B of A Securities Upgrades Tanger to Buy Amid Mixed Shareholder Activity

Analysts Forecast a Potential Drop in Tanger’s Stock Price

On November 11, 2024, B of A Securities changed their outlook on Tanger (LSE:0LD4) from Neutral to Buy.

Analyst Price Forecast Suggests 10.24% Downside

As of September 25, 2024, analysts set the average one-year price target for Tanger at 32.10 GBX per share. Predictions vary, with a low estimate at 29.27 GBX and a high at 35.67 GBX. This average price target indicates a potential decline of 10.24% from the recent close of 35.77 GBX per share.

Explore our leaderboard showcasing companies with the biggest price target upside.

Tanger’s Projected Revenue Declines

The expected annual revenue for Tanger is forecasted at 456 million, which represents a decline of 12.81%. Non-GAAP earnings per share (EPS) are projected to be 0.59.

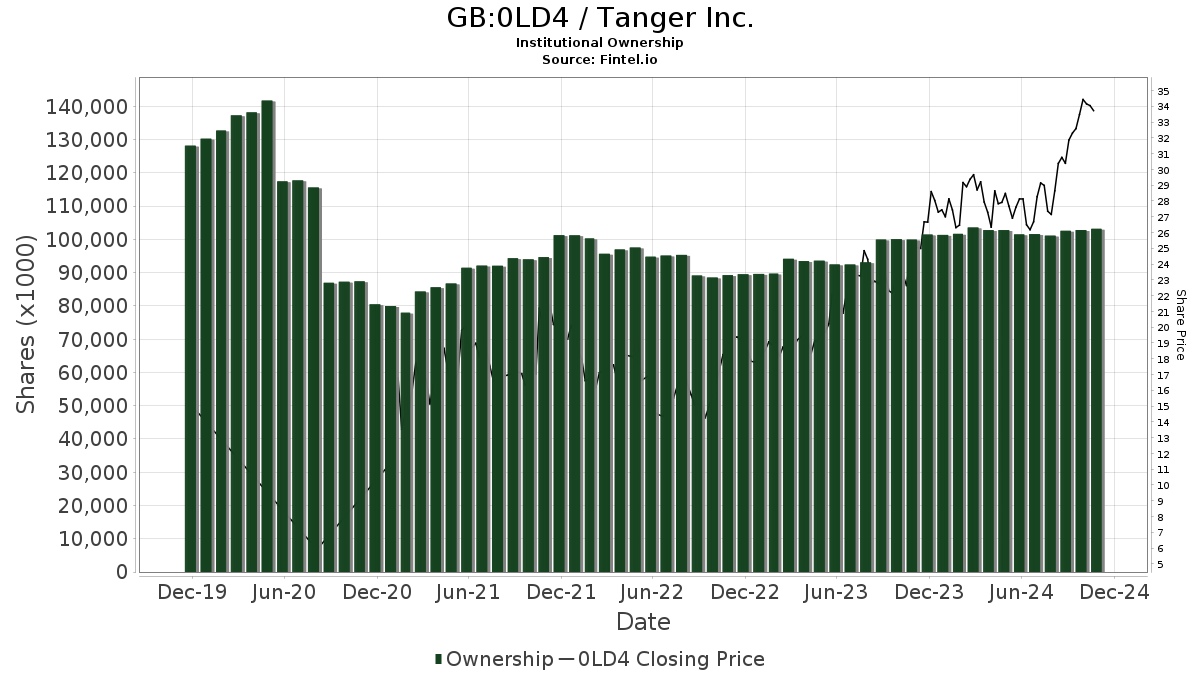

Fund Sentiment Shows Increased Institutional Interest

Currently, 663 funds or institutions report holding positions in Tanger, reflecting a rise of 23 owners or 3.59% over the previous quarter. On average, these funds allocate 0.19% of their portfolios to 0LD4, which is an increase of 1.00%. Institutional shares owned have risen by 4.44% over the last three months to a total of 103,212K shares.

Recent Moves by Other Shareholders

IJR – iShares Core S&P Small-Cap ETF now holds 7,072K shares, representing 6.47% ownership of Tanger. In its last report, it owned 7,298K shares, indicating a decrease of 3.20%. The ETF reduced its allocation in 0LD4 by 7.61% this quarter.

VGSIX – Vanguard Real Estate Index Fund Investor Shares owns 4,362K shares, equating to 3.99% ownership. Previously, it held 4,396K shares, showing a decrease of 0.78%. The fund’s allocation in 0LD4 fell by 9.88% in the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares has 3,485K shares, representing 3.19% ownership. An increase of 5.51% occurred from its previous holding of 3,292K shares, although it still cut its allocation to 0LD4 by 5.51% recently.

Wellington Management Group LLP holds 2,914K shares for 2.66% ownership. This is a drop from 3,112K shares, marking a decrease of 6.82%, and a significant reduction of 87.80% in its portfolio allocation to 0LD4 this past quarter.

NAESX – Vanguard Small-Cap Index Fund Investor Shares reports holding 2,746K shares, or 2.51% of the company, which is up from 2,635K shares, reflecting an increase of 4.06%. The allocation in 0LD4 saw a slight boost of 0.38% in the last quarter.

Fintel provides comprehensive investing research tools for individual investors, traders, financial advisors, and small hedge funds.

The platform offers extensive data, including fundamentals, analyst reports, ownership statistics, fund sentiment, options data, insider trading insights, and unique stock picks fueled by advanced quantitative models.

Click to Learn More

This article was originally published by Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the official stance of Nasdaq, Inc.