Stock Markets Soar After Trump’s Victory

Key Insights

- Following Donald Trump’s election as president, U.S. stocks have rallied, pushing indexes to all-time highs.

- Stocks like NVDA, AMZN, V, and CRM are well-positioned to benefit from this market surge.

- Discover our report on the 7 Best Stocks for the Next 30 Days—available for free!

Wall Street experienced its most successful week of the year, with major indexes landing at record highs. The Dow gained 4.6%, the S&P 500 climbed 4.7%, and the Nasdaq rose 5.7% for the week, all driven by a widespread rally following Donald Trump’s presidential election victory.

The Dow made particularly significant strides, closing in on several key benchmarks. Investors are optimistic about this trajectory, especially focusing on four robust blue-chip stocks: NVIDIA Corporation (NVDA), Amazon.com, Inc. (AMZN), Visa Inc. (V), and Salesforce, Inc. (CRM).

These companies have favorable market positions to capitalize on the current upward trend, each holding a Zacks Rank of #1 (Strong Buy) or #2 (Buy) which suggests promising returns.

Dow Surpasses 44,000 Mark

On Friday, the Dow continued its rally, increasing by 259.65 points (0.6%) and achieving a historic high of 44,000 points. Ultimately, it closed at 43,988.99 points, making it one of the strongest weeks for the index in years.

Earlier in the week, the Dow surged by more than 1,500 points after Trump’s decisive electoral win. This represented the largest single-day increase for the Dow since November 2022 and the most substantial post-election increase in 128 years.

Additionally, the Federal Reserve’s recent decision to cut interest rates by 25 basis points, its second consecutive reduction after a series of increases aimed at tackling high inflation, provided further support to the equities market.

Continuing Momentum in the Dow

Investor sentiment remains high as optimism grows from Trump’s victory and the Federal Reserve’s monetary policy. Many investors anticipate lower taxes and reduced regulations stemming from the new administration, as Trump has previously shown an interest in the stock market and currency exchange rates.

Historically, stock markets tend to perform strongly in election years. Following the 2020 election, for instance, the Dow rose from around 28,000 in late October to over 30,000 shortly thereafter. This time, however, the Dow’s ascent is remarkable.

Furthermore, many market watchers expect continued interest rate cuts from the Federal Reserve, particularly as inflation appears to be stabilizing. The Fed has already lowered interest rates by 75 basis points since September, bringing the benchmark rate to a range of 4.5% to 4.75%.

Recent projections indicate the Fed may further reduce rates to a target range of 4.25% to 4.5% by year-end, with additional cuts anticipated in the coming years.

Four Promising Dow Stocks

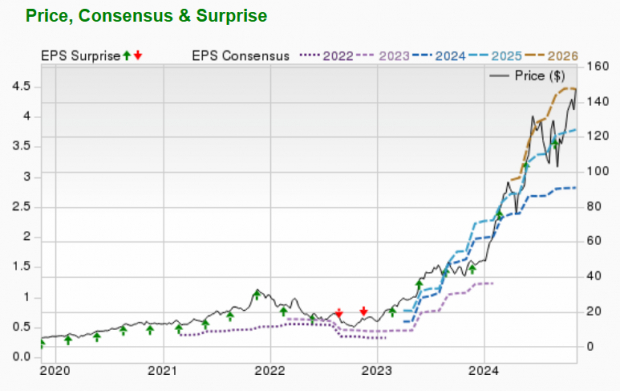

NVIDIA Corporation

NVIDIA Corporation is recognized globally for its advancements in visual computing technologies and is known for creating the graphic processing unit (GPU). Over time, the company’s focus has shifted from PC graphics to artificial intelligence solutions that enhance high-performance computing, gaming, and virtual reality.

NVIDIA expects earnings growth of over 100% this year. Additionally, the Zacks Consensus Estimate for this year’s earnings has risen by 4.5% over the past two months, leading to a Zacks Rank of #3.

Image Source: Zacks Investment Research

Amazon.com, Inc.

Amazon.com, Inc. ranks among the largest providers of e-commerce services and has extensive operations across North America and internationally. The company’s online retail business thrives on its well-regarded Prime program and robust distribution network. The acquisition of Whole Foods Market has also positioned Amazon prominently within the grocery sector, while Amazon Web Services dominates the cloud-computing landscape.

Amazon anticipates earning growth of 78.3% this year. The Zacks Consensus Estimate for its present earnings has increased by 8.2% over the last two months, earning it a Zacks Rank of #2.

Image Source: Zacks Investment Research

Visa Inc.

Visa Inc. serves as a leading technology company for payment processing worldwide. VisaNet, its global processing platform, facilitates services such as authorization, clearing, and settlement for financial institutions and merchants.

Visa has a projected earnings growth rate of 11.2% for the current year, with the Zacks Consensus Estimate for its earnings rising by 0.9% in the last two months. At present, Visa maintains a Zacks Rank of #2.

Image Source: Zacks Investment Research

Salesforce, Inc.

Salesforce, Inc. is a premier provider of Customer Relationship Management (CRM) software, aiding organizations in managing many vital operations, from sales automation to marketing strategies. Over the past 25 years, CRM has secured its position as the top vendor, capturing nearly 20% of the market, as reported by Gartner.

Salesforce expects a 22.6% earnings growth rate this year, with the Zacks Consensus Estimate for earnings having improved by 0.2% in the past two months, resulting in a current Zacks Rank of #2.

Image Source: Zacks Investment Research

Explore Top Clean Energy Stocks

Energy underpins our economy, driving a multi-trillion dollar industry with some of the world’s most profitable enterprises.

Innovative technology is paving the way for clean energy sources to surpass traditional fossil fuels, with trillions of dollars now being invested in initiatives like solar energy and hydrogen fuel cells.

These emerging leaders could represent some of the most promising investments on the market. Grab our report, “5 Stocks Powering the Future,” to see Zacks’ top selections free of charge.

For the latest insights from Zacks Investment Research, download our report on “5 Stocks Set to Double” for free.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.