Big Names Increase Their Dividend Payouts: AbbVie, Visa, and Comfort Systems USA

Key Insights

- AbbVie (ABBV), Visa (V), and Comfort Systems USA (FIX) have announced increases to their dividend payouts.

- Investors may find dividend stocks appealing for generating passive income alongside potential growth in stock value.

- Check out our free report on the 7 Best Stocks for the Next 30 Days!

Investors often appreciate dividends because they create a consistent income. They can also reduce losses in other investments while providing multiple ways to profit.

When looking for dividend stocks, those that have a history of increasing their payouts are particularly attractive, showcasing their dedication to rewarding shareholders.

Recently, AbbVie (ABBV), Visa (V), and Comfort Systems USA (FIX) each announced higher payouts. Let’s explore their updates in detail.

Comfort Systems USA: A Hidden Gem in AI

Comfort Systems USA, rated Zacks Rank #2 (Buy), specializes in heating, ventilation, and air conditioning services.

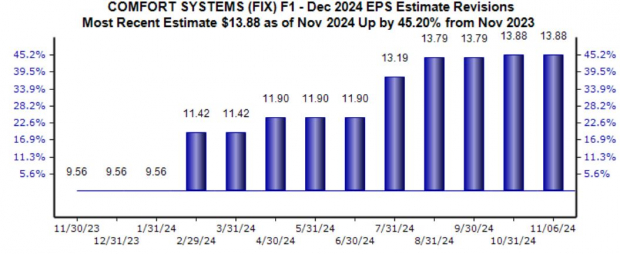

It supplies essential components for data centers, positioning itself as a unique player in the rising AI market. The company’s earnings-per-share (EPS) estimate for the current fiscal year has increased 45% from the previous year, predicting nearly 60% annual growth.

Image Source: Zacks Investment Research

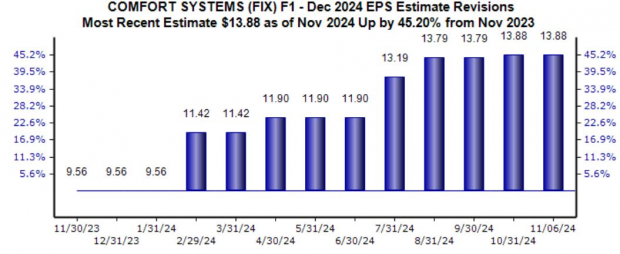

Following its quarterly earnings release, the company raised its dividend by 17%. This move aligns with a solid 28% average annual dividend growth rate over the past five years.

Image Source: Zacks Investment Research

Initially, the stock reacted negatively after the earnings announcement. However, it has now rebounded and is reaching near all-time highs, which often indicates a positive trend, especially when combined with upward revisions in earnings forecasts.

Visa: Powerhouse in Payment Processing

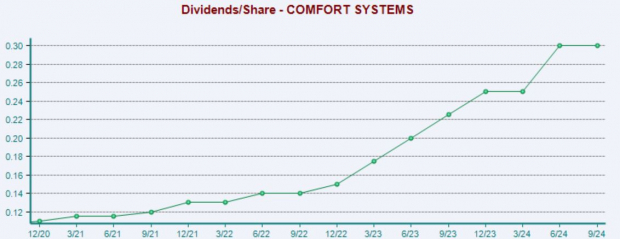

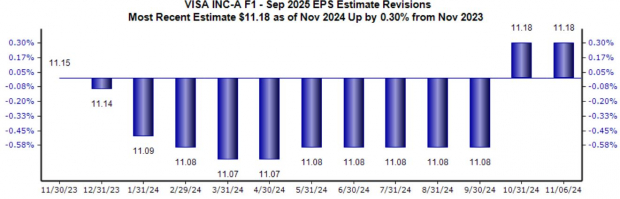

Visa, also a Zacks Rank #2 (Buy), is a leader in the global payments industry, providing diverse financial services to its clients. Its recent quarterly report indicated a positive trend, with the EPS estimate up 11% compared to the previous year.

Image Source: Zacks Investment Research

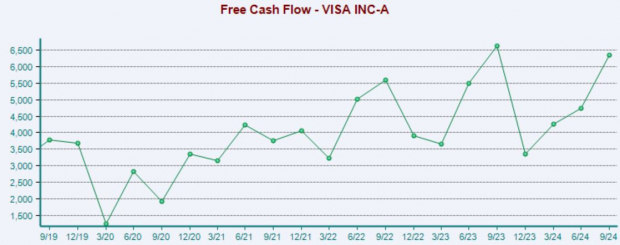

Visa reported an 8% increase in Payments Volume and a 10% rise in Processed Transactions year-over-year, demonstrating solid growth in its core operations. The board approved a 13% increase to its quarterly dividend, which now stands at $0.59 per share. With $6.4 billion in free cash flow reported, Visa remains attractive to income-focused investors.

Shares yield 0.7% annually.

Image Source: Zacks Investment Research

AbbVie Increases Earnings Guidance

AbbVie recently reported impressive earnings, with its shares climbing following the announcement. The company exceeded both EPS and revenue expectations, showing a 1.7% increase in EPS alongside a 3.8% rise in sales.

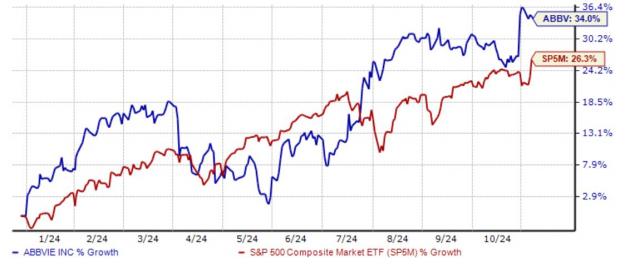

This year, AbbVie’s shares have surged 34%, significantly outperforming the S&P 500.

Image Source: Zacks Investment Research

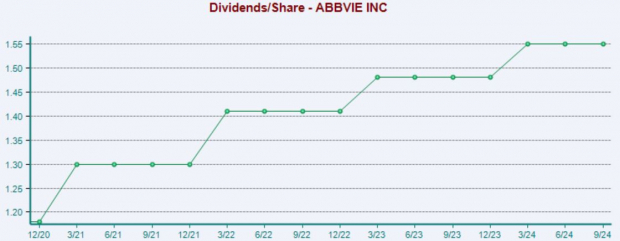

Key products like Skyrizi, generating $3.2 billion, and Rinvoq, which brought in $1.6 billion, were crucial for these results. Consequently, AbbVie raised its full-year adjusted EPS estimates to between $10.90 and $10.94 per share, up from a previous range of $10.67 to $10.87. Additionally, the company announced a 5.8% increase to its quarterly dividend payout.

Image Source: Zacks Investment Research

Conclusion

Dividends are often seen as an investor’s reward, providing income and stability. The recent dividend increases from AbbVie, Visa, and Comfort Systems USA showcase their commitment to rewarding shareholders.

Investors seeking dividend stocks that have recently raised payouts can look into these three companies, which are focused on sustaining shareholder value.

Discover Opportunities in Nuclear Energy

With global electricity demand soaring and a push to lessen reliance on fossil fuels, nuclear energy stands out as a viable alternative.

Recently, the U.S. and 21 other nations vowed to triple the world’s nuclear energy capacity. This significant shift could usher in vast profits for stocks in the nuclear sector, especially for early investors.

Our free report, Atomic Opportunity: Nuclear Energy’s Comeback, details key players and technologies in this field, highlighting three standout stocks likely to excel.

Download *Atomic Opportunity: Nuclear Energy’s Comeback* at no cost today.

Want the latest insights from Zacks Investment Research? Download our report on 5 Stocks Set to Double for free.

Visa Inc. (V): Free Stock Analysis Report

AbbVie Inc. (ABBV): Free Stock Analysis Report

Comfort Systems USA, Inc. (FIX): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.