Guggenheim Downgrades Sunrun to Neutral: What This Means for Investors

Overview of Fund Sentiment

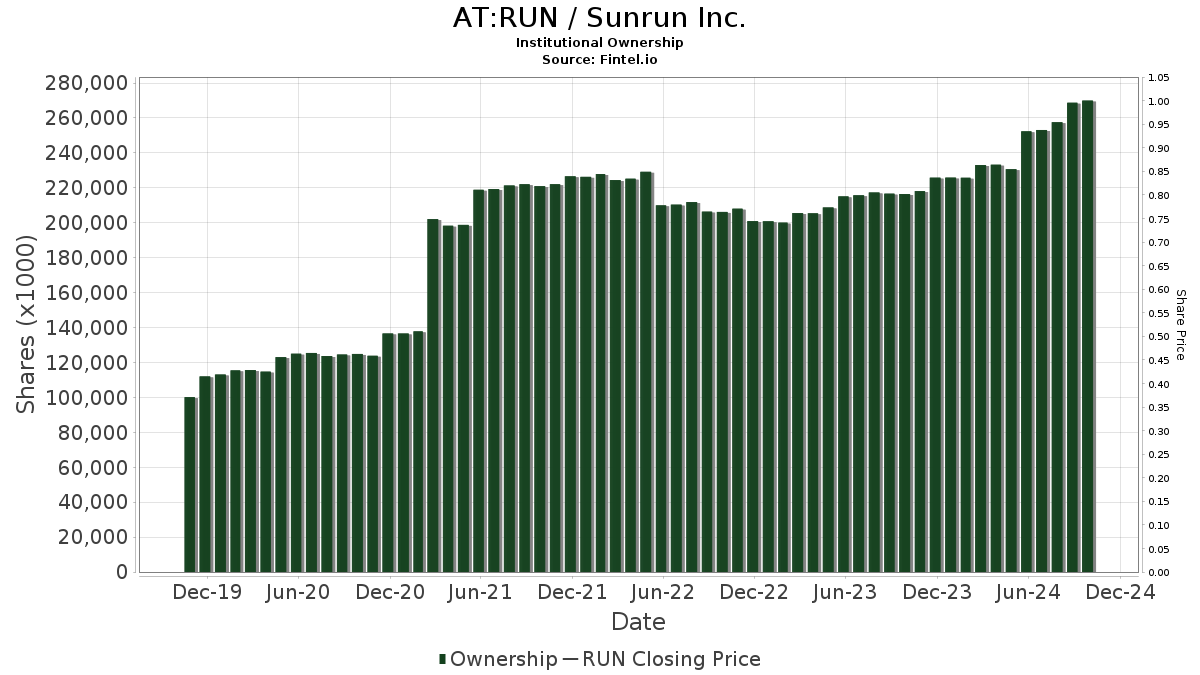

As of November 7, 2024, Guggenheim has changed its outlook for Sunrun (WBAG:RUN) from Buy to Neutral. Currently, 768 funds or institutions report holdings in Sunrun, marking a rise of 12 owners or 1.59% since last quarter. The average portfolio weight of all funds invested in RUN stands at 0.22%, which is an increase of 14.20%. Institutional ownership has surged by 8.08% over the past three months, totaling 269,732K shares.

Current Moves by Significant Shareholders

Grantham, Mayo, Van Otterloo & Co. now holds 16,311K shares, representing 7.30% ownership, a notable increase from their previous 14,626K shares, reflecting a growth of 10.33%. However, the firm has reduced its portfolio allocation in RUN by 6.74% in the last quarter.

The IJR – iShares Core S&P Small-Cap ETF recently increased its holdings to 14,335K shares, capturing 6.41% ownership. This marks a remarkable change from the previous report where they held 0K shares, translating into a 100.00% increase.

Orbis Allan Gray holds 13,896K shares, or 6.22% ownership. Their prior report indicated ownership of 14,231K shares, showing a decrease of 2.42%. In the last quarter, they cut their portfolio allocation in RUN by 32.49%.

Greenvale Capital LLP increased its holdings from 9,750K shares to 11,750K shares, reflecting a 17.02% growth, despite a decrease of 11.21% in portfolio allocation over the last quarter as well.

Alyeska Investment Group, on the other hand, saw a significant increase from 1,400K shares to 7,614K shares, which is an impressive rise of 81.62%. This firm has notably increased its portfolio allocation in RUN by 354.71% in the last quarter.

Fintel serves as a comprehensive research platform for individual investors, traders, financial advisors, and small hedge funds.

Our data encompasses global insights, including fundamentals, analyst reports, ownership data, fund sentiment, and more, ultimately supporting our advanced, backtested quantitative models for improved investment outcomes.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.