturns in oil prices. In addition to exploration and production, the company has a substantial presence in refining and chemicals, which supports its financial stability.

Furthermore, ExxonMobil’s strong balance sheet, coupled with a much lower debt-to-capitalization ratio compared to industry peers, enhances its financial standing. Improved commodity prices have allowed the company to strengthen its financial position and reduce the debt accrued during the pandemic.

Should Investors Consider ExxonMobil Now?

Beyond its traditional operations, ExxonMobil is expanding into lithium markets, which are crucial for electric vehicle batteries. With increasing demand for lithium driven by the growth in electric vehicles, the company is well-positioned for future gains.

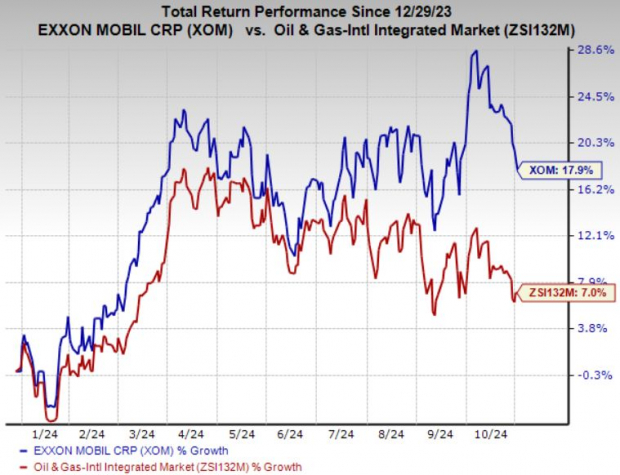

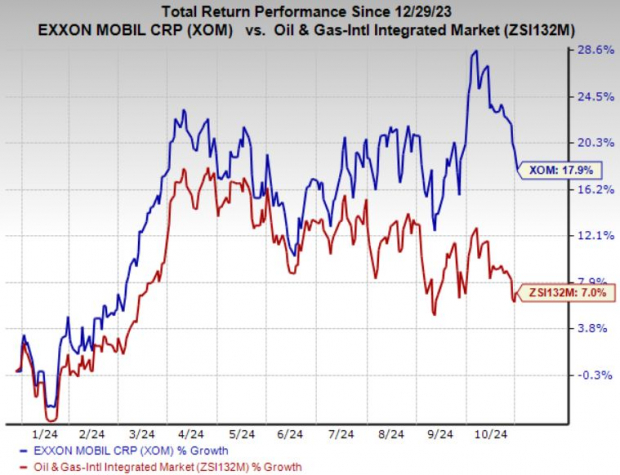

This strong performance has pushed ExxonMobil’s stock up 17.9% year-to-date, outperforming the 7% increase of the broader industry.

Image Source: Zacks Investment Research

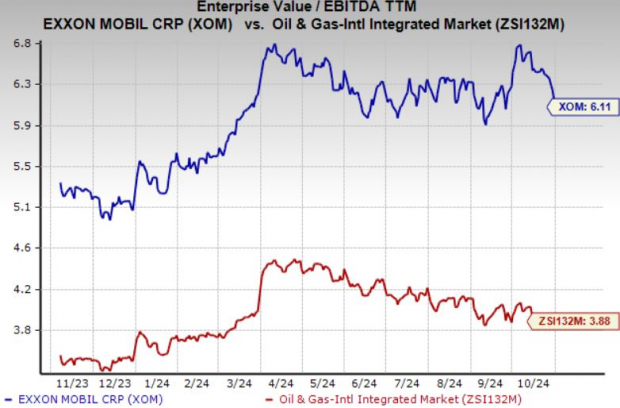

Despite this increase, the stock now appears relatively expensive. Currently trading at a 6.11x trailing 12-month Enterprise Value to Earnings Before Interest, Taxes, Depreciation and Amortization (EV/EBITDA), ExxonMobil commands a premium over the industry average of 3.88x.

Image Source: Zacks Investment Research

This premium suggests that investors are optimistic about ExxonMobil’s growth and feel justified in paying a higher price for its shares. However, potential investors should consider several factors before buying in. For instance, the Pioneer acquisition and new projects may lead to increased short-term costs, which could impact near-term profitability. The complexity of these initiatives also adds operational strain.

Though ExxonMobil’s investments in low-carbon technologies, hydrogen, and advanced materials show promise, the financial returns from these long-term projects remain uncertain. Profitable scaling in the near term could present challenges.

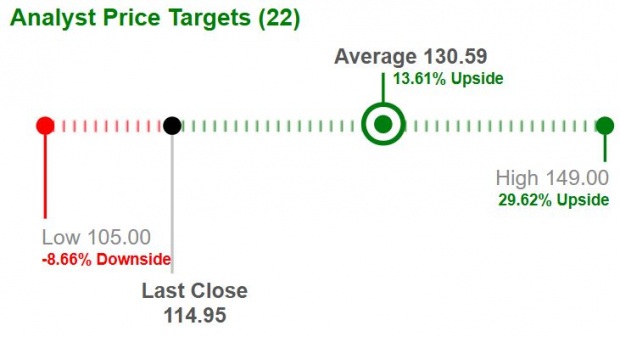

Nevertheless, the overall outlook for ExxonMobil is positive. Analysts project that the Wall Street average price target is 13.6% above its last closing price of $114.95, with the highest target reaching $149, reflecting a potential upside of 29.6%.

Image Source: Zacks Investment Research

Thus, existing investors may choose to hold onto their shares to take advantage of this upward price trend. However, for those considering a new investment in ExxonMobil, it may be wiser to wait for a better entry point, given the current overvaluation. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts…

“““html

Unlocking Potential: A Stock Poised for Major Gains

Top Analysts Predict Big Moves for This Company Targeting Young Consumers

Recently, a group of financial experts highlighted five stocks they believe could soar over 100% in the upcoming months. Among these options, Director of Research Sheraz Mian singles out one company that stands out as having the greatest growth potential.

This company focuses on attracting millennial and Gen Z consumers, raking in nearly $1 billion in revenue just last quarter. A recent decline in its stock prices presents a prime opportunity for investment. Although not every recommended stock experiences success, this one aims to exceed previous Zacks favorites like Nano-X Imaging, which surged by an impressive 129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

For those interested in receiving the latest investment suggestions from Zacks Investment Research, you can download 5 Stocks Set to Double for free.

Additional resources include:

- BP p.l.c. (BP) : Free Stock Analysis Report

- Chevron Corporation (CVX) : Free Stock Analysis Report

- Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

For further details, you can read an insightful article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`