Is Nvidia Undervalued? Masayoshi Son’s Bold Claim Explored

Masayoshi Son, the renowned CEO of Japanese holding company SoftBank, has made a name for himself as a savvy investor. His firm has a history of notable investments across various industries.

While SoftBank has had its share of disappointing investments (notably WeWork), Son has often been able to pinpoint promising technologies before they gain traction.

A case in point is semiconductor company Arm Holdings, which SoftBank purchased for about $32 billion in 2016. Today, Arm is publicly traded and valued at nearly $150 billion—a remarkable return.

Recently, Son stirred conversations during an interview with CNN’s Richard Quest by stating that the stock of Nvidia ((NASDAQ: NVDA)) is undervalued.

This assertion raises eyebrows, especially since Nvidia’s stock has surged by 880% in just two years. In this article, I will delve into why Nvidia might seem undervalued and share my perspective on Son’s claim.

What Makes Nvidia Appear Undervalued?

Initially, Nvidia focused primarily on the gaming sector, improving graphics for gamers. However, in recent years, the company has successfully expanded into other areas.

Its compute and networking services have grown substantially, driven by the increasing demand for artificial intelligence (AI) solutions. Nvidia’s advanced graphics processing units (GPUs) play a crucial role in generative AI, and the firm also provides essential software that works alongside its hardware.

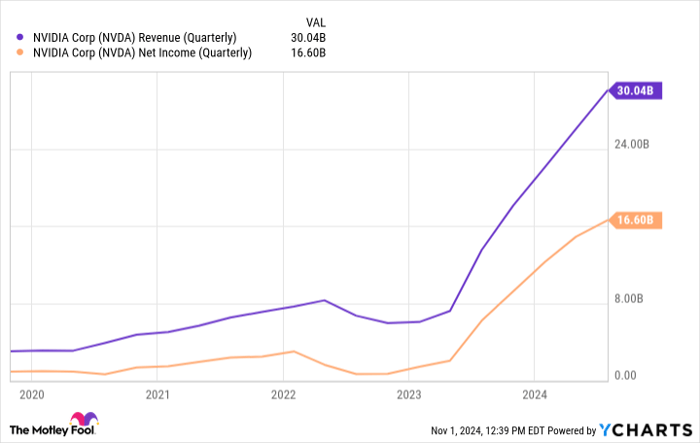

This means that businesses using Nvidia’s products rely heavily on the company for their AI infrastructure, resulting in significant revenue growth. The chart below illustrates Nvidia’s remarkable financial progress.

NVDA Revenue (Quarterly) data by YCharts

As revenue and profits escalate rapidly, Nvidia’s strong performance contributes to the perception that the stock is undervalued.

Nvidia’s shares are currently trading below their five-year average based on both price-to-earnings (P/E) and price-to-free cash flow (P/FCF) metrics. This raises a question: How can a company that has transformed so drastically appear cheaper now than it was five years ago?

NVDA PE Ratio data by YCharts

The straightforward answer is that Nvidia’s profit growth is outpacing the stock price. While Nvidia’s share value seems to rise continually, its net income and cash flows are growing even faster.

This perspective might suggest Nvidia is undervalued; however, my view on the valuation discussion entails more complexity.

Reasons I Skeptical of the Undervaluation Claim

During Son’s interview, he argued that Nvidia is undervalued because the total addressable market (TAM) for generative AI is expanding. This indicates continued strong demand for GPUs in the future, a positive trend for Nvidia.

While I agree that the TAM for AI infrastructure is growing, I am concerned about how significant this will be for Nvidia.

Major tech firms such as Microsoft, Meta Platforms, Amazon, and Alphabet are developing their own chips to train AI models. These companies are among Nvidia’s biggest customers, and the advent of custom GPUs could present serious challenges for Nvidia.

I don’t believe these companies will completely abandon Nvidia. However, as competition increases, the firm may need to lower prices to stay relevant. If that occurs, Nvidia’s revenue growth could stabilize while profit margins decline, ultimately impacting profitability.

Typically, when a company sees falling sales and profits, its valuation takes a hit.

Image source: Getty Images.

Should You Consider Buying Nvidia Stock?

At first glance, Nvidia’s valuation metrics may suggest that its stock is selling at a fair price. However, due to the rising competition, I believe Nvidia could be trading at a premium compared to other investment options in the AI space. While this premium may be justified for now, I have doubts about how long it can be maintained.

Only time will reveal whether Son’s assertion about Nvidia holds true. As mentioned in a previous analysis, I consider Nvidia more of a trading opportunity than a long-term investment. For this reason, carefully timing purchases and sales is crucial if you’re considering Nvidia over the next few years. My perspective suggests that Son may not be entirely correct in his assessment.

Is Now a Good Time to Invest $1,000 in Nvidia?

Before making a decision to invest in Nvidia, ponder this:

The Motley Fool Stock Advisor analyst team has identified its top ten stocks for investors, and Nvidia is not among them. The stocks they selected could generate substantial returns over the coming years.

Consider that if you had invested $1,000 in Nvidia when it was recommended on April 15, 2005, you would now have $833,729*!

Stock Advisor offers investors a straightforward path to success, complete with portfolio-building tips, ongoing analyst insights, and two new stock picks each month. The service has significantly outperformed the S&P 500 since 2002*.

View the top ten stocks »

*Stock Advisor returns as of November 4, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, sits on The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also a member of The Motley Fool’s board of directors. Adam Spatacco holds positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.