By RoboForex Analytical Department

EUR/USD Navigates Changes Amid Trump’s Return

As EUR/USD hovers around 1.0785, the impact of recent events is creating ripples in the market. With Donald Trump back as US President, financial analysts are reassessing inflation and the economic policies likely to return.

Trump’s protectionist approach has the potential to escalate inflation, compelling the Federal Reserve to sustain higher interest rates than previously expected. This possibility enhances the dollar’s attractiveness in the current financial landscape.

In a move anticipated by the market, the Federal Reserve reduced interest rates by 25 basis points to 4.75%. The Fed’s statement indicated no shift in its intended rate path, suggesting that further easing may be on the horizon.

Another reduction of 25 basis points is projected for the Fed’s December meeting, consistent with its careful but progressive monetary easing strategy.

Technical Insights on EUR/USD

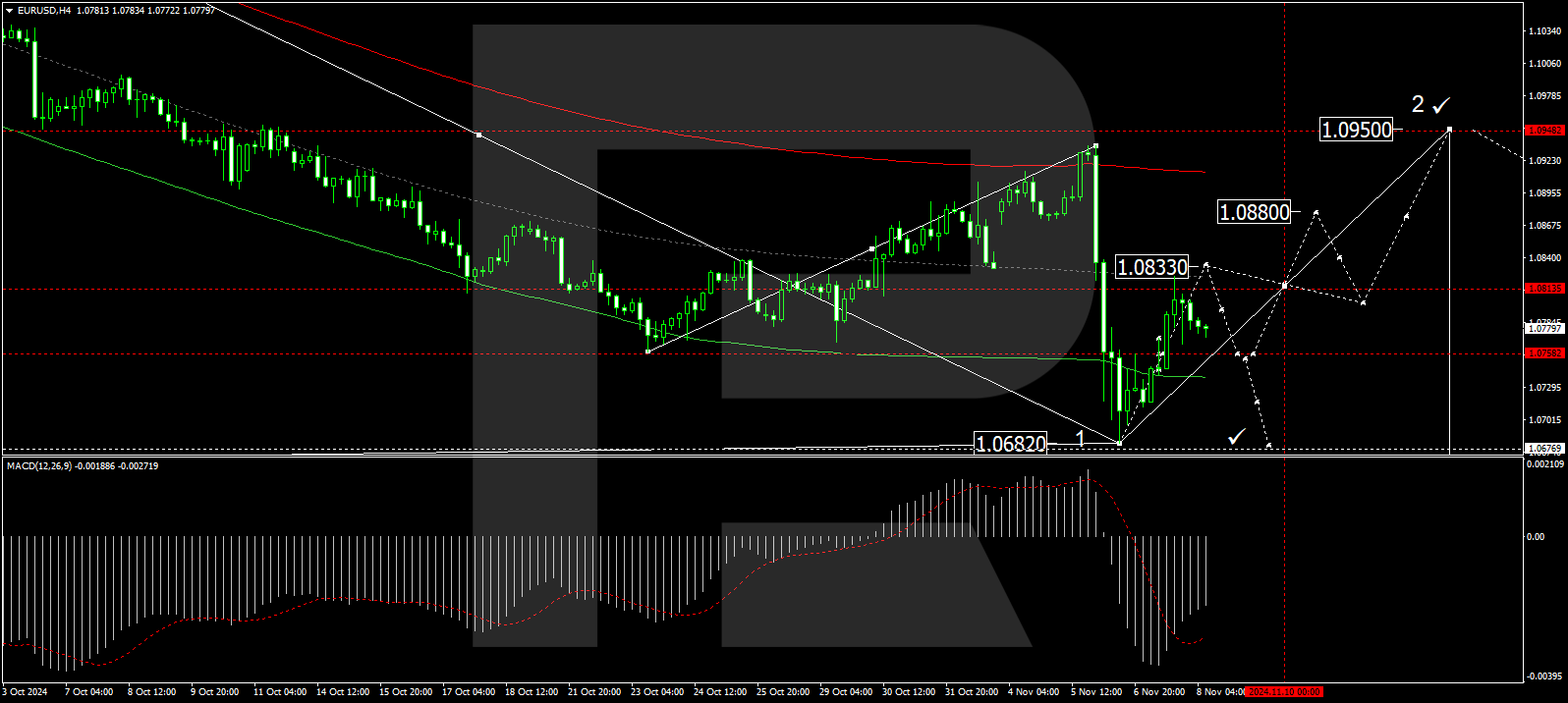

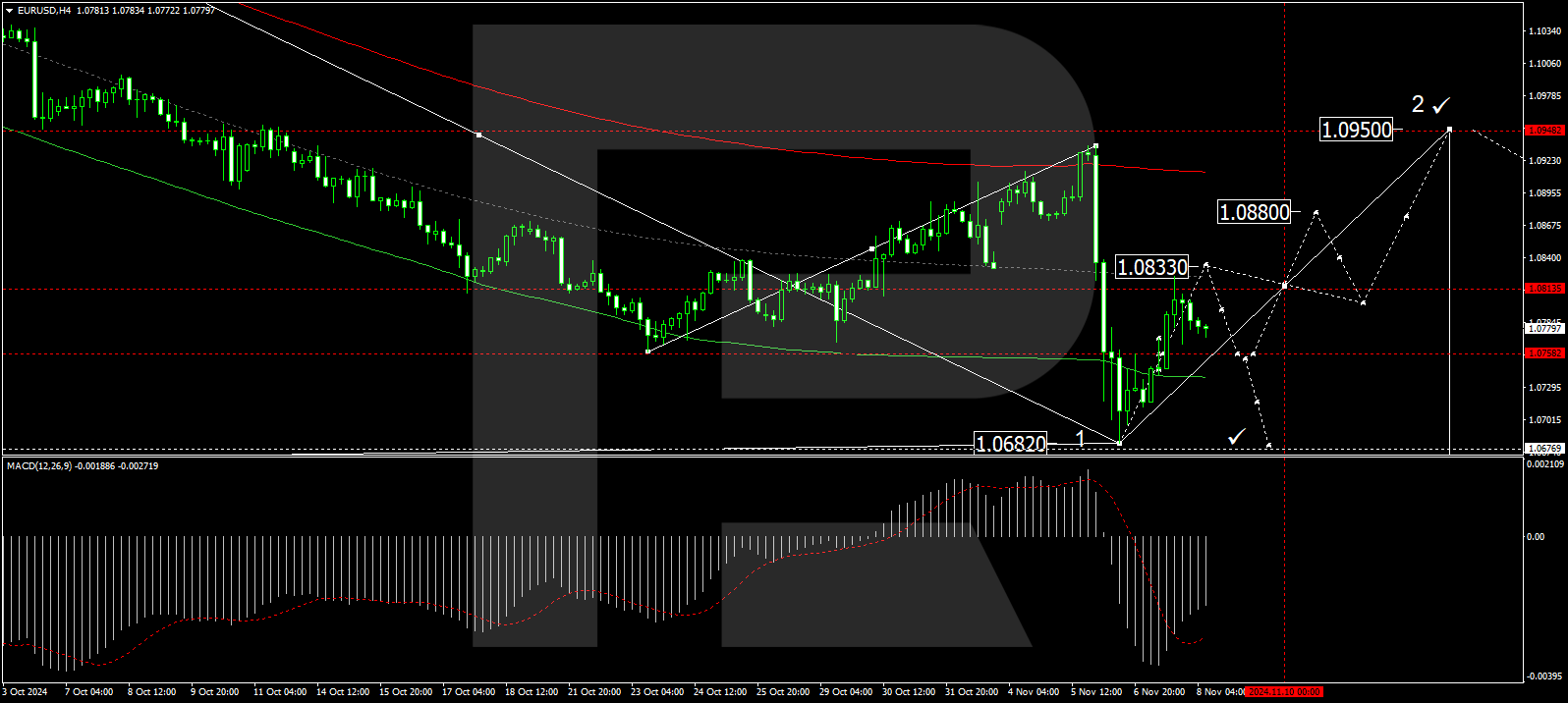

Recently, the EUR/USD pair reached a bullish target of 1.0820 as part of a continuing upward trend. Current patterns indicate a potential pullback to 1.0758 before the pair attempts to rise towards 1.0833. This forecast is backing by the MACD indicator, which is trending upwards despite being below zero, hinting at sustained bullish momentum.

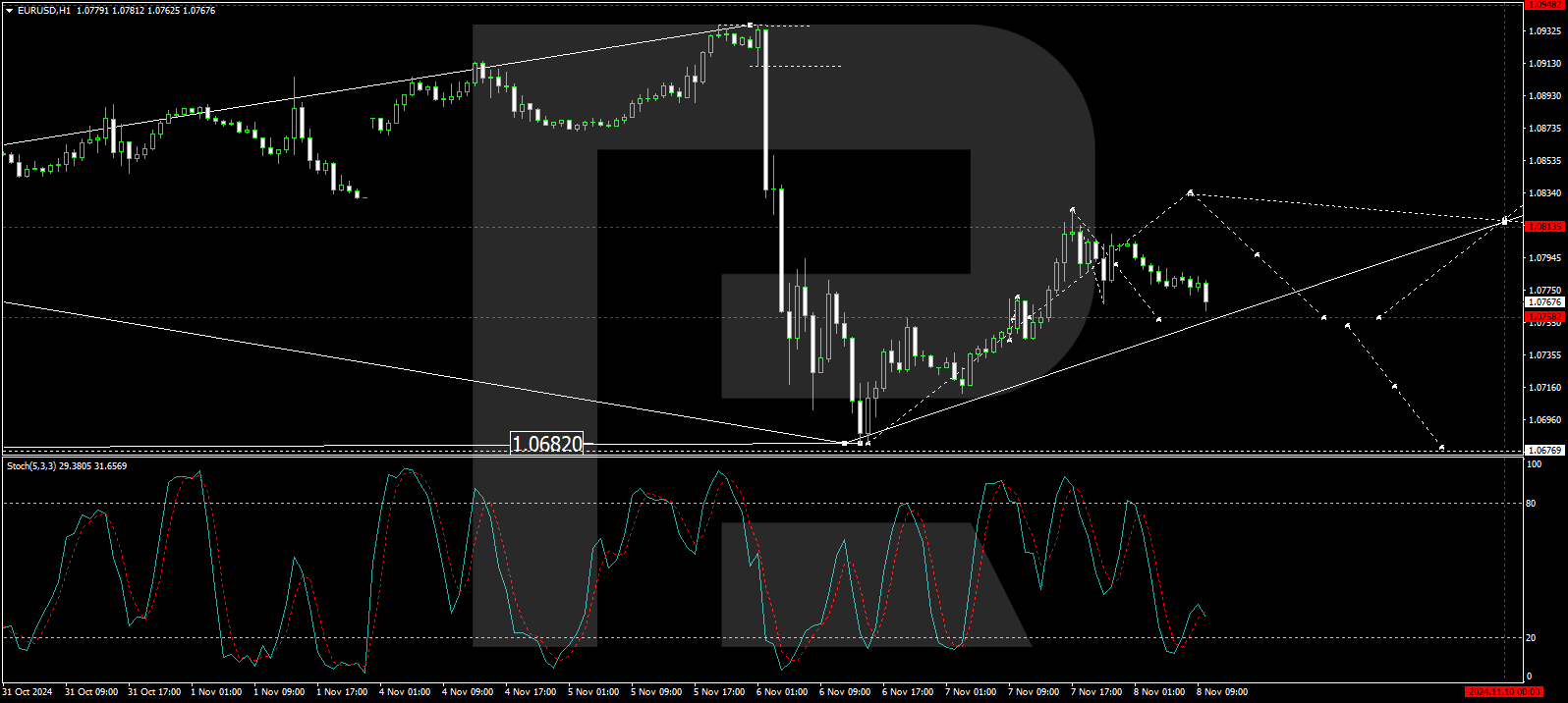

In the hourly analysis, the EUR/USD pair appears to be in a corrective phase, aiming for 1.0758. After reaching this level, a bounce back to 1.0833 is anticipated, possibly followed by another dip to 1.0758. The stochastic oscillator supports this view, indicating an upward shift toward 80, which suggests growing bullish momentum.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs