IBM Expands Cloud Solutions on Microsoft Azure Amid Strong AI Demand

International Business Machines Corporation (IBM) recently announced its Apptio portfolio, featuring enterprise agile planning (EAP), IT financial management, and cloud FinOps solutions, will now be available on Microsoft Azure, the cloud platform of Microsoft Corporation (MSFT). Additionally, IBM expanded the global reach of its software portfolio to 14 more countries via the Azure Marketplace, aiming to support customers through their digital transformation journeys.

Strength in Cloud and AI Markets

IBM stands to gain from strong demand in hybrid cloud and artificial intelligence (AI), which are driving growth in its Software and Consulting segments. The company’s long-term prospects appear bright, supported by advancements in analytics, cloud services, and security. A favorable business mix, coupled with improved productivity and investments in growth areas, is likely to enhance profitability.

In a notable collaboration, IBM partnered with Intel Corporation (INTC) to implement Intel’s Gaudi 3 AI accelerators as a service in IBM Cloud, positioning IBM as the first cloud service provider to deploy Gaudi 3 in both hybrid and on-premise settings.

This partnership aims to improve visibility and control over software stacks and streamline the management of workloads and applications. The collaboration is set to help organizations scale enterprise AI workloads efficiently, with a focus on performance, security, and resiliency. The new offering is anticipated to launch by early 2025, potentially leading to further innovation in Generative AI.

Watsonx Drives Enterprise AI Adoption

IBM’s Watsonx platform is set to be the foundation for its AI capabilities. Watsonx provides enterprises with essential models to enhance productivity. The platform consists of three key products: watsonx.ai, which focuses on new foundational models, generative AI, and machine learning; watsonx.data, a data storage solution built on an open lake house architecture; and watsonx.governance, a toolkit ensuring responsible and transparent AI workflows.

Stock Performance Overview

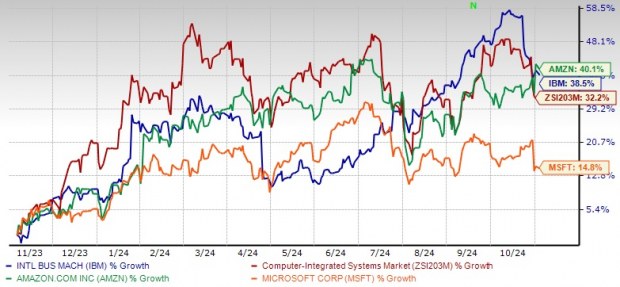

Strong demand for hybrid cloud and AI solutions has resulted in IBM’s stock appreciating by 38.5% over the last year, outperforming the industry growth of 32.2%. However, it still lags behind Amazon.com, Inc. (AMZN), despite surpassing peers like Microsoft.

One-Year Price Performance

Image Source: Zacks Investment Research

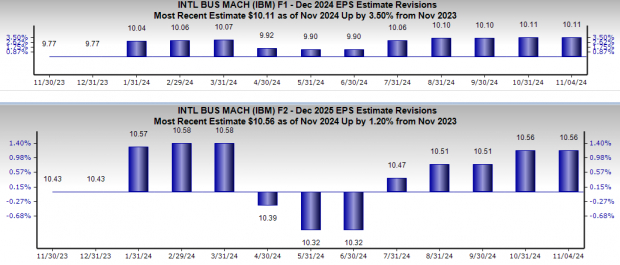

Positive Revisions for Earnings Estimates

Recent trends show an upward revision in IBM’s earnings estimates. For 2024, estimates have risen by 3.5% to $10.11, while 2025 estimates have increased by 1.2% to $10.56. This reflects positive sentiment regarding the company’s growth potential.

Image Source: Zacks Investment Research

Challenges Impacting Margins

Despite the positive momentum in the hybrid cloud and AI sectors, IBM faces fierce competition from Amazon Web Services and Microsoft Azure, which is squeezing margins. Over the years, profitability has generally declined, with only occasional recoveries. The extended transition to a cloud-based business model adds complexity, while challenges from a weakening traditional business and foreign exchange fluctuations are concerning. Recent economic uncertainties, tied to geopolitical tensions and evolving interest rate landscapes, have also affected IBM’s third-quarter performance through a slowdown in discretionary spending.

Valuation Insights

In terms of valuation, IBM’s stock appears to be trading at a premium compared to the industry average, with a price-to-book ratio of 7.78, significantly higher than the industry’s 3.42 and the stock’s historical average of 5.85.

Image Source: Zacks Investment Research

Final Thoughts

IBM seeks to capitalize on the increasing trend of businesses adopting cloud-agnostic strategies to manage multi-cloud environments, with a keen focus on hybrid cloud and generative AI solutions. There’s a growing demand for traditional cloud-native workloads and applications, which has resulted in a complex infrastructure for many enterprises.

However, trading at a Zacks Rank #3 (Hold), IBM appears to be in a cautious position, and new investors may want to proceed carefully. Given its premium valuation metrics, it may be wise to wait for a more favorable entry point before investing. For those interested, a comprehensive list of today’s Zacks #1 Rank (Strong Buy) stocks is available.

Expert Stock Picks for Future Growth

Among thousands of stocks, five Zacks experts have selected their favorites expected to soar +100% or more soon. The Director of Research, Sheraz Mian, has handpicked one with exceptional potential.

This noted company targets millennial and Gen Z consumers, generating nearly $1 billion in revenue last quarter alone. A recent downturn offers an ideal window for investment. While not all selections guarantee success, this stock has the potential to outperform past Zacks stocks, such as Nano-X Imaging, which rose +129.6% in just over nine months.

Free: Get Our Top Stock Recommendations and 4 Alternatives

For the latest insights from Zacks Investment Research, download “5 Stocks Set to Double” today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

International Business Machines Corporation (IBM): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.