Nvidia Soars: A Closer Look at the AI Giant’s Future

Nvidia (NASDAQ: NVDA) stock has experienced remarkable growth, increasing by 2,700% over the past five years. This surge is largely due to Nvidia’s pivotal role in the booming artificial intelligence (AI) market. Today’s $200 billion AI sector is projected to hit $1 trillion by the end of the decade, positioning Nvidia as a leading competitor.

The company has created a vast AI ecosystem that includes the fastest chips for AI tasks alongside a comprehensive range of products and services. This growth has consistently boosted Nvidia’s earnings quarter after quarter. Recently, the firm achieved notable milestones, surpassing Apple to become the world’s most valuable company and earning an invitation to join the Dow Jones Industrial Average.

Looking ahead, Nvidia faces two major catalysts that could significantly impact its stock price. Investors may be wondering whether this is the right time to invest in Nvidia. Let’s explore these upcoming events.

Image source: Getty Images.

High Demand for Nvidia’s GPUs

First, let’s recap Nvidia’s journey so far. The company’s graphics processing units (GPUs) are regarded as the best in the world, leading to a high demand among the largest tech firms. Recently, Oracle co-founder Larry Ellison revealed that he and Tesla CEO Elon Musk were “begging” Nvidia for additional GPUs.

Beyond GPUs, Nvidia provides everything required for clients to launch and maintain AI projects. The company’s accessibility via public cloud platforms makes its offerings easy to acquire.

These factors have contributed to Nvidia’s impressive quarterly earnings growth. In its latest report, the company announced a record revenue of $30 billion, complemented by a gross margin exceeding 70%.

Upcoming Earnings and Product Launch

Now, let’s delve into the two key events to watch: Nvidia’s third-quarter earnings report on November 20 and the rollout of its new architecture, Blackwell, in the fourth quarter. Any news—positive or negative—could have a substantial impact on its stock performance.

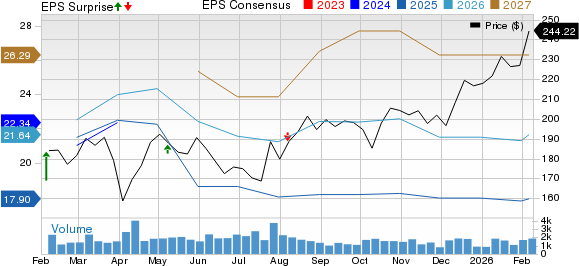

Nvidia has already hinted at what to expect from these events. The company forecasts double-digit revenue growth while maintaining margins in the mid-70% range. Although this may seem less impressive compared to previous triple-digit increases, it’s important to consider the context.

As revenue levels have grown over the last few years, achieving similar growth rates becomes progressively challenging. For instance, Nvidia’s data center revenue soared from under $4 billion in earlier years to over $26 billion in the most recent quarter. A double-digit revenue increase in the upcoming quarter would thus indicate strong performance rather than cause for concern.

Nvidia has consistently highlighted sustained demand for its products, further reinforcing confidence in its ability to meet earnings forecasts. Furthermore, the company has a track record of exceeding estimates for at least the past four quarters.

The Anticipated Blackwell Launch

The second catalyst, the release of Blackwell, is highly anticipated. Nvidia plans to ramp up production in the fourth quarter, predicting billions in revenue from Blackwell. Meeting or exceeding these expectations could lead to a notable boost in stock prices.

However, a potential risk involves managing supply chain challenges. Nvidia has indicated that the demand for Blackwell exceeds the current supply, a trend expected to continue into next year. While this reflects strong customer interest, it may prove disadvantageous if Nvidia struggles to fulfill orders.

Should you consider buying Nvidia stock before these pivotal events? Now might be an opportune time to invest in this leading AI company, as potential developments could yield benefits. Nevertheless, remember that immediate fluctuations in stock price may not significantly affect your portfolio if you’re focused on long-term holdings. Such an approach is generally the best way to build wealth over time.

This indicates that Nvidia remains an excellent AI stock to buy today or after the catalysts, as short-term news—positive or negative—won’t alter the company’s promising future.

Is Now the Right Time to Invest $1,000 in Nvidia?

Before making an investment in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team recently highlighted what they believe are the 10 best stocks to buy right now, and Nvidia was not among them. The stocks that made the list have the potential for substantial returns in the upcoming years.

Reflecting on the past, if you had invested $1,000 in Nvidia when it first appeared on the list on April 15, 2005, your investment would now be worth $904,692!*

Stock Advisor provides a straightforward investment strategy, including portfolio guidance and regular analyst updates, offering two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the S&P 500’s returns.*

See the 10 stocks »

*Stock Advisor returns as of November 4, 2024

Adria Cimino has positions in Oracle and Tesla. The Motley Fool has positions in and recommends Apple, Nvidia, Oracle, and Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.