Fortuna Mining Surpasses Expectations with Strong Q3 Earnings

Fortuna Mining Corp. FSM reported third-quarter 2024 adjusted earnings per share of 16 cents, exceeding the Zacks Consensus Estimate of 11 cents. This represents a 60% increase from the same period last year, spurred by rising gold and silver prices that mitigated the effects of declining sales volumes.

After adjustments for non-cash and non-recurring items, adjusted attributable net income was $49.9 million, up from $29.6 million in the previous year. Overall attributable net income for the third quarter reached $50.5 million, or 16 cents per share, marking an 84% annual rise.

Stay informed on all quarterly releases: Check Zacks Earnings Calendar.

Revenues Rise Due to Strong Precious Metal Prices

Fortuna Mining’s revenues climbed 13% year over year to $275 million, driven by higher realized prices for gold and silver, which helped offset waning gold sales volume.

The realized gold price was $2,490 per ounce, marking a 29% increase from $1,925 per ounce in the same quarter last year. Realized silver prices also rose, up 24% to $29.00 per ounce.

However, gold equivalent production dropped 14% year over year to 110,820 ounces. The company produced 91,251 ounces of gold, down 4% from the prior year, while silver production fell sharply by 51%, landing at 816,187 ounces.

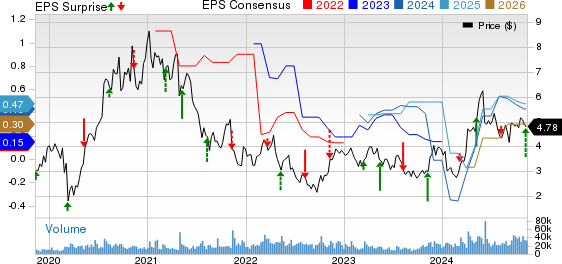

Fortuna Mining Corp. Price, Consensus, and EPS Surprise

Fortuna Mining Corp. price-consensus-eps-surprise-chart | Fortuna Mining Corp. Quote

The Séguéla mine contributed 34,998 ounces of gold in the third quarter, indicating an increase of 11% year over year. Lindero Mine’s output rose by 16% to 24,345 ounces. Conversely, gold production at the Yaramoko Mine declined 18% to 28,006 ounces.

At the San Jose Mine, output reached 510,741 ounces of silver and 3,771 ounces of gold. This reflects significant declines of 63% and 54%, respectively, from the previous year’s third quarter, as mining operations moved into areas of greater geological uncertainty. Meanwhile, silver production at Caylloma fell 1% to 305,446 ounces.

For the third quarter, the All-In Sustaining Cost per gold equivalent ounce was $1,696, which is a 29% increase from last year. Cash costs per ounce for gold equivalent sold rose 30% to $1,059.

FSM Shows Significant Profit Growth

FSM achieved a mine-operating profit of $87 million, marking a year-over-year increase of 32%. The operating income surged 60% to $72.7 million, attributed to improved profits from Lindero, Yaramoko, and Caylloma.

Adjusted EBITDA climbed 26% year over year to $131 million, with the adjusted margin rising to 47.7% compared to 43% in the same quarter last year.

Fortuna Mining Ends Q3 with Strong Cash Reserves

By the end of the third quarter, Fortuna Mining held approximately $180.6 million in cash and cash equivalents, a notable rise from $128 million at the close of 2023. Net cash flow from operating activities was recorded at $93 million, a decrease from $106.5 million in the third quarter of the previous year.

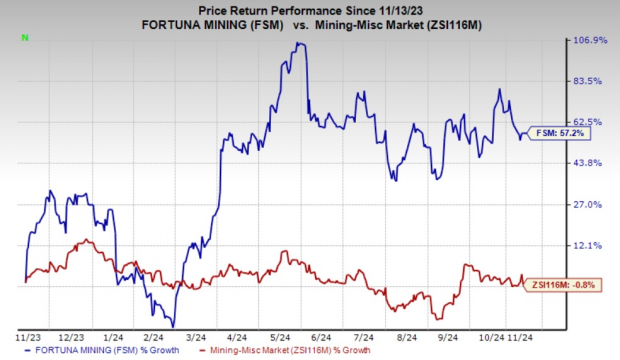

Stock Performance Overview

In the past year, Fortuna Mining’s shares have increased by 57.2%, significantly outpacing the industry’s modest decline of 0.8%.

Image Source: Zacks Investment Research

Peer Review: Fortuna Mining Competitors in Q3

Pan American Silver Corp. PAAS posted adjusted earnings per share of 32 cents for the third quarter, surpassing the Zacks Consensus Estimate of 21 cents. This was a significant improvement from an adjusted EPS of just 1 cent in the prior year.

Including special items, Pan American reported earnings of 16 cents per share compared to a loss of 5 cents per share in the year-ago quarter.

Pan American’s revenues increased 16% year over year to $716 million, although this figure fell short of the Zacks Consensus Estimate of $741 million. Silver production dropped by 4% to about 5.47 million ounces, while gold output fell 8% to 225,000 ounces.

The average realized silver price shot up 27.7% year over year to $29.52 per ounce, and the average realized gold price rose 28.4% to $2,475 per ounce.

First Majestic Silver AG reported a third-quarter loss of 3 cents per share, missing the Zacks Consensus Estimate of earnings of 9 cents. This reflects a worsening from a loss of 2 cents per share in the second quarter of 2023.

Total production fell to 5.5 million silver equivalent ounces, which includes roughly 1.968 million silver ounces and 41,761 gold ounces, representing a 13% decline from the previous year due to reduced output at San Dimas. AG’s quarterly revenues increased by 10% year over year to $146 million, driven by a 33% rise in average realized silver price despite lower payable sales volumes.

Fortuna Mining’s Market Rank

Fortuna Mining currently holds a Zacks Rank #4 (Sell).

Alternatively, Carpenter Technology Corporation CRS is a better-ranked option in the materials sector, holding a Zacks Rank #1 (Strong Buy). This company has exceeded the Zacks Consensus Estimate in each of the last four quarters, with an average earnings surprise of 14.1%. The consensus estimate for CRS’ fiscal 2025 earnings stands at $6.68 per share, projecting a 41% year-over-year growth. The company’s stock has surged 159% over the past year.

Get a Free Report on Clean Energy Stocks

Energy stands as a pivotal component of the global economy, contributing to a multi-trillion dollar industry with some of the largest, most profitable companies.

With advances in technology, clean energy sources are beginning to outpace traditional fossil fuels. Massive investments are flowing into clean energy initiatives, encompassing everything from solar power to hydrogen fuel cells.

Emerging leaders in this market could present some of the most promising investment opportunities for your portfolio.

Investing in the Future: 5 Energy Stocks to Watch

Explore Top Picks in Renewable Energy

Download “Nuclear to Solar: 5 Stocks Powering the Future” to see Zacks’ top picks free today.

Latest Recommendations Await

Stock Analysis Reports

Carpenter Technology Corporation (CRS): Free Stock Analysis Report

Pan American Silver Corp. (PAAS): Free Stock Analysis Report

Fortuna Mining Corp. (FSM): Free Stock Analysis Report

First Majestic Silver Corp. (AG): Free Stock Analysis Report

To read this article on Zacks.com, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.