ON Semiconductor Faces Market Challenges Despite Strong Earnings

ON Semiconductor Corporation (ON), based in Scottsdale, Arizona, is a significant name in the semiconductor field. With a market cap of $30.8 billion, ON specializes in intelligent sensing and power solutions, providing a wide range of discrete and embedded semiconductor components.

Recent Performance Shows Weakness Compared to Benchmarks

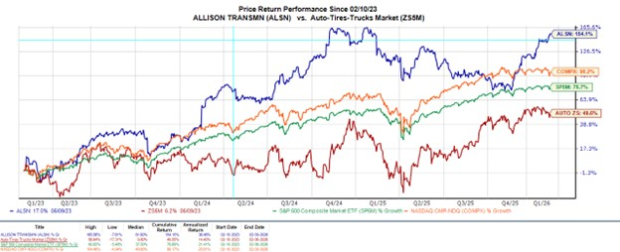

Over the past year, shares of ON have struggled, declining 7.9%, while the S&P 500 Index ($SPX) surged by 36.4%. In 2024, the stock is up only 1.8%, compared to SPX’s impressive gain of 25.2% year-to-date.

Additionally, ON underperformed the Semiconductor Select SPDR Fund (XSD), which showed returns of 37.8% over the same period. ON has also trailed behind this ETF’s YTD increase of 11%.

Positive Earnings Report Lifts Stock Prices

On November 6, despite its year-long struggles, ON Semiconductor experienced a notable surge, climbing over 3%, paralleling positive trends in the broader chip industry. The company released its Q3 earnings on October 28, revealing an adjusted net income of $0.99 per share, which exceeded Wall Street’s prediction of $0.97. Its revenue for the quarter reached $1.76 billion, slightly surpassing the anticipated $1.75 billion. For Q4, ON expects adjusted earnings between $0.92 and $1.04 per share, with revenue projected between $1.71 billion and $1.81 billion.

Analysts Predict a Decline in Earnings for the Year

For the current fiscal year ending in December, analysts forecast a 22.4% year-over-year decline in ON’s EPS to $4. However, the company’s earnings surprise history is promising, having exceeded consensus estimates in each of the last four quarters.

Among the 29 analysts covering ON stock, the consensus rating is “Moderate Buy.” This includes 15 “Strong Buys,” one “Moderate Buy,” 11 “Holds,” one “Moderate Sell,” and one “Strong Sell.”

Analyst Insights and Future Prospects

This outlook is slightly less optimistic than three months ago, when 16 analysts favored a “Strong Buy.” On October 28, Truist Financial Corporation (TFC) analyst William Stein adjusted ON Semiconductor’s price target from $97 to $89, yet maintained a “Buy” rating following a mixed Q3 report. Stein pointed out that ON is still poised for double-digit EPS growth and labeled its shares as undervalued compared to other analog semiconductor stocks.

Currently, the consensus price target of $86.56 indicates a 20.1% upside from ON’s current levels. The highest target set by analysts at $107 points to a potential rise of 48.5% from the current stock prices.

More Stock Market News from Barchart

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.