Montrose Environmental Group’s Outlook Adjusted by B of A Securities

On November 6, 2024, B of A Securities revised their rating for Montrose Environmental Group (MUN:5MO) from Buy to Neutral.

Analyst Price Predictions Indicate Significant Potential

As of March 31, 2023, the projected average price target for Montrose Environmental Group is 56.95 €/share. Expectations vary, with estimates ranging from a low of 40.40 € to a high of 76.65 €. This average suggests a potential growth of 133.40% from the company’s recent closing price of 24.40 € per share.

Revenue and Earnings Expectations

The anticipated annual revenue for Montrose Environmental Group stands at 657MM, reflecting a slight decrease of 0.81%. The expected annual non-GAAP EPS is projected at -0.25.

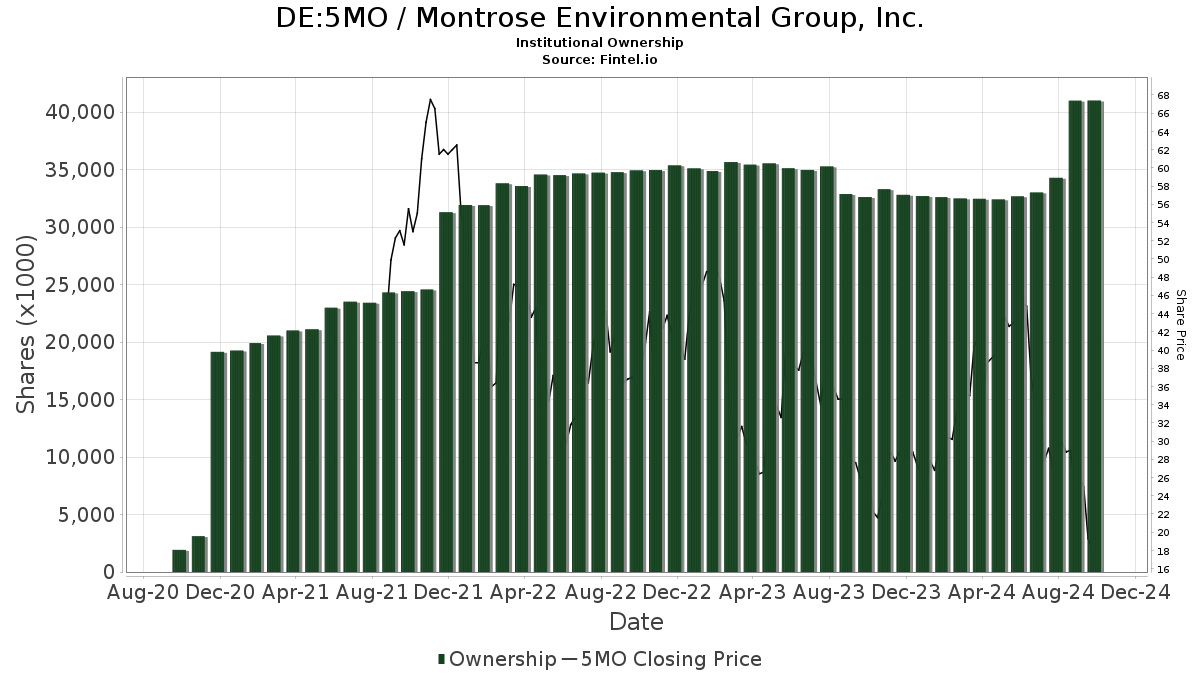

Fund Ownership Trends

Currently, 403 funds and institutions report holding positions in Montrose Environmental Group, marking an increase of 19 holders or 4.95% compared to the previous quarter. Funds dedicated to 5MO have an average portfolio weight of 0.23%, which has risen by 9.04%. In the past three months, institutional shares owned have grown by 18.56% to reach 40,616K shares.

Activity Among Shareholders

Ubs Asset Management Americas currently holds 2,364K shares, representing 6.91% ownership in the company. Their previous report listed 2,103K shares, showing an 11.05% increase, although they have reduced their portfolio allocation in 5MO by 86.67% in the last quarter.

Fred Alger Management owns 1,396K shares, equating to 4.08% ownership. This is up from 1,187K shares previously reported, reflecting a 14.96% increase. Their portfolio allocation in 5MO was raised by 21.38% recently.

Federated Kaufmann Small Cap Fund Shares hold 1,350K shares, representing 3.94% ownership. This is an increase from 1,266K shares, yet they decreased their portfolio allocation in 5MO by 22.87% over the last quarter.

Champlain Investment Partners has 1,347K shares, representing 3.93% ownership. They slightly reduced their holdings from 1,350K shares while increasing their portfolio allocation in 5MO by 21.56%.

Federated Hermes holds 1,270K shares for 3.71% ownership. Their latest filing shows an increase from 1,140K shares (up 10.23%), although they decreased their portfolio allocation in 5MO by 28.01% in the last quarter.

Fintel provides in-depth investment research for individual investors, traders, financial advisors, and small hedge funds.

The platform includes comprehensive data such as fundamentals, analyst reports, ownership details, fund sentiment, and more to support smarter investing decisions.

Click to Learn More

This story was originally featured on Fintel.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.