Top Three Stocks Set to Thrive in the Age of AI

Over the past year, artificial intelligence (AI) has captivated companies and investors, showing the potential to drive the next wave of economic growth.

Among the prospective beneficiaries, a few standout companies appear well-positioned to capitalize on the AI boom. The following companies not only leverage AI technology but also maintain relatively reasonable valuations. Here’s a closer look at three promising stocks and their AI strategies.

1. Alphabet (GOOG, GOOGL)

Concerns about generative AI disrupting Google Search, Alphabet’s flagship segment, have surfaced as competitors like OpenAI’s ChatGPT gain traction. Research suggests Google has lost nearly 3% of its total market share since the launch of ChatGPT in November 2022. Further, there are fears the U.S. Department of Justice might ban Google’s longstanding deal with Apple, which currently makes Google Search the default on iPhones.

However, according to Statcounter, Google Search still dominates the global market, comprising 89.3% of total searches. In Q3 2024, this segment generated $49.3 billion in revenue, marking a 12.2% increase from the previous year. If the deal with Apple collapses, Alphabet could save around $25 billion annually, a significant sum.

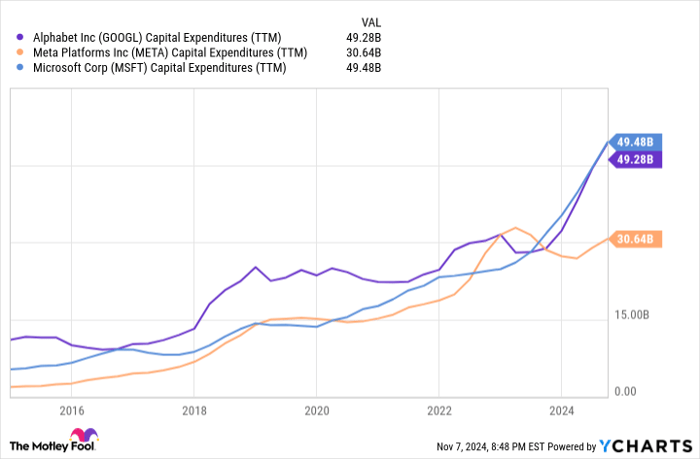

In response to AI’s challenges, Alphabet has invested a remarkable $49.3 billion in capital expenditures, primarily to expand its AI infrastructure, including new servers and data centers. Users might have noticed the introduction of “AI Overviews,” a feature that condenses search results into concise summaries, currently reaching over 1 billion users monthly.

The stock has risen nearly 30% year-to-date and trades at a valuation of 24 times earnings, compared to a higher median P/E ratio of 26.6 over the past five years, indicating a potential bargain. With $82.3 billion in net cash, Alphabet has substantial resources for dividends and share repurchases, having started paying dividends in 2024 and buying back 11% of its shares in the past five years, benefiting existing shareholders.

2. Meta Platforms (META)

The second company on our list is Meta Platforms, which includes social media giants Facebook and Instagram. The stock has surged over 60% in 2024, following an announcement of both quarterly revenue and net income records. Meta began paying a quarterly dividend of $0.50 per share, resulting in an annual yield of 0.35%.

Meta has committed between $38 billion and $40 billion in capital expenditures to enhance its AI capabilities. CEO Mark Zuckerberg highlighted AI’s positive influence across the company’s operations, stating, “We’re seeing AI have a positive impact on nearly all aspects of our work.”

Meta’s performance reveals that AI is already starting to make a difference, with Q3 2024 results showing $40.6 billion in revenue and $15.7 billion in net income, reflecting a year-over-year growth of 19% and 35%, respectively.

Additionally, the company’s operating margin improved from 40% to 43%, the highest level in three years, suggesting effective engagement and monetization strategies thanks to AI implementation.

Currently, Meta’s stock is trading at 28 times its trailing earnings, slightly above its five-year median of 27. The firm retains $42 billion in net cash, making its stock appear fairly valued as margins continue to improve.

3. Microsoft (MSFT)

Lastly, Microsoft has been the most aggressive in terms of capital expenditures among its peers, investing $49.5 billion in the last year alone, not including its estimated $13.8 billion investment in OpenAI since 2019.

GOOGL Capital Expenditures (TTM) data by YCharts

Microsoft is witnessing success in its workflow products through AI integration. In the latest quarterly earnings call, CEO Satya Nadella stated AI is causing a “fundamental change in the business applications market.” The company anticipates its AI business will grow rapidly, estimating an annual revenue run rate of $10 billion.

With contributions from AI and the recent $69 billion acquisition of Activision Blizzard, Microsoft set new records in both revenue and net income. In its fiscal Q1 2025, it reported $65.6 billion in revenue and $24.7 billion in net income, representing growth of 16% and 11%, respectively.

Like its peers, Microsoft utilizes its $33.3 billion in net cash for dividends and stock buybacks, announcing an increase in its quarterly dividend to $0.83 per share along with a new $60 billion share repurchase program.

Valuation-wise, Microsoft trades at 35 times trailing earnings, close to its five-year median of 34 times. Given its solid financials and AI investments, Microsoft presents a compelling option for long-term investors.

Should you invest $1,000 in Meta Platforms right now?

Before you consider investing in Meta Platforms, take note:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms isn’t one of them. The 10 stocks that made the cut could deliver significant returns in the coming years.

For example, when Nvidia was highlighted on April 15, 2005… an investment of $1,000 at the time would now be worth $904,692!

Stock Advisor offers a straightforward strategy for investors, including portfolio-building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor service has notably surpassed the S&P 500’s returns by more than fourfold since 2002*.

See the 10 stocks »

*Stock Advisor returns as of November 11, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook, is also a member of The Motley Fool’s board. Collin Brantmeyer has positions in Alphabet, Apple, and Microsoft. The Motley Fool has recommended Alphabet, Apple, Meta Platforms, and Microsoft. The Motley Fool advises on certain options related to Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.