Piper Sandler Upgrades Upstart Holdings Amid Mixed Market Sentiment

Fintel reports that on November 8, 2024, Piper Sandler upgraded their outlook for Upstart Holdings (NasdaqGS:UPST) from Neutral to Overweight.

Analyst Forecast Predicts Significant Decline

As of October 22, 2024, the average one-year price target for Upstart Holdings stands at $30.05 per share. Estimates vary, with a low of $9.09 and a high of $50.40. This average implies a notable decrease of 62.90% from the latest reported closing price of $81.00 per share.

Explore our leaderboard for companies with the largest price target upside.

Projected Revenue Shows Positive Growth

The anticipated annual revenue for Upstart Holdings is $992 million, marking an impressive increase of 63.98%. Additionally, the projected annual non-GAAP EPS is estimated at 1.20.

Institutional Sentiment on Upstart Holdings

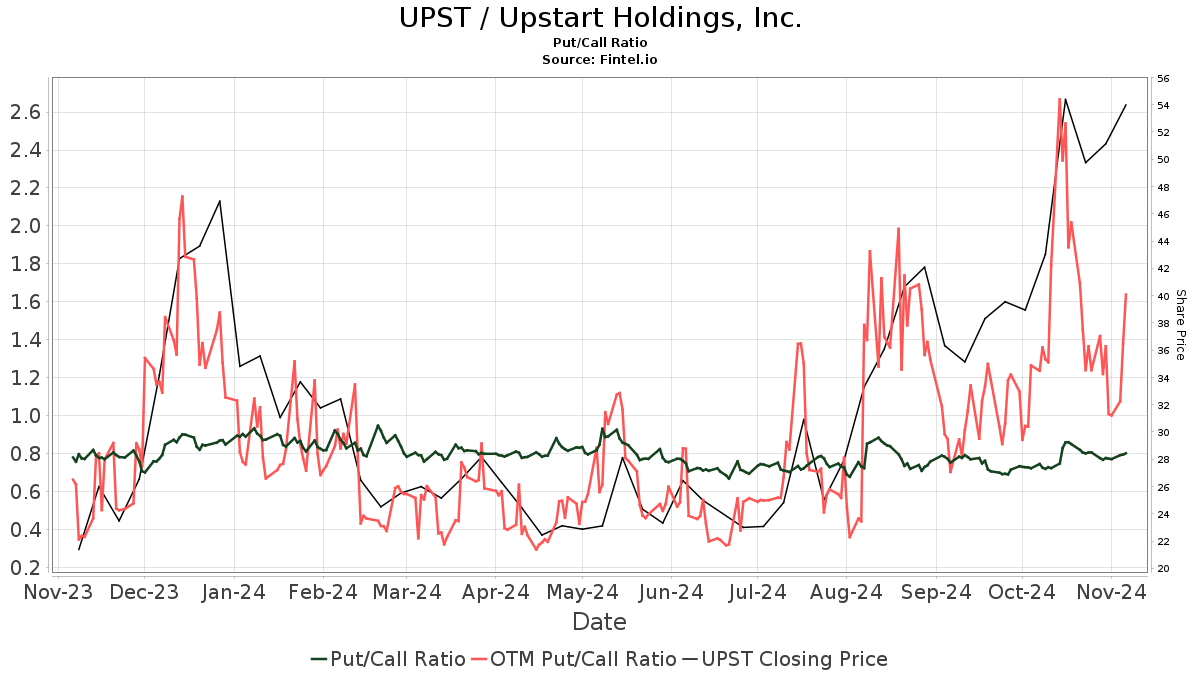

A total of 471 funds and institutions currently report holding positions in Upstart Holdings. This reflects an increase of 20 shareholders, or 4.43%, in the last quarter. The average portfolio weight for all funds committed to UPST is now 0.06%, reflecting a 9.31% rise. Over the past three months, total shares owned by institutions grew by 9.98% to reach 42,046K shares.  The put/call ratio for UPST is currently at 0.82, suggesting a bullish outlook.

The put/call ratio for UPST is currently at 0.82, suggesting a bullish outlook.

Recent Institutional Changes in Holdings

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares owns 2,363K shares, equating to 2.64% ownership of the company. In a previous filing, the firm reported 2,252K shares, showing an increase of 4.67%. However, the firm reduced its portfolio allocation in UPST by 10.51% in the past quarter.

NAESX – Vanguard Small-Cap Index Fund Investor Shares holds 1,879K shares, representing 2.10% ownership. Previously, they reported 1,876K shares, reflecting a slight increase of 0.18%. In the last quarter, they decreased their UPST allocation by 7.81%.

Geode Capital Management controls 1,787K shares or 2.00%. Their prior holding was 1,667K shares, indicating a 6.73% increase, yet they also decreased their portfolio allocation in UPST by 10.74% in the last quarter.

IWM – iShares Russell 2000 ETF holds 1,731K shares for 1.93% ownership. It previously reported 1,821K shares, a decrease of 5.21%. The firm reduced its UPST allocation by 9.03% over the last quarter.

Susquehanna International Group, LLP owns 1,527K shares, equivalent to 1.71% ownership. The firm reported holding 1,459K shares before, indicating a 4.43% increase, despite a slight decrease in portfolio allocation of 1.57% over the last quarter.

Overview of Upstart Holdings

(Description provided by the company.)

Upstart is a leading AI lending platform that collaborates with banks to enhance access to affordable credit. By using Upstart’s AI technology, partner banks can achieve higher approval rates and lower loss rates, all while ensuring a seamless digital lending experience. Over two-thirds of Upstart loans receive instant approval and are fully automated. Founded by former Google employees in 2012, Upstart operates out of San Mateo, California, and Columbus, Ohio.

Fintel offers an extensive investing research platform for individual investors, traders, financial advisors, and small hedge funds. Our data covers a range of information, from fundamentals and analyst reports to ownership data and fund sentiment.

To learn more, click here.

This story originally appeared on Fintel.

The views and opinions expressed herein reflect those of the author and do not necessarily represent the views of Nasdaq, Inc.