Deutsche Bank Elevates Celanese Rating to Buy Amid Positive Forecasts

On November 6, 2024, Deutsche Bank upgraded Celanese’s (NYSE:CE) rating from Hold to Buy.

Analysts Anticipate Significant Price Growth

As of October 22, 2024, analysts predict an average one-year price target for Celanese of $150.75 per share. The estimates vary, with a low of $121.20 and a high of $186.90. This average target implies a potential upside of 63.08%, compared to the company’s recent closing price of $92.44 per share.

Positive Financial Outlook for Celanese

Celanese forecasts annual revenues of $12.89 billion for the upcoming year, marking an increase of 23.04%. Additionally, the projected non-GAAP earnings per share (EPS) stands at 15.78.

Fund Sentiment Around Celanese

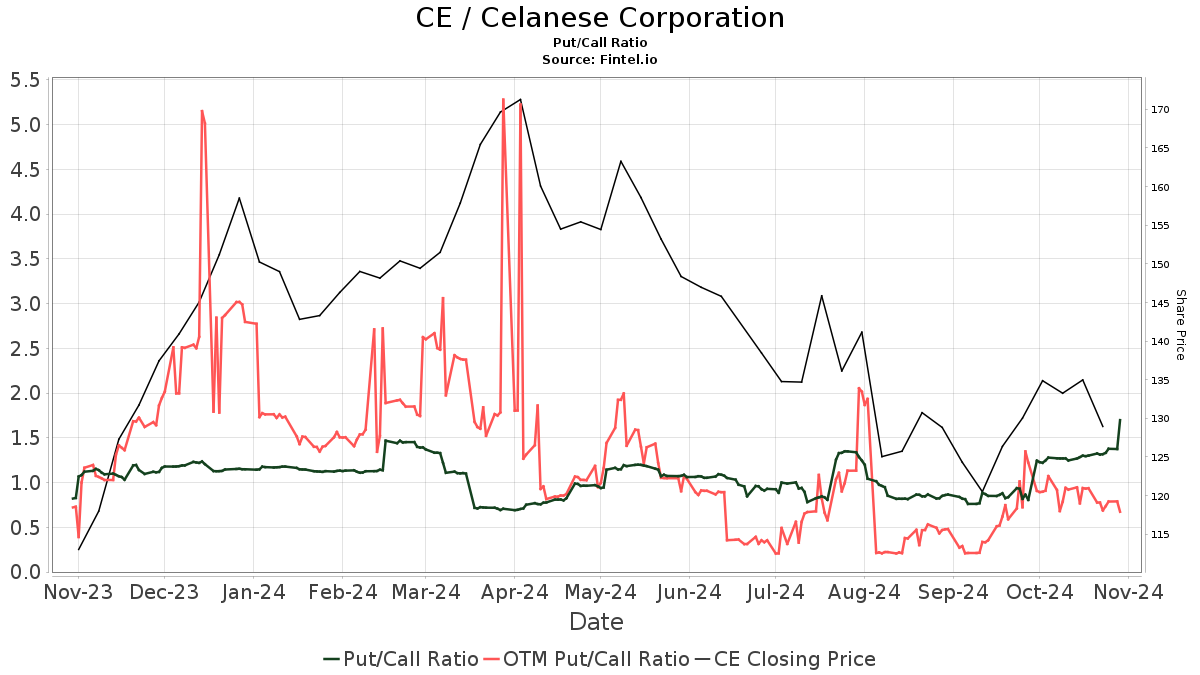

Currently, there are 1,319 funds and institutions holding shares in Celanese, representing a quarterly increase of 19 owners or 1.46%. The average portfolio weight for all funds invested in CE is 0.17%, which is a rise of 15.80%. Overall, institutional ownership rose by 0.63% over the last three months, totaling 155,942K shares. The current put/call ratio for CE is 0.79, suggesting a positive sentiment among investors.

Recent Actions by Major Shareholders

Among the notable institutional shareholders, Capital Research Global Investors owns 15,294K shares, equating to 14.00% ownership. Their latest filing showed an increase from 14,899K shares, though their percentage allocation in Celanese dropped by 21.86% in the last quarter.

Capital International Investors holds 11,134K shares, or 10.19% of the company, reflecting a decrease of 1.90% from its previous count of 11,345K shares.

Washington Mutual Investors Fund (AWSHX) owns 7,768K shares (7.11% ownership), a slight decrease from 7,771K shares previously. The firm decreased its CE portfolio allocation by 14.21% last quarter.

Investment Co of America (AIVSX) holds 7,589K shares, representing 6.95% ownership, showing a minimal decrease of 0.03% from the prior quarter. They have cut back their allocation in Celanese by 25.12% recently.

Wellington Management Group LLP possesses 7,424K shares (6.79% ownership), down from 7,944K shares, and has reduced its allocation by a striking 89.58% over the last quarter.

Understanding Celanese Corporation

(This description is provided by the company.)

Celanese Corporation stands as a global leader in technology focused on producing specialty materials and differentiated chemistry solutions used across various industries. With two core business segments — Acetyl Chain and Materials Solutions — Celanese aims to leverage its global expertise to deliver value to customers. The company also seeks to positively impact its communities through The Celanese Foundation. Headquartered in Dallas, Celanese employs around 7,700 people worldwide and reported $5.7 billion in net sales for 2020.

Fintel serves as a comprehensive investment research platform, providing individual investors, financial advisors, and small hedge funds with extensive data, including fundamentals, analyst reports, ownership analytics, and fund sentiment. Our unique stock picks are developed through advanced quantitative models aimed at enhancing profit opportunities.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.