Stantec Outperforms Earnings Estimates, Eyes Future Growth

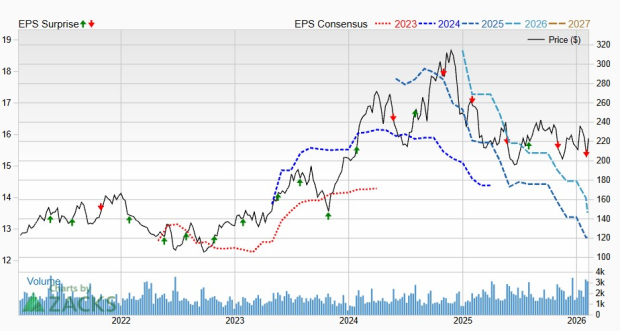

Stantec (STN) announced quarterly earnings of $0.95 per share, surpassing the Zacks Consensus Estimate of $0.90 per share. In comparison, the company earned $0.85 per share during the same quarter last year. These earnings are adjusted for non-recurring items.

Earnings Surprise Highlights Performance

Stantec’s latest report represents an earnings surprise of 5.56%. Last quarter, it was expected to report earnings of $0.81 per share but exceeded expectations by posting $0.82, resulting in a surprise of 1.23%.

In the past four quarters, Stantec has outperformed consensus EPS estimates three times, demonstrating consistent growth.

As a key player in the Zacks Consulting Services industry, Stantec generated revenues of $1.12 billion for the quarter ending September 2024, which again surpassed the Zacks Consensus Estimate by 0.17%. This revenue is a significant increase from $981.64 million in the same quarter last year. The company has exceeded consensus revenue estimates in all of the last four quarters.

The future performance of Stantec’s stock will likely depend on management’s commentary during the upcoming earnings call, as investors will be eager for insights on expected earnings trends.

Market Performance and Future Considerations

Stantec shares have risen by approximately 5.1% since the start of the year, although this lags behind the S&P 500’s gain of 24.3%.

Investors are now pondering what lies ahead for Stantec. While no simple answers exist, understanding the company’s earnings outlook is crucial. This includes current consensus earnings expectations for upcoming quarters and any recent changes in those estimates.

Research shows a strong link between stock movements and trends in earnings estimate revisions. Investors can track these revisions themselves or utilize tools like the Zacks Rank, known for effectively predicting stock performance based on earnings estimates.

Leading up to this earnings announcement, the trend of estimate revisions for Stantec appears favorable. Despite potential changes in estimates following the latest report, the current status gives the stock a Zacks Rank of #2 (Buy), indicating an expectation for it to outperform the market in the near term.

The consensus EPS estimate for the upcoming quarter stands at $0.68, with anticipated revenues of $1.04 billion. For the current fiscal year, the estimate is $3.07 on $4.23 billion in revenues.

Investors should also consider broader industry trends, as the outlook for Stantec could be significantly influenced by the overall performance of the Zacks Consulting Services industry, which is currently ranked in the top 16% of over 250 Zacks industries. Historically, stocks in the top 50% of Zacks-ranked industries often outperform those in the bottom half by a ratio of more than 2 to 1.

Upcoming Earnings Reports to Monitor

Another company within the Zacks Business Services sector, comScore (SCOR), has yet to report its results for the quarter ending September 2024. Its results are set to be released on November 12.

comScore is projected to report a quarterly loss of $0.94 per share, reflecting a year-over-year decline of 135%. It is estimated that the company will generate revenues of $86 million, which is a 5.5% decrease from the previous year.

Insights from Zacks Research

With thousands of stocks to choose from, five Zacks experts have each identified their top pick for significant growth in the near future. Among these, the Director of Research, Sheraz Mian, has singled out one stock believed to have the most explosive upside potential.

This particular company targets the millennial and Gen Z markets and generated nearly $1 billion in revenue last quarter alone. After a recent pullback in price, analysts feel this is an ideal investment opportunity. While not every pick leads to success, this choice has the potential to outperform previous high-flying stocks, such as Nano-X Imaging, which surged by 129.6% in just over nine months.

To find the latest investment recommendations from Zacks Investment Research, you can download the report listing 5 Stocks Set to Double.

Stantec Inc. (STN) : Free Stock Analysis Report

comScore, Inc. (SCOR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.