Palo Alto Networks Faces Downgrade Amid Positive Price Forecast

OTR Global Lowers Outlook from Mixed to Negative

Fintel reports that on November 7, 2024, OTR Global downgraded their outlook for Palo Alto Networks (XTRA:5AP) from Mixed to Negative.

Analysts Anticipate Minor Growth in Share Price

As of October 22, 2024, the average one-year price target for Palo Alto Networks is 362,26 €/share. The forecasts range from a low of 257,13 € to a high of 431,97 €. The average price target represents a potential increase of 9.02% from its latest reported closing price of 332,30 € / share.

See our leaderboard of companies with the largest price target upside.

Strong Revenue Growth Expected for the Company

The projected annual revenue for Palo Alto Networks is 10,060MM, an increase of 25.32%. Furthermore, the projected annual non-GAAP EPS is 5.47.

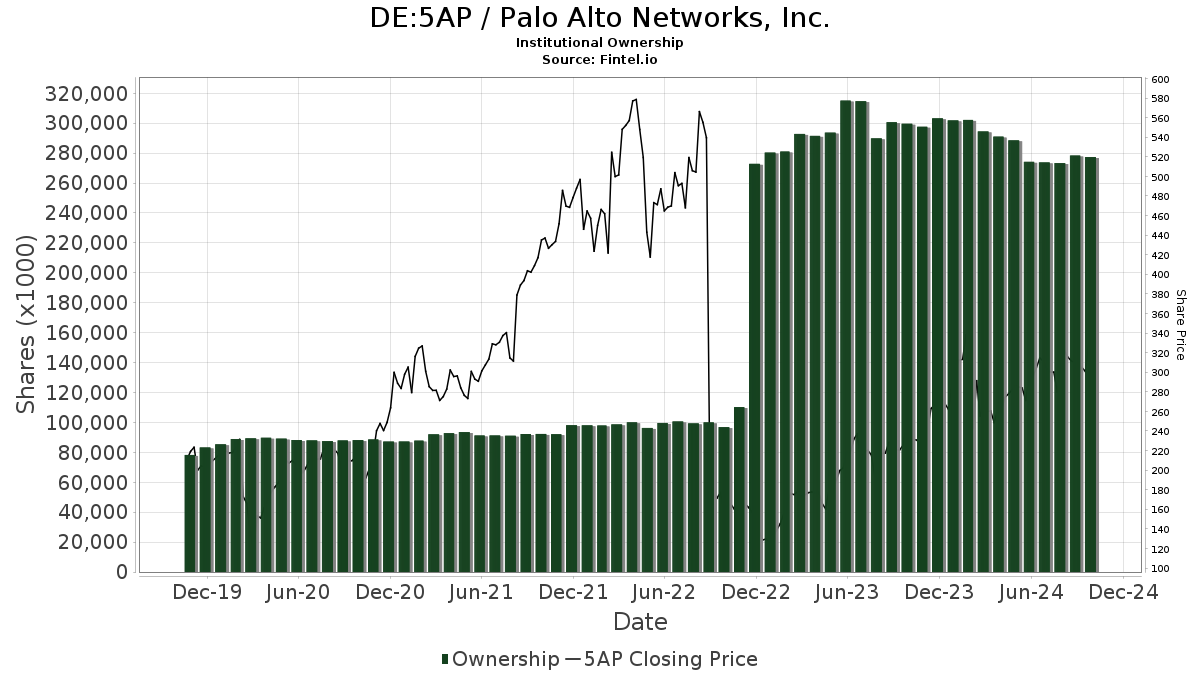

Fund Ownership on the Rise

As of now, 3,035 funds or institutions are reporting positions in Palo Alto Networks. This shows an increase of 20 owners, or 0.66%, over the last quarter. The average portfolio weight of all funds dedicated to 5AP stands at 0.47%, rising by 1.54%. Additionally, total shares owned by institutions increased by 7.73% over the past three months to 280,195K shares.

Institutional Shareholders Adjust Their Holdings

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 10,228K shares, representing 3.13% ownership of the company. The firm previously reported owning 10,156K shares, indicating an increase of 0.70%. Over the last quarter, it also increased its portfolio allocation in 5AP by 16.85%.

Bank of America owns 8,313K shares, accounting for 2.54% of the company. Earlier, the firm reported 7,557K shares, reflecting a 9.10% increase. Notably, its portfolio allocation in 5AP saw a significant decrease of 69.24% last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares now holds 8,293K shares, giving it 2.53% ownership. The previous filing listed 7,946K shares, indicating a 4.19% increase in ownership, alongside a 17.88% rise in portfolio allocation.

JPMorgan Chase holds 7,804K shares, equating to 2.38% ownership. This is an increase from the earlier 7,532K shares, marking a gain of 3.48%, and a portfolio allocation rise of 20.04% over the last quarter.

Geode Capital Management owns 7,436K shares, or 2.27% of the company. Reflecting an increase from 7,014K shares reported previously, this marks a change of 5.68%, alongside a 37.32% decrease in portfolio allocation in 5AP.

Fintel offers one of the most comprehensive investing research platforms for individual investors, financial advisors, and hedge funds.

Our data spans worldwide markets, including fundamentals, analyst reports, ownership data, sentiments on funds, insider trading, and more. Additionally, our exclusive stock picks are based on advanced, backtested quantitative models designed to enhance profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.