JP Morgan Upgrades Yum China Holdings: A Closer Look at the Financial Outlook

Analysts Predict Modest Growth Ahead

On November 5, 2024, JP Morgan raised its outlook for Yum China Holdings (NYSE:YUMC) from Neutral to Overweight.

As of October 22, 2024, analysts have set an average one-year price target of $50.96 per share for Yum China Holdings. Notably, predictions vary, with estimates ranging from a low of $35.35 to a high of $75.83. This average price target indicates a potential upside of 2.31% from its last reported closing price of $49.81 per share.

For a broader view, check out our leaderboard showing companies with the highest potential price increases.

Revenue and Earnings Projections

Yum China Holdings is expected to report annual revenue of $12,695 million, reflecting a 13.34% increase. Analysts also project a non-GAAP EPS of 2.35.

Institutional Investment Trends

Currently, 1,006 funds or institutions hold positions in Yum China Holdings. This figure shows a slight decrease of 31 owners (2.99%) within the last quarter. The average portfolio weight for all funds invested in YUMC stands at 0.31%, which marks a 16.50% increase. Additionally, total shares owned by institutional investors rose by 6.44% in the past three months, totaling 356,152K shares.

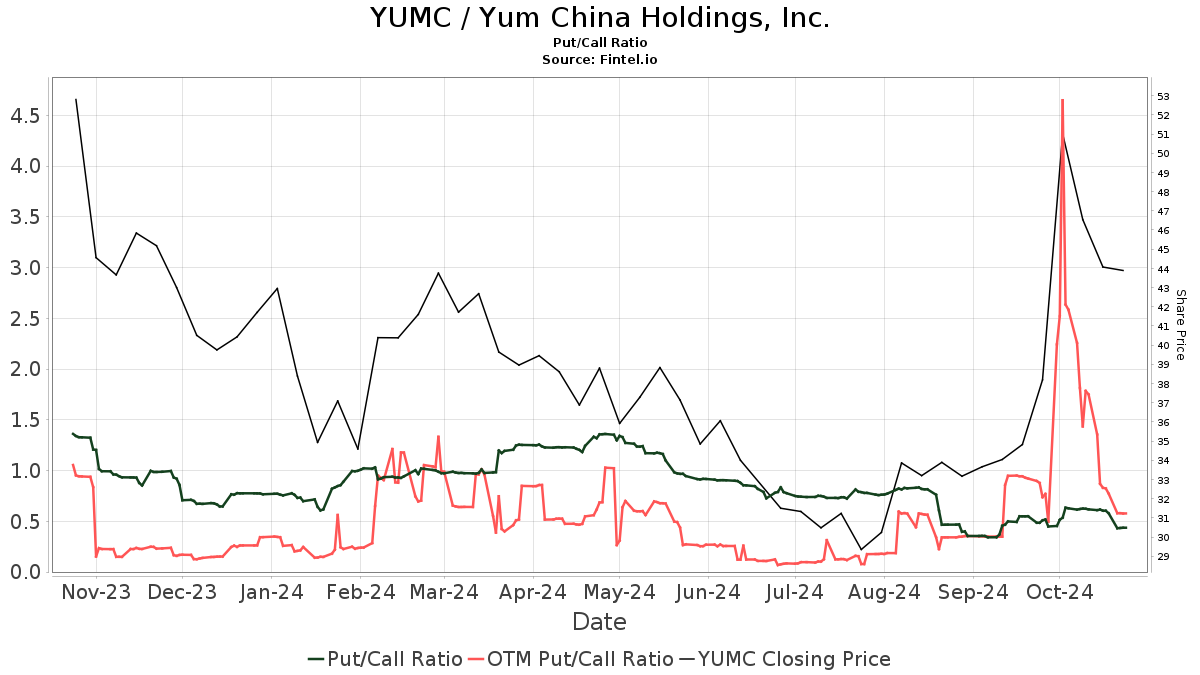

The put/call ratio for YUMC is currently 0.44, indicating a generally bullish investor sentiment.

Changes in Holdings Among Major Shareholders

JP Morgan Chase currently holds 19,619K shares, equating to 5.16% ownership, a drop from their previous 20,307K shares (a decrease of 3.51%) and a 27.28% reduction in portfolio allocation over the last quarter.

Invesco now owns 15,145K shares, which is 3.98% of the company, a decrease from 18,389K shares previously (representing a 21.42% reduction and a 37.15% drop in their portfolio allocation).

Price T Rowe Associates holds 14,464K shares, representing 3.80% ownership, down from 16,745K shares, marking a 15.77% decline in shareholding and a 34.64% decrease in their portfolio allocation.

Primavera Capital Management’s holdings remain unchanged at 12,036K shares, representing 3.17% ownership.

Massachusetts Financial Services now holds 11,967K shares, accounting for 3.15% ownership, reflecting a small increase from 11,846K shares (an increase of 1.02%) but an 87.63% decrease in portfolio allocation.

Background on Yum China Holdings

(This description is provided by the company.)

Yum China Holdings, Inc. is a franchisee of Yum! Brands in mainland China, with exclusive rights to well-known brands such as KFC, Pizza Hut, and Taco Bell in the region. The company also operates its own concepts, including Little Sheep and COFFii & JOY. As of December 2020, Yum China managed 10,506 restaurants in over 1,500 cities. Notably, it ranked #361 on the Fortune 500 list in 2020 and has received multiple accolades for sustainability and workplace equality.

Fintel serves as a leading investing research platform, providing essential data to individual investors, traders, financial advisors, and small hedge funds. The platform includes detailed fundamentals, analyst reports, ownership data, and much more.

Click to Learn More

This information originally appeared on Fintel.

The views and opinions expressed in this report are those of the author and do not necessarily reflect those of Nasdaq, Inc.