Trump’s Triumph: Market Implications Following His Election Victory

The U.S. presidential election results are in, and former President Donald J. Trump has reentered the White House. This victory brings mixed emotions across the country—while some celebrate, others express their disappointment. Yet, as investors, it’s crucial to set aside personal feelings and assess market trends with a clear mind.

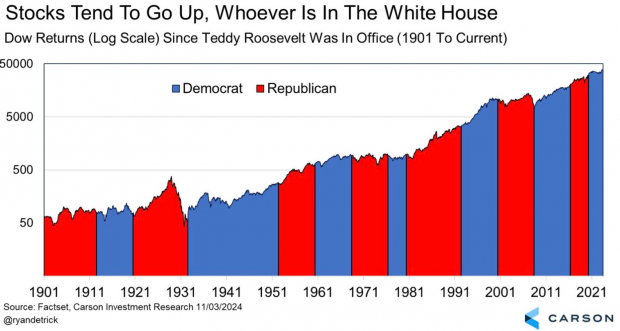

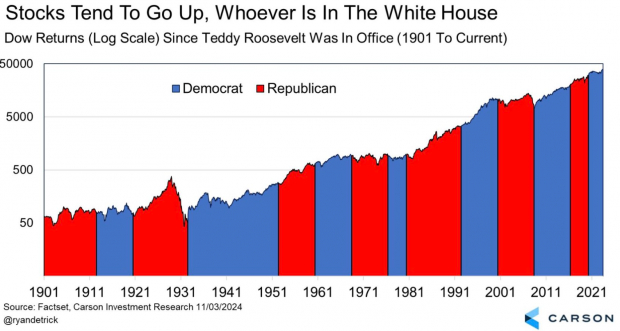

A General Overview of Stocks Regardless of Political Leadership

In general, U.S. stocks have shown resilience, often continuing to rise over time, irrespective of which party is in power. As illustrated in an infographic by Ryan Detrick of Carson Investment Research, historical trends suggest that equity markets can weather political changes effectively.

Image Source: Carson Investment Research, Factset

For index investors, the general upward trend is reassuring. However, those who actively pick stocks should keep an eye on specific sectors that might be influenced by Trump’s policies during his second term. Here are five industries to monitor closely:

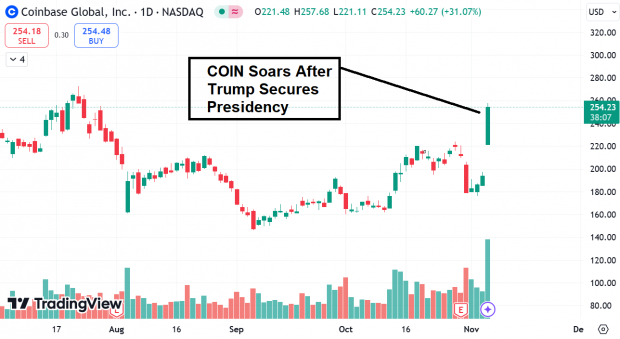

Cryptocurrency: A New Era? Gensler’s Exit

With Trump’s victory, Bitcoin surged past $75,000, driven by expectations of leadership changes at the SEC. Trump has indicated intentions to replace Gary Gensler, who many view as a crypto skeptic. Consequently, the stock of crypto exchange Coinbase (COIN) increased by over 30% following the news.

Image Source: TradingView

Solar Energy: Potential Cuts Ahead?

Conversely, the solar industry faced challenges after Trump’s pledge to reduce or eliminate several clean energy subsidies. This could negatively impact stocks like First Solar (FSLR).

Tariff Policies and Small-Cap Stocks

Famed for his protectionist views, Trump plans to use tariffs to encourage manufacturing jobs to return to the U.S. His “tariff man” stance suggests that small-cap stocks might thrive as international products become more expensive. Following this election outcome, the Russell 2000 Index ETF (IWM) soared over 5% in response.

Pharmaceuticals: A Shift in Health Policies?

In the healthcare domain, independent candidate Robert F. Kennedy Jr. may play a significant role following his alliance with Trump against Kamala Harris. Rumors suggest that Trump could appoint RFK to a key position related to health policy, which raises concerns about increased scrutiny on vaccine companies such as Pfizer (PFE).

Energy Sector: Deregulation on the Horizon?

With an optimistic view on American energy resources, Trump advocates for deregulating the oil and gas sector. His catchphrase “drill baby, drill” suggests that he will prioritize drilling activities, leading to a 4% increase in the Energy Select Sector SPDR ETF (XLE) on significant trading volume.

Conclusion

Ultimately, while the stock market appears steady regardless of political leadership, astute investors recognize the importance of examining industry-specific dynamics under a new administration.

Zacks Identifies Top Semiconductor Stock

It may be much smaller than NVIDIA, which has gained over 800% since our recommendation, but new potential exists in another semiconductor stock with significant growth potential.

With impressive earnings growth and an expanding client base, this company is set to capitalize on the increasing demand for sectors like Artificial Intelligence and the Internet of Things. The global semiconductor market is forecasted to grow from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock Now for Free >>

Pfizer Inc. (PFE): Free Stock Analysis Report

First Solar, Inc. (FSLR): Free Stock Analysis Report

Energy Select Sector SPDR ETF (XLE): ETF Research Reports

iShares Russell 2000 ETF (IWM): ETF Research Reports

Coinbase Global, Inc. (COIN): Free Stock Analysis Report

Read the full article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.