Maximizing Returns: A Look at Western Alliance Bancorporation’s Covered Call Strategy

Shareholders of Western Alliance Bancorporation (Symbol: WAL) can enhance their income beyond the stock’s 1.8% annual dividend yield. By selling a covered call for January 2027 at a $125 strike price, investors can earn a premium based on a $7.50 bid. This situation could provide an additional 4% rate of return on the current stock price, resulting in a total of 5.8% if the stock is not called away. It’s important to note that any gains above $125 will be forfeited if the stock appreciates beyond that level. However, for this to occur, WAL shares would need to rise 47.8% from their current position, leading to a remarkable 56.6% return if the stock is called, plus any dividends earned before that point.

Dividend payouts are inherently unpredictable and can vary based on the company’s profitability. For investors in Western Alliance Bancorporation, examining the dividend history chart below can provide insight into whether the latest dividend is sustainable and if a 1.8% annualized yield is realistic.

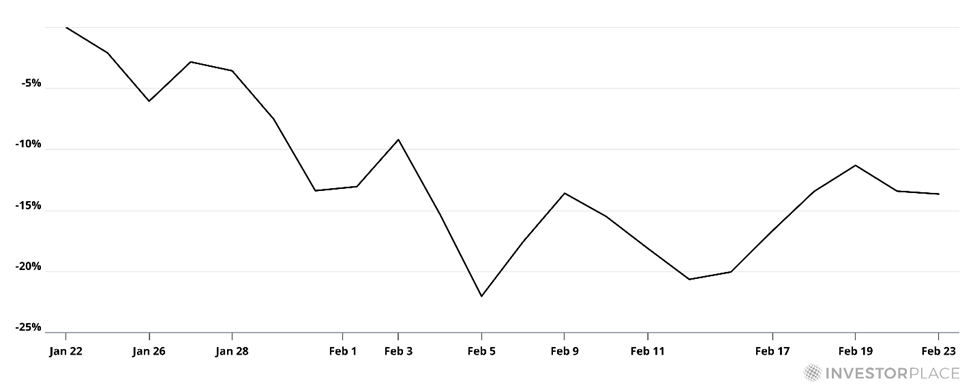

The following chart presents WAL’s trailing twelve-month trading history, with the $125 strike clearly marked in red:

This chart, along with the stock’s historical volatility, serves as a valuable resource when assessing whether selling the January 2027 covered call at the $125 strike presents an attractive risk-reward ratio. Currently, we calculate the trailing twelve-month volatility for Western Alliance Bancorporation—using data from the last 251 trading days as well as today’s price of $84.20—to be 42%. Investors looking for alternative call options at differing expiration dates can explore the WAL Stock Options page on StockOptionsChannel.com.

During mid-afternoon trading on Tuesday, the volume for put options among S&P 500 components reached 690,005 contracts, while call options amounted to 1.29 million contracts. This resulted in a put-to-call ratio of 0.54, indicating a preference among buyers for call options compared to puts. This high call volume is notable against the long-term median put-to-call ratio of 0.65, suggesting positive market sentiment among options traders.

![]() Top YieldBoost Calls of the S&P 500 »

Top YieldBoost Calls of the S&P 500 »

Additional Resources:

- Utilities Dividend Stock List

- MHE Videos

- Top Ten Hedge Funds Holding EXE

The views expressed in this article are the author’s own and do not necessarily reflect those of Nasdaq, Inc.