Investors Eye Arista Networks and Arm Holdings Ahead of Earnings Reports

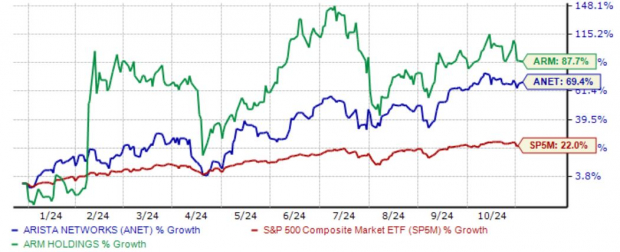

The AI boom continues to attract investors, leading many to seek opportunities in this space over the past year. This week, two key players in the technology sector, Arista Networks (ANET) and Arm Holdings (ARM), are set to release their earnings reports. Both companies have shown impressive stock performance this year, significantly outpacing the S&P 500.

Image Source: Zacks Investment Research

Let’s examine what to expect from each company ahead of their announcements.

Arista Networks: A Surge in Profitability

Arista Networks, ranked #1 (Strong Buy) by Zacks, leads in client-to-cloud networking for data centers, depending on large-scale environments. Analysts have favorable opinions on the company, forecasting a $2.09 Zacks Consensus EPS estimate that represents a strong 14% increase compared to last year.

Image Source: Zacks Investment Research

Recent revenue revisions have also shown an upward trend, with an expected $1.8 billion indicating a 16% growth year-over-year. The company has consistently reported sequential revenue growth for the last ten periods, showcasing solid business performance.

A quarterly sales chart illustrates their positive trajectory.

Image Source: Zacks Investment Research

Margin recovery has also been a crucial aspect of Arista’s recent performance. The company has achieved a noteworthy 33% EPS growth due to improved profitability. For the upcoming release, ANET expects a non-GAAP gross margin in the range of 63% to 64%. The following chart emphasizes the 12-month trailing results.

Image Source: Zacks Investment Research

Arm Holdings: Record Performance Ahead

Arm specializes in designing and licensing high-performance, energy-efficient CPU technology, which is essential for top semiconductor manufacturers and original equipment manufacturers (OEMs) worldwide.

The company’s earnings have been positive since going public, averaging a remarkable 22% outperformance against consensus EPS projections over its first four reports. For their next release, ARM faces expectations of a 30% EPS decline, along with a slight 0.4% sales growth.

A quarterly sales chart for Arm is available below.

Image Source: Zacks Investment Research

Recent performance has been bolstered by record royalty revenues, particularly from the adoption of Arm’s latest technology, Armv9. In the recent period, revenue from Armv9-based chips rose to about 25% of total royalty revenue, up from 20% and 15% in preceding quarters.

Royalty revenue will again be a critical focus during the upcoming earnings release. The growth in the mobile market has led to a 50% increase in smartphone royalty revenue recently. As chip technology becomes more complex and AI adoption accelerates, Arm is well-positioned to benefit significantly.

Conclusion: Earnings Season is Here

Earnings season remains in full swing, with a diverse range of companies revealing their financial results daily. This week, Arista Networks (ANET) and Arm Holdings (ARM), both beneficiaries of the AI trend, will present their quarterly results.

For ANET, margin performance will play a vital role, with expectations for strong revenue and earnings growth. Historically, Arista’s earnings announcements have prompted positive stock reactions, contributing to substantial share performance this year.

In the case of Arm, the upcoming report will likely be influenced by royalty revenue, particularly from Armv9 technology, as its mobile market penetration continues to expand.

Exclusive Stock Picks from Zacks

From an extensive list of stocks, five Zacks experts have identified their top choices poised for significant growth. Among them, Director of Research Sheraz Mian has spotlighted one stock that he believes could double in value. This company, focused on engaging millennial and Gen Z consumers, generated nearly $1 billion in revenue last quarter.

A recent dip in stock price provides a favorable entry point. Although not every stock will succeed, this one has the potential to outperform past recommendations, such as Nano-X Imaging, which soared over 129% within nine months.

Free: See Our Top Stock And 4 Runners Up

For the latest stock recommendations from Zacks Investment Research, download our report on the 5 Stocks Set to Double.

ARM Holdings PLC Sponsored ADR (ARM): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

To view this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.