Microsoft: A Prime Investment as AI Propels Growth

Microsoft (NASDAQ: MSFT), Apple, and Nvidia are the only three companies in the world with a valuation of $3 trillion or more. While Nvidia leads in artificial intelligence (AI) chips, Microsoft is rapidly emerging as a prominent player in AI software.

Recently, Microsoft announced its financial results for the fiscal 2025 first quarter (ended Sept. 30), revealing impressive growth driven by its Copilot AI assistant and cloud services.

Copilot AI Assistant Fuels Remarkable Growth

In early 2023, Microsoft declared a $10 billion investment in OpenAI, known for ChatGPT, and immediately began incorporating OpenAI’s advanced models into its own virtual assistant, Copilot. This tool can generate text, images, computer code, and answer challenging questions across various subjects.

Copilot is free to users of Microsoft’s major software products, including Windows, Bing, and Edge. Users of the 365 platform, which encompasses Word, PowerPoint, Excel, and more, can access Copilot for an extra monthly fee. This potential revenue stream could become substantial as over 400 million 365 licenses are in use worldwide.

Currently, 70% of Fortune 500 companies utilize Copilot for 365. Although Microsoft does not disclose total adoption numbers, CEO Satya Nadella recently noted that daily user engagement more than doubled in Q1 compared to three months prior.

Telecommunications giant Vodafone has begun implementing Copilot for 365 among over 68,000 employees, reportedly saving three hours of work per employee each week in their trial run.

Furthermore, Microsoft’s Copilot Studio platform experienced robust growth in Q1, allowing businesses to create tailored Copilots for specific functions. For instance, one Copilot may assist with scheduling meetings in Teams, while another helps analyze data in Excel.

As of Q1, more than 100,000 organizations had leveraged Copilot Studio, representing a 100% increase from the previous quarter.

Image source: Getty Images.

Azure Cloud Services Show Strength with AI Growth

Microsoft’s Azure cloud platform is consistently one of its fastest-growing sectors. It provides a variety of services needed for modern digital operations, ranging from data storage to advanced software development tools. Among these is Azure AI, which offers businesses extensive capabilities for developing and deploying AI solutions.

With Azure AI, developers can tap into powerful computing resources powered by top-tier chips from providers like Nvidia and Advanced Micro Devices. Notably, Azure is the first cloud platform to use Nvidia’s new Blackwell-based GB200 GPUs, recognized as the most sophisticated for AI tasks.

Additionally, Azure offers access to cutting-edge large language models (LLMs), including OpenAI’s latest models. Microsoft states that usage of its Azure OpenAI platform has doubled in the last six months as companies create AI-enhanced tools to boost employee productivity.

For the third quarter, Azure’s revenue surged by 33% compared to the same period last year, with AI services contributing 12 points to that growth—up from eight points just three months ago. Demand for its data center infrastructure continues to exceed supply.

In Q1, Microsoft allocated $20 billion to capital expenditures (capex), primarily aimed at AI data centers and chip investments. This follows a significant $55.7 billion in capex in fiscal 2024. Thus, it is crucial for Microsoft to demonstrate returns on these investments, and the uptick in Azure AI is promising.

Capex Investments Could Yield Huge Returns by 2030

Experts believe AI represents a transformative financial opportunity. Last year, Ark Investment Management predicted that AI could contribute $200 trillion to the global economy by 2030 by enhancing productivity among workers. Cathie Wood, Ark’s Chief Investment Officer, anticipates that AI software companies could generate $8 in revenue for every $1 spent on chips.

If her forecast is correct, Microsoft’s significant investment in AI infrastructure could lead to massive returns—in the order of hundreds of billions of dollars. Other firms have also projected exceptional growth for the AI sector:

- PwC estimates AI could add $15.7 trillion to the global economy by 2030.

- McKinsey & Company forecasts an additional $13 trillion in economic activity from AI by 2030.

- Goldman Sachs anticipates AI could generate $7 trillion in economic activity over the next decade.

Why Microsoft Stock Is Worth Considering Now

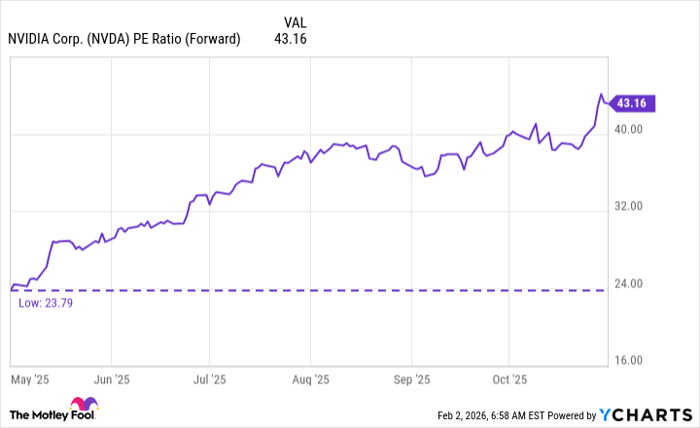

Microsoft has reported $12.12 in earnings per share over the last four quarters. With its current stock price at $412.05, the company trades at a price-to-earnings (P/E) ratio of 33.9, slightly above the Nasdaq-100 technology index’s P/E ratio of 32.3. Notably, this stock is near its lowest trading level this year:

MSFT PE Ratio data by YCharts

Microsoft’s leading position in AI software and its potential for monetization deserves a premium valuation over the tech sector. Investors who decide to purchase Microsoft stock today may reflect back in 2030 and consider this an excellent opportunity if AI projections hold true.

Is Now the Right Time to Invest $1,000 in Microsoft?

Before investing in Microsoft, keep this in mind:

The Motley Fool Stock Advisor analyst team recently highlighted what they believe are the 10 best stocks to invest in now, and Microsoft was not among them. The selected ten stocks could see substantial returns in the coming years.

For instance, Nvidia made the list on April 15, 2005. If you had invested $1,000 at that time, your investment would now be worth $857,383!*

Stock Advisor provides investors with a roadmap to success featuring guidance on building a portfolio, regular updates from analysts, and two new stock recommendations every month. The Stock Advisor service has more than quadrupled the returns of the S&P 500 since its inception in 2002*.

See the 10 stocks »

*Stock Advisor returns as of November 4, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Goldman Sachs Group, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.