Chip Stocks Slide Amid New U.S. Restrictions

Major semiconductor firms saw declines on Monday, reflecting concerns over regulatory changes impacting the industry.

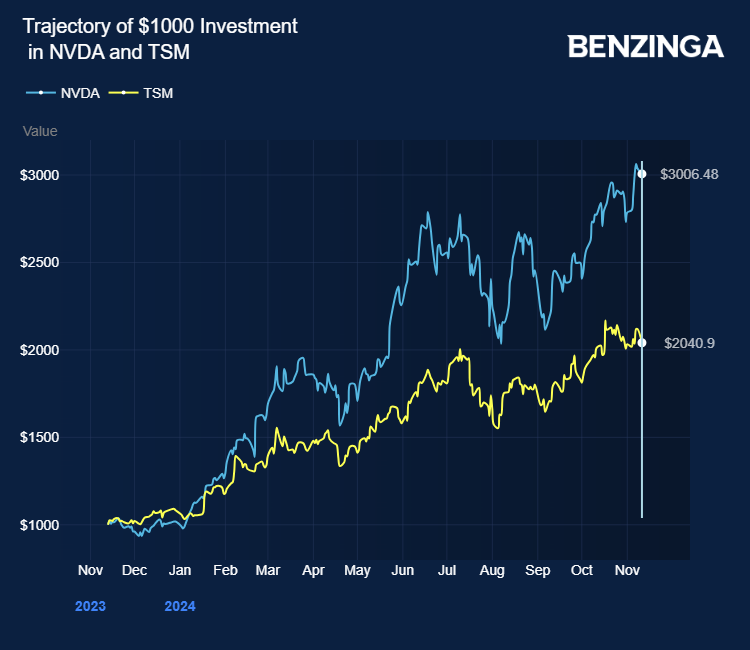

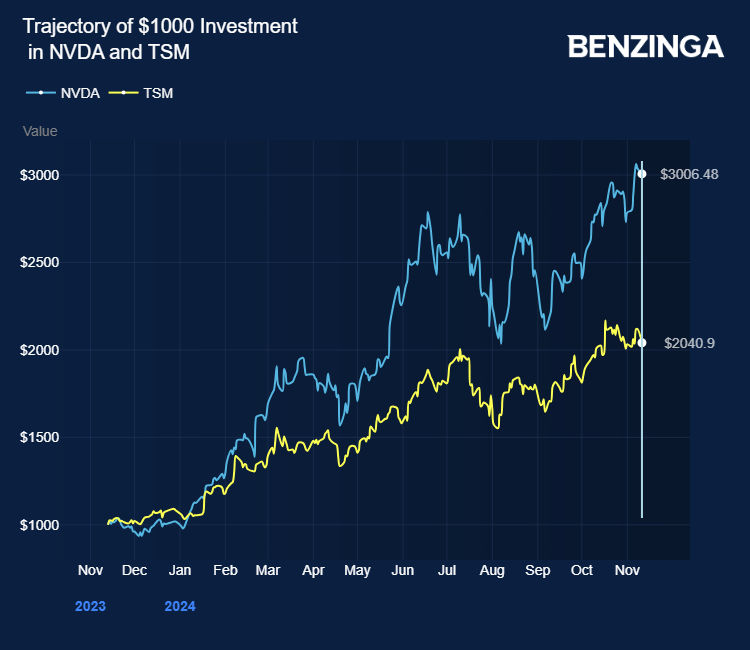

Chip stocks including Nvidia Corp NVDA, Broadcom Inc AVGO, Intel Corp INTC, Arm Holdings plc ARM, Advanced Micro Devices, Inc AMD, Credo Technology Group Holding CRDO, Lattice Semiconductor Corp LSCC, Microchip Technology Inc MCHP, Marvell Technology, Inc MRVL, MACOM Technology Solutions Holdings MTSI, Micron Technology, Inc MU, Qualcomm Inc QCOM, Qorvo, Inc QRVO, and United Microelectronics Corp UMC are trading lower following the news involving contract chipmaker Taiwan Semiconductor Manufacturing Co TSM.

Taiwan Semiconductor’s stock suffered after the U.S. Department of Commerce ordered it to halt shipments of advanced chips—those with designs of 7 nanometers or more—to China. These chips are vital for AI and graphics processing.

This U.S. action has raised alarms across the semiconductor sector, with investors worried about potential future restrictions from the incoming administration of President-elect Donald Trump. His prior critiques of the U.S. Chips Act and Taiwan Semiconductor’s operations have intensified concerns in the market.

Also Read: Monday.com Stock Tanks Despite Q3 Beat, Raised Outlook

Taiwan Semiconductor is a key supplier for major technology companies like Apple Inc AAPL and Nvidia.

The downturn in semiconductor stocks was further compounded by negative reports from Edgewater Research analysts concerning Monolithic Power Systems MPWR. The firm experienced a major drop in stock value on Monday due to issues impacting the supply of Nvidia’s Blackwell GPUs, attributed to problems with Monolithic’s Power Management ICs.

Analysts indicated that Japanese company Renesas and German firm Infineon may gain from this situation, as they received rush orders that could replace Monolithic in supplying Nvidia’s B200 and GB200 systems.

Edgewater highlighted worries over Monolithic’s temporary solutions, which were seen as inadequate by supply chain partners.

Investors looking to diversify into semiconductor stocks have options like the VanEck Semiconductor ETF SMH and the iShares Semiconductor ETF SOXX.

Price Action: As of Monday, NVDA was trading down 1.67% at $145.19, INTC fell 4.16%, and ARM decreased by 4.07%.

Also Read:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs