Nvidia (NASDAQ: NVDA) has been one of the top-performing stocks for the last two years. As we look ahead to 2025, indicators suggest it will continue to perform well, although its rapid growth may slow down. While Nvidia’s stock price is likely to rise, investors might find a compelling alternative in a different tech giant.

So, which stock could potentially outperform the leader in artificial intelligence (AI) investing? The answer lies with Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), for several reasons.

Alphabet’s Diverse Business Strengths Shine

Alphabet is the parent company of Google, heavily focused on advertising, which accounts for about three-fourths of its revenue. Concerns had arisen regarding Google’s future in the era of generative AI, but those worries have not materialized. Instead, Google has embraced these trends, ready to adapt and innovate even further if new competitors enter the market.

Alphabet’s positive performance is evident. In Q3, Google’s Search revenue climbed by 12.3% year-over-year, demonstrating solid growth from a mature segment. This growth provides a platform for Alphabet to expand its other ventures.

Particularly impressive is Google Cloud, which posted a remarkable 35% year-over-year revenue increase, achieving a 17% operating margin. This growth indicates acceleration from earlier quarters, where Google Cloud expanded by 29% in Q2 and 28% in Q1. The management credits its generative AI tools as a significant factor in this success, as they offer unmatched resources to developers.

Although Google Cloud contributes only about 13% of Alphabet’s total revenue, it significantly boosts overall growth, with total revenue increasing by 15% year-over-year. Coupled with efforts for efficiency and stock buybacks, Alphabet’s earnings per share (EPS) rose from $1.55 to $2.12, marking a 37% increase.

The market responded favorably, leading to a rise in Alphabet’s stock price. However, it’s essential to note that these numbers still fall short of Nvidia’s impressive performance.

How could Alphabet possibly outperform Nvidia in 2025?

Alphabet’s Stock Valuation Has Room for Growth

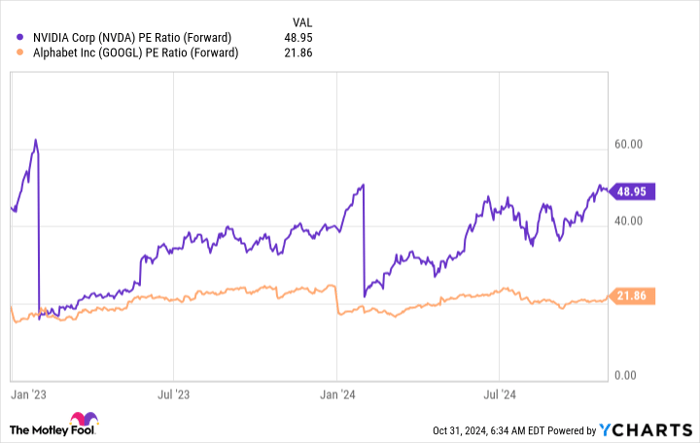

Alphabet’s stock currently trades at 22 times forward earnings, considerably less than Nvidia’s 49 times. This discrepancy highlights the significant valuation difference between the two companies. Alphabet’s valuation is even below the broader market, represented by the S&P 500, which trades at 24 times forward earnings.

NVDA PE Ratio (Forward) data by YCharts

This low price-to-earnings ratio signals that the market may undervalue Alphabet. For comparison, consider other major tech players like Microsoft, which reported EPS growth of only 10% but trades at 31 times forward earnings. Similarly, Apple’s best quarter since 2022 showed 16% EPS growth, yet its stock trades for 30 times forward earnings.

Essentially, the market appears to underestimate Alphabet, even though its EPS is growing significantly faster than many of its peers.

On the other hand, while Nvidia has enjoyed remarkable growth, forecasts indicate a slowdown, with EPS growth projected to be around 43% for FY 2026.

This combination suggests that even if Alphabet does not grow as rapidly as Nvidia, the increase in Alphabet’s earnings multiple, coupled with a likely decrease in Nvidia’s valuation, could position Alphabet to outperform in 2025. Regardless of whether it surpasses Nvidia, Alphabet remains one of the most attractive investments available today.

Is Investing $1,000 in Alphabet a Smart Move?

Before purchasing Alphabet stock, consider this:

The Motley Fool Stock Advisor team has recently identified what they believe are the 10 best stocks to invest in right now… and Alphabet is not among them. The stocks highlighted could provide significant returns in the future.

For instance, if you had invested $1,000 in Nvidia after it was recommended on April 15, 2005, your investment would now be worth $829,746!*

Stock Advisor offers a straightforward strategy for investors, including tips on building a portfolio, regular updates, and two new stock selections each month. Since 2002, subscribers have more than quadrupled the S&P 500’s returns.

Find out about the 10 stocks »

*Stock Advisor returns as of November 4, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury holds positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Apple, Microsoft, and Nvidia. The Motley Fool recommends specific options involving Microsoft. The Motley Fool adheres to a strict disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.