Morgan Stanley Begins Coverage on Allegro MicroSystems with Positive Outlook

Analyst Forecast Indicates Significant Growth Potential

On November 7, 2024, Morgan Stanley started its coverage of Allegro MicroSystems (NasdaqGS:ALGM) with an Equal-Weight recommendation. As of October 22, 2024, the average one-year price target for Allegro MicroSystems is $31.07 per share. This forecast varies, with a low of $25.25 and a high of $36.75. The average price target signifies a potential increase of 40.19% from the most recent closing price of $22.16 per share.

For more insights, check our leaderboard showcasing companies with the highest price target upside.

The expected annual revenue for Allegro MicroSystems stands at $1,176 million, reflecting a robust increase of 38.37%. Additionally, the projected annual non-GAAP earnings per share (EPS) is anticipated to be 1.46.

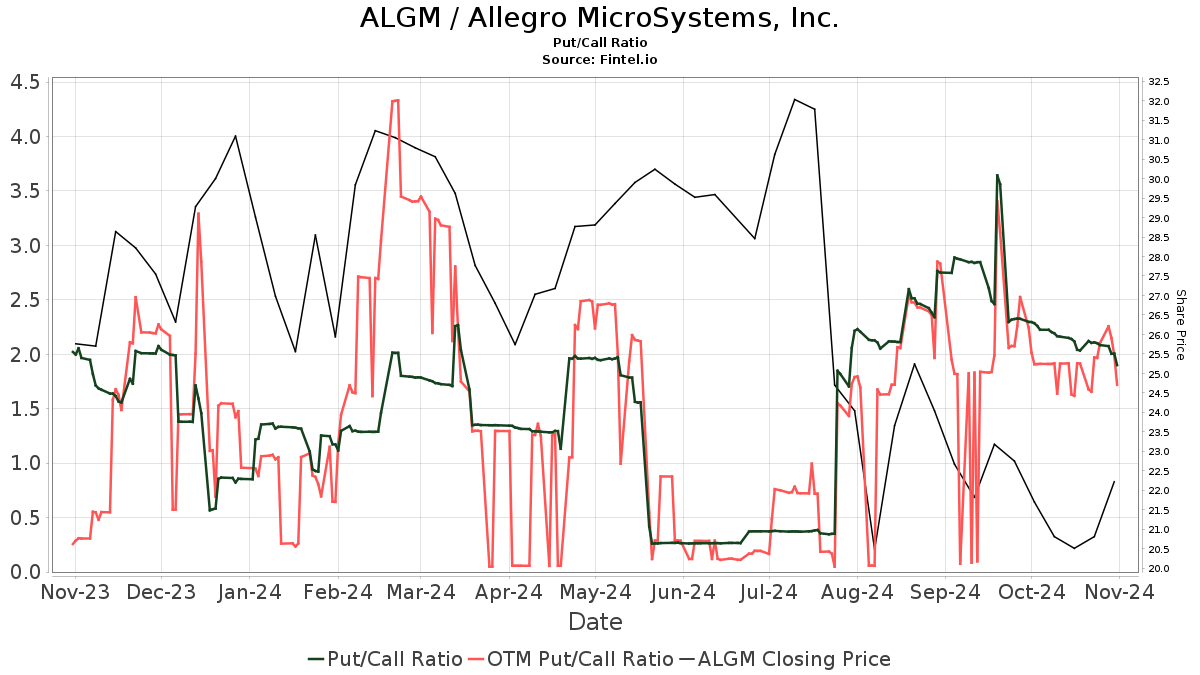

Current Fund Sentiment Towards Allegro MicroSystems

As of now, 692 funds and institutions have reported holdings in Allegro MicroSystems. This marks an increase of 2 owners, or 0.29%, from the previous quarter. On average, funds have dedicated 0.18% of their portfolios to ALGM, which is an increase of 18.75%. Institutional ownership has risen by 2.60% in the last three months, totaling 134,880K shares.  The current put/call ratio for ALGM stands at 1.90, which suggests a bearish outlook.

The current put/call ratio for ALGM stands at 1.90, which suggests a bearish outlook.

Activity Among Major Shareholders

JPMorgan Chase has increased its holdings to 9,139K shares, which constitutes 4.97% ownership. This represents a notable increase of 38.13% from the previous report where they owned 5,654K shares. Their portfolio allocation in ALGM has risen by 64.42% over the last quarter.

The FSELX – Semiconductors Portfolio now holds 7,899K shares, accounting for 4.29% ownership after a 31.68% increase from 5,396K shares last quarter, reflecting a growth of 15.03% in portfolio allocation.

Invesco holds 5,918K shares, representing 3.22% ownership, up by 31.06% from their previous holding of 4,080K shares, marking a 49.60% increase in their allocation.

Clearbridge Investments has slightly decreased its holdings to 3,679K shares, now holding 2.00% of Allegro after a small reduction of 1.41%. Their portfolio allocation increased by 5.31% during the last quarter. T. Rowe Price Investment Management owns 2,854K shares, or 1.55% of the company, which is an increase from 2,767K shares, translating to a 3.05% rise in their allocation over the last quarter.

About Allegro MicroSystems

(Company Description)

Allegro MicroSystems is at the forefront of innovation, focusing on sensing and power technologies. Their work encompasses areas like sustainable energy, advanced mobility, and motion control systems. With a dedicated team, they strive to provide smart solutions that enhance their clients’ competitive advantage. Allegro serves as a reliable ally to both large corporations and local market leaders around the globe.

Fintel offers one of the most thorough investing research tools available for individual investors, traders, and small hedge funds. Our extensive data encompasses fundamentals, analyst evaluations, ownership statistics, fund sentiment, and more, ensuring users make informed investment decisions.

Click to Learn More

This report originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.