“`html

Potential Stock Winners Under a Trump Presidency

Key Takeaways

- Certain stocks may see strong growth under the Trump administration, regardless of individual opinions about politics.

- Palantir Technologies, Tesla, and Talkspace stocks have positive momentum and are expected to continue rising.

- Check out our free report on the 7 Best Stocks for the Next 30 Days!

In a divided country, reactions to the election vary widely. Focusing on financial aspects, we will explore how a Trump presidency could impact the economy and the stock market.

Historically, Trump’s first term led to an uptick in economic activity, largely due to tax cuts and efforts to reduce regulations. These strategies proved effective in sparking growth by influencing key economic drivers.

However, broader factors such as Federal Reserve policies, geopolitical tensions, and demographic trends also significantly affect market performance. While the presidency plays a vital role, it’s important to consider these other influences.

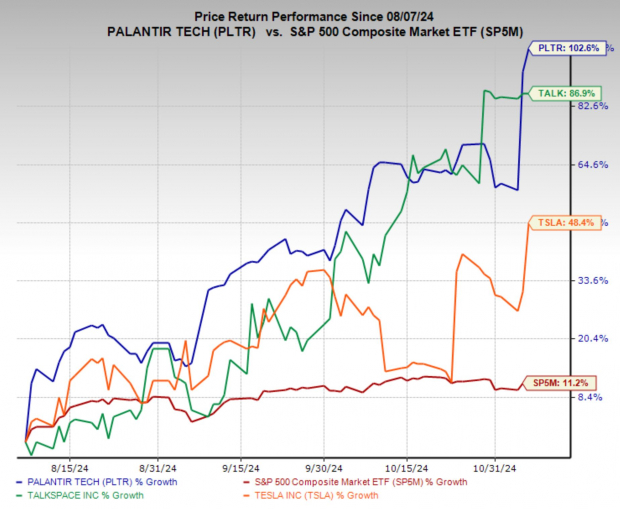

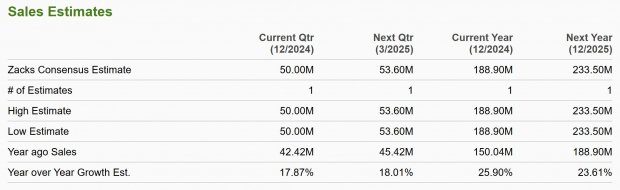

I have pinpointed three stocks that are poised to gain in a Trump-led economy: Palantir Technologies (PLTR), Tesla (TSLA), and Talkspace (TALK). Each of these companies benefits from unique factors related to Trump’s policies, alongside impressive stock performance and high Zacks Ranks.

Image Source: Zacks Investment Research

Tesla: Political Ties Boost Stock Performance

Elon Musk was instrumental in supporting Trump’s election campaign through significant donations and social media influence. With his extensive reach on X.com, where he has 200 million followers, Musk’s involvement marks a notable shift in Tesla’s political connections.

This has had a tangible effect on TSLA stock, which rose nearly 14% in one day and is achieving new year-to-date highs.

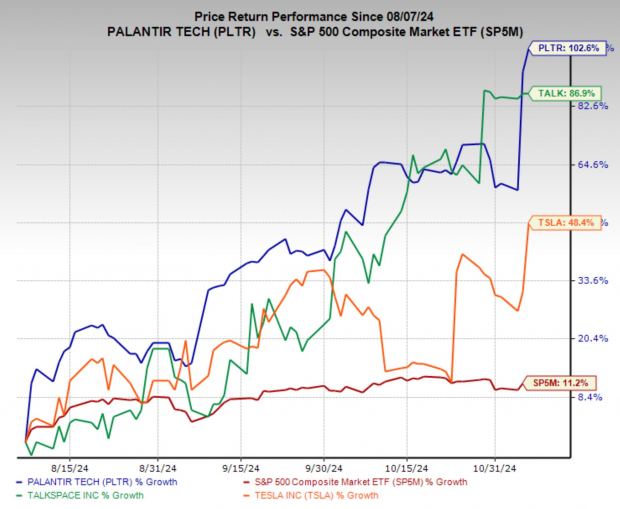

Additionally, Tesla boasts a Zacks Rank #1 (Strong Buy), highlighting positive revisions in its earnings estimates. The current quarter estimates surged by 13.4% over the past 60 days, while FY24 estimates experienced a 7.5% increase.

Image Source: Zacks Investment Research

Palantir Technologies: Benefits from Increased Government Contracts

Palantir Technologies is well-positioned to thrive under a Trump administration due to its strong ties with the government, particularly in defense and intelligence sectors. The company’s established relationship with federal agencies, including the Department of Defense, could lead to increased government contracts driven by pro-defense spending.

With advanced data analytics and AI solutions, Palantir is poised to support national security efforts, aligning with an administration likely to prioritize military and intelligence funding.

Palantir holds a Zacks Rank #2 (Buy), reflecting a positive trend in its earnings outlook. The stock has seen a nearly 6% increase recently, showcasing Wall Street’s confidence in its future potential.

Image Source: TradingView

Talkspace: Increased Focus on Mental Health Stocks

As tensions rise in today’s political climate, Talkspace, a platform for online therapy, is likely to see a surge in demand. Many individuals grappling with emotional responses to political changes may seek mental health support.

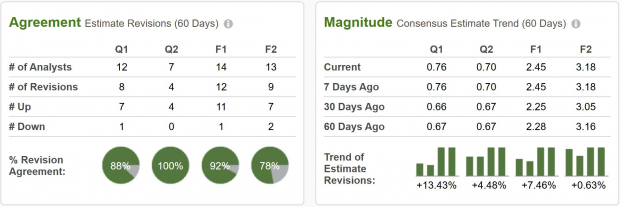

Talkspace’s annual sales are projected to grow over 20% this year and next. With a Zacks Rank #1 (Strong Buy), analysts are optimistic about its growth potential.

As awareness of mental health continues to expand, Talkspace stands ready to capitalize on growing demand and favorable trends in the industry.

“““html

Stock Picks to Watch: Tesla, Palantir, and Talkspace Post-Election

Image Source: Zacks Investment Research

Strategizing in a Shifting Economic Climate

Investors navigating the challenges of the post-election economy might find it useful to consider stocks with solid foundations. Tesla, Palantir, and Talkspace are companies that could thrive under a business-friendly approach that many anticipate from a Trump presidency.

These businesses not only show strong potential for growth, but they also boast solid revenue and earnings fundamentals. companies with favorable valuations paired with a high Zacks Rank often yield better investments over time than simply trying to gauge how political leadership will sway the market. By focusing on these stocks, investors can benefit from both industry stability and optimistic trends in the overall economy.

Top Semiconductor Stock Spotlighted by Zacks

While it remains 1/9,000th the size of NVIDIA, which has soared over 800% since our initial recommendation, our latest semiconductor pick appears poised for significant growth as well.

This emerging chip stock demonstrates strong earnings and a growing customer base, positioning it to capitalize on the increasing need for Artificial Intelligence, Machine Learning, and Internet of Things solutions. Forecasts predict that global semiconductor manufacturing will expand from $452 billion in 2021 to $803 billion by 2028.

Don’t miss out on this opportunity—see this stock now for free >>

Want to stay updated with the latest insights from Zacks Investment Research? Download “5 Stocks Set to Double” for free today.

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

Talkspace, Inc. (TALK) : Free Stock Analysis Report

To read the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.

“`