Why Investors Should Consider Shopify Over Apple Right Now

The last few years have proven fruitful for patient Apple (NASDAQ: AAPL) shareholders. Since its pandemic-induced low in early 2022, Apple’s stock has skyrocketed more than 300%, and it has even surged 700% over the past decade, largely thanks to the iPhone and the App Store.

Despite this impressive growth, Apple’s revenue has remained fairly flat since early 2023. The ongoing expansion of its services sector has helped maintain stability, but stock prices have risen mainly due to optimistic expectations surrounding Apple’s entry into the artificial intelligence market.

The Case Against Apple

It’s essential to clarify that Apple isn’t in dire straits. The company remains a leader in the smartphone market and continues to see growth in its services division.

Nevertheless, Apple faces a significant challenge. Its iPhone business has stagnated, evident in both unit sales and revenue figures.

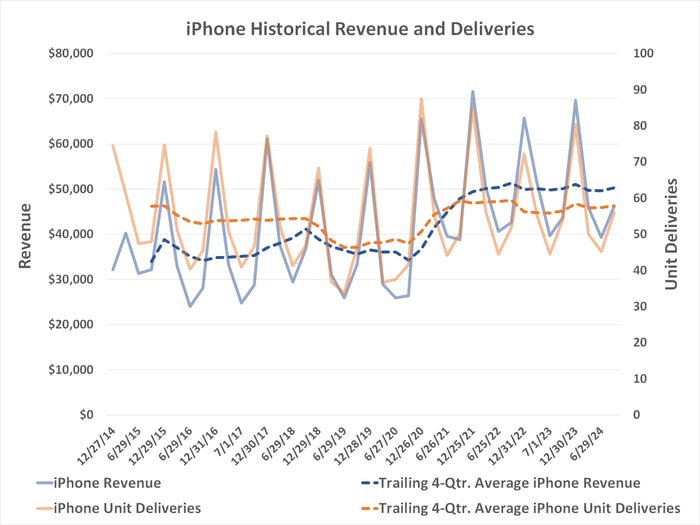

iPhone sales tend to fluctuate throughout the year, typically peaking when new models launch in September and soaring during the holiday season. However, this variability makes it difficult to assess whether overall growth is occurring. The chart below illustrates that the iPhone has indeed stagnated since early 2022.

Data source: Apple Inc. and IDC. Chart by author. Revenue is in millions. Unit deliveries are in millions.

This stagnation isn’t catastrophic, especially for such a significant company. However, with the iPhone making up about half of Apple’s total revenue, the company will eventually need to find a way to drive notable growth.

New AI-capable iPhones might reinvigorate sales, but success isn’t guaranteed. Competing brands offer similar online tools, diminishing any unique edge Apple’s artificial intelligence features might bring.

Why Shopify Stands Out

In contrast, Shopify (NYSE: SHOP) offers real growth potential in both the current market and for the foreseeable future.

Shopify provides comprehensive e-commerce solutions, enabling businesses to build their online stores effectively. They offer everything from shopping carts to payment processing and customer management tools, making it an attractive option for various types of businesses.

Merchants are flocking to these services. During the three-month period ending in June, Shopify facilitated sales of $67.2 billion, marking a 22% increase compared to the previous year. The company’s consistent growth trend is expected to continue for several more years.

Data source: StockAnalysis.com. Chart by author.

This optimistic outlook may even underestimate Shopify’s future growth potential, as the e-commerce sector is evolving rapidly. Although online marketplaces like Amazon and eBay have been successful, many businesses are now opting to manage their customer relationships directly rather than relying on third-party platforms.

Moreover, only about 16% of U.S. retail sales occur online, according to the Census Bureau, suggesting a large opportunity remains for Shopify to capture more market share as consumer shopping habits change.

Market research from Precedence Research estimates that the global e-commerce industry could grow at nearly 15% annually through 2034, led by brands that focus on direct-to-consumer sales.

Interestingly, while Apple’s stock has recently hit new highs, Shopify shares are still recovering from their late-2021 peak, making them an attractive option for savvy investors.

Pragmatic Investing

Conditions in the market fluctuate: today may not be the time to buy Apple shares at peak prices, while Shopify presents a compelling opportunity.

Inevitably, moments will arise when Apple shares will be a must-have and perhaps when Shopify carries too much risk.

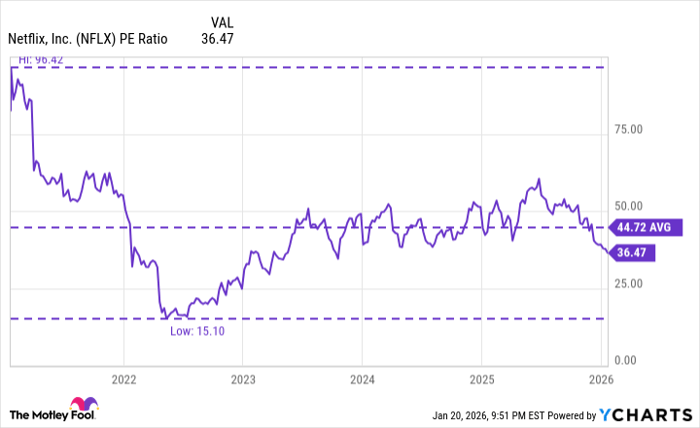

However, the current climate suggests Apple could be overvalued, whereas Shopify is undervalued. Investors should carefully consider this dynamic to make informed decisions, focusing on fundamentals rather than mere popularity in the stock market.

Seize the Chance for Smart Investment

Have you ever felt like you missed your chance to invest in high-performing stocks? Now may be the time to take action.

Our team of analysts has identified companies they believe are poised for significant growth. If you’ve hesitated in the past, the opportunity to invest is ripe right now:

- Amazon: if you invested $1,000 when we recommended this stock in 2010, you’d have $23,324!

- Apple: if you invested $1,000 in 2008, you’d have $42,133!

- Netflix: if you invested $1,000 in 2004, you’d have $420,761!

Currently, we’re highlighting “Double Down” alerts for three exceptional companies—a chance that may not come around again anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, and Shopify. The Motley Fool recommends eBay. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.