Semiconductor Stocks Thrive Amid AI Boom

Key Insights

- Top recommendations: NVDA, TSM, and SMTC stocks hold strong buy or buy positions.

- Global semiconductor sales reached $166 billion last quarter, surging over 23% year on year.

- Sign up now for our exclusive report on the 7 Best Stocks for the Next 30 Days.

The semiconductor industry is rebounding after a tough year in 2023. This recovery is being driven by innovations in artificial intelligence (AI), advancements in data processing, and a revival in the electronics manufacturing sector, all lifting market demand.

With the Federal Reserve likely to reduce interest rates further, the semiconductor sector is poised for additional growth. Stocks like NVIDIA Corporation (NVDA), Taiwan Semiconductor Manufacturing Company Limited (TSM), and Semtech Corporation (SMTC) are considered wise investment choices. These companies carry Zacks Ranks of #1 (Strong Buy), #2 (Buy), or #3 (Hold). For a comprehensive list of Zacks #1 Rank stocks, see here.

Strong Surge in Semiconductor Sales

On Tuesday, the Semiconductor Industry Association (SIA) announced that global semiconductor sales hit $166 billion in the third quarter, marking an increase of 23.3% compared to last year and up 10.7% sequentially.

September alone saw a 4.1% rise in semiconductor sales, totaling $55.3 billion.

John Neuffer, SIA President and CEO, noted, “The global semiconductor market continued to grow during the third quarter of 2024, with quarter-to-quarter sales increasing at the fastest rate since 2016.” He also highlighted September’s sales as a record monthly high, significantly boosted by a 46.3% year-over-year increase in the Americas.

The increasing interest in AI, particularly generative AI, is one of the main factors driving semiconductor demand. NVIDIA has played a leading role in this market surge, contributing significantly to the overall rally in tech stocks this year.

Stocks Set to Benefit from AI Momentum

Market experts highlight that AI has vast untapped potential, suggesting that demand for semiconductors will rise as more manufacturers venture into this space.

Chips designed specifically for AI applications are increasingly vital across various sectors, including high-performance computing and consumer electronics. Additionally, the demand for memory products like NAND flash and DRAM is rebounding, fulfilling specialized computing requirements and supporting AI functionalities.

Gartner forecasts global semiconductor revenues will reach $630 billion in 2024, up 19% from the previous year. Revenues from NAND flash are expected to soar by 12% by 2025, mainly due to ongoing supply constraints and escalating demand for AI solutions.

Following a 50 basis point interest rate cut in September—the first since March 2020—the Federal Reserve’s current benchmark rate is between 4.75% and 5%, the lowest since April 2023. Analysts anticipate another 25 basis point rate cut during the upcoming November meeting. Lower rates typically enhance growth assets by decreasing the cost of holding non-yielding securities, such as technology and semiconductor stocks.

Promising Semiconductor Stocks

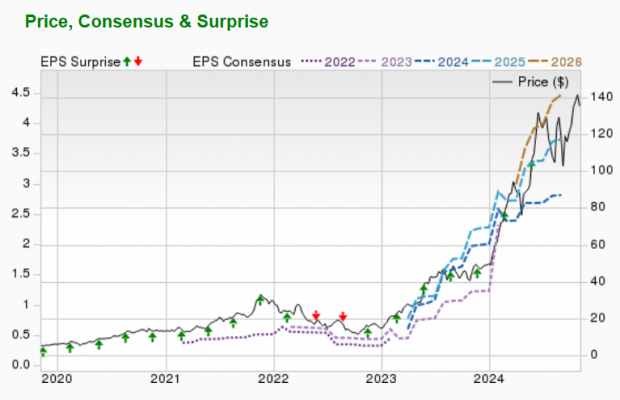

NVIDIA Corporation

NVIDIA Corporation is a global leader in visual computing technologies and creator of the graphic processing unit (GPU). Over time, NVDA’s focus has shifted from PC graphics to AI-based solutions that cater to high-performance computing, gaming, and virtual reality platforms.

The expected growth rate for NVIDIA’s earnings exceeds 100% this year, with the Zacks Consensus Estimate increasing by 0.7% in the last 60 days. NVDA currently holds a Zacks Rank #2.

Image Source: Zacks Investment Research

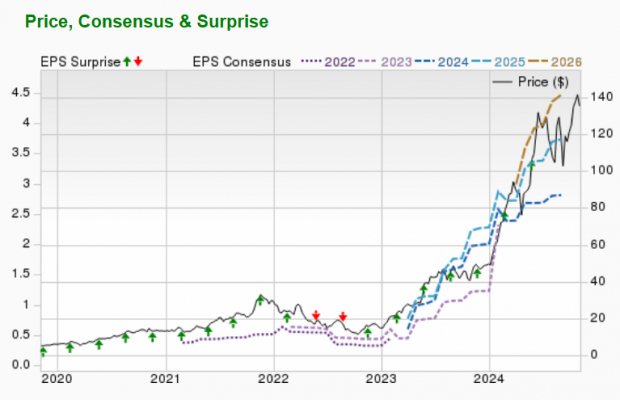

Taiwan Semiconductor Manufacturing Company Limited

Taiwan Semiconductor Manufacturing Company Limited is the world’s leading independent integrated circuit foundry. TSM manufactures integrated circuits based on customers’ designs using its advanced production techniques. The company’s goal is to strengthen its position as a top semiconductor company globally.

Expected earnings growth for Taiwan Semiconductor is 28% this year, with the Zacks Consensus Estimate improving by 2.8% over the last 60 days. TSM carries a Zacks Rank #2.

Image Source: Zacks Investment Research

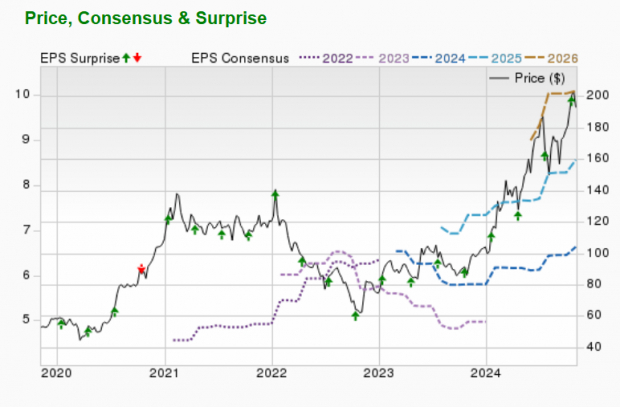

Semtech Corporation

Semtech Corporation develops, manufactures, and sells a variety of analog and mixed-signal semiconductors for commercial applications. Its offerings include Signal Integrity Products, Protection Products, Power and High-Reliability Products, Wireless and Sensing Products, and Systems Innovation.

Semtech’s anticipated earnings growth this year surpasses 100%. The Zacks Consensus Estimate for earnings has increased by 6.3% over the last 90 days. SMTC currently has a Zacks Rank #3.

Image Source: Zacks Investment Research

Free Report: Investing in Nuclear Energy’s Growth

As global electricity demand skyrockets alongside the push to reduce reliance on fossil fuels, nuclear energy emerges as a promising alternative.

Leaders from the US and 21 other nations have committed to TRIPLING the world’s nuclear energy capacities. This bold transition suggests substantial opportunities for nuclear-related stocks, particularly for investors who act swiftly.

Our comprehensive report, Atomic Opportunity: Nuclear Energy’s Comeback, delves into key players and technologies at the forefront of this shift, highlighting three standout stocks ready to reap the benefits.

Download the Atomic Opportunity: Nuclear Energy’s Comeback report free today.

Looking for the latest investment advice from Zacks Investment Research? You can also download the report on 5 Stocks Set to Double, available now.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Semtech Corporation (SMTC): Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.