Fed Cuts Rates, But Long-Term Interest Rates Surge: Understanding the Market’s Reaction

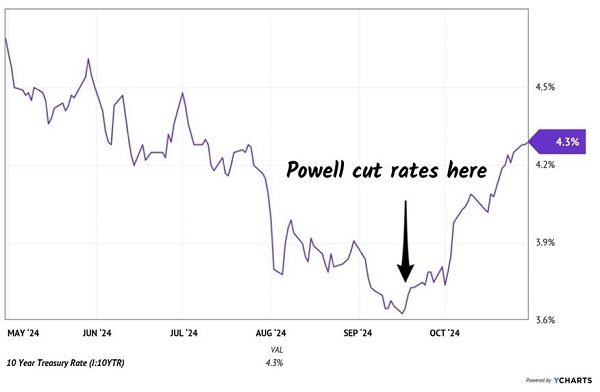

The Federal Reserve recently made headlines by cutting interest rates by a noteworthy 50 basis points. Yet, to the surprise of many, interest rates skyrocketed instead.

So, what’s going on here?

The Federal Funds Rate serves as a target range that impacts short-term rates in the economy. For instance, money market funds have lowered their interest payouts by 0.5% compared to two months ago following the Fed’s decision.

In contrast, long-term rates operate differently. While the Fed exerts some influence, it does not have direct control over the vast global bond market, which is valued at a staggering $130 trillion.

This creates a puzzling situation. Fed Chair Jay Powell’s decision to cut rates by 50 basis points has been met with skepticism by the bond market.

How can you promote such a dovish stance, Jay, in light of a thriving economy? Your policy could set us up for inflation, leading to demands for higher interest over a 10-year term.

Fed Cuts Lead to Rising 10-Year Rates

This raises an important question: How can the economy seem so robust after a series of aggressive interest rate hikes? Concerns about a looming recession have lingered since the summer of 2022.

The factor complicating predictions is the government’s rampant deficit spending. It has spiraled out of control, and while that could lead to consequences down the road, for now, the economy appears to be thriving.

Inflation benefits borrowers by diminishing the real value of their debts, and Uncle Sam does not shy away from this approach. For fiscal year 2024, the Congressional Budget Office (CBO) estimates a $1.9 trillion deficit against $4.9 trillion in tax receipts. It’s worth noting that this CBO often comes with optimistic projections.

So we face nearly $5 trillion in revenue contrasted with an almost $7 trillion expenditure, resulting in a staggering 40% overshoot in spending.

Given this, it seems reasonable to expect long-term rates to rise. But hold on!

Renowned economist Nouriel Roubini recently presented a study on “activist Treasury issuance” (ATI) which offers insight into the situation:

Roubini suggests that the US Treasury is strategically managing its debt issuance in a way that keeps longer-term rates lower than typical. This strategy has effectively reduced the 10-year Treasury yield by 30 to 50 basis points.

He refers to this approach as “stealth QE,” which mirrors what has been labeled as quiet QE in previous discussions.

The unfortunate side of this is that the 10-year yield realistically should be higher, near 5%. On the positive side, the federal government is seemingly aligned with market interests. Although the bond market is too vast for complete control, it can be influenced temporarily.

(As a proponent of free markets, I do not endorse this level of interference, yet I appreciate it if such actions lead to increased bond values.)

When analyzing the recent surge in rates, it’s essential to maintain perspective. Overall, nothing alarming appears to be taking place. For the past three years, rates have fluctuated within a defined range. After a prolonged decline, a rebound is merely a reflection of market behavior—rates typically increase and decrease in cycles.

Understanding the Recent Rate Rise

If we accept that this trend will eventually stabilize (a nod to Abraham Lincoln’s wisdom), savvy investors might consider hunting for bargains in the bond market. The DoubleLine Yield Opportunities Fund (DLY) appears particularly promising right now.

With a yield of 8.7%, DLY offers double the current 10-year rate, providing a cushion against potential declines in Treasury yields. Despite the general inverse relationship between bond prices and yields, an 8.7% yield stands out as remarkably significant.

Jeffrey Gundlach, the notable founder of DoubleLine, excels in identifying opportunities. Approximately three-quarters of DLY’s bonds are rated below investment grade or are unrated. While this might raise concerns, Gundlach’s expertise inspires confidence.

These investments can deliver substantial returns because many large institutional investors, like pensions, cannot buy below investment grade bonds. As such, issuers often approach Gundlach first to sell their bonds, much like sellers reaching out to Warren Buffett.

This means investors like us benefit from opportunities that others overlook, along with curated selections from skilled experts. DLY represents a promising avenue in the arena of fixed income, thanks to its flexibility—characteristics that ETFs and traditional mutual funds may lack.

Let’s leave the worries over interest rates to the more conservative investors. We, as contrarians, are more than content to embrace an 8.7% yield.

One of the best aspects of DLY is its monthly payout schedule. Solid monthly dividends are rare, but the recent “Fed cut, rates rise” scenario offers an influx of 8%+ monthly dividends for investors ready to seize them.

However, it’s crucial to maintain balanced investments—ensure you don’t place all your resources solely in the DLY basket. Diversify your holdings and enjoy monthly dividends with yields over 8%.

Also see:

• Warren Buffett Dividend Stocks

• Dividend Growth Stocks: 25 Aristocrats

• Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.