JP Morgan Upgrades Cisco Systems: What Investors Should Know

On November 11, 2024, JP Morgan shifted its outlook for Cisco Systems (NasdaqGS:CSCO) from Neutral to Overweight.

1.15% Decrease Expected in Stock Price

The average one-year price target for Cisco Systems is currently $57.97/share, which reflects a 1.15% decline from its most recent closing price of $58.65/share. Projections show a range from a low of $49.49 to a high of $81.90 as of October 22, 2024.

Check out our leaderboard to see which companies have the greatest potential price increases.

Cisco Systems is expected to generate annual revenue of $59,642 million, marking a notable rise of 10.85%. Additionally, the anticipated annual non-GAAP EPS is set at 4.12.

Current Fund Sentiment Towards Cisco

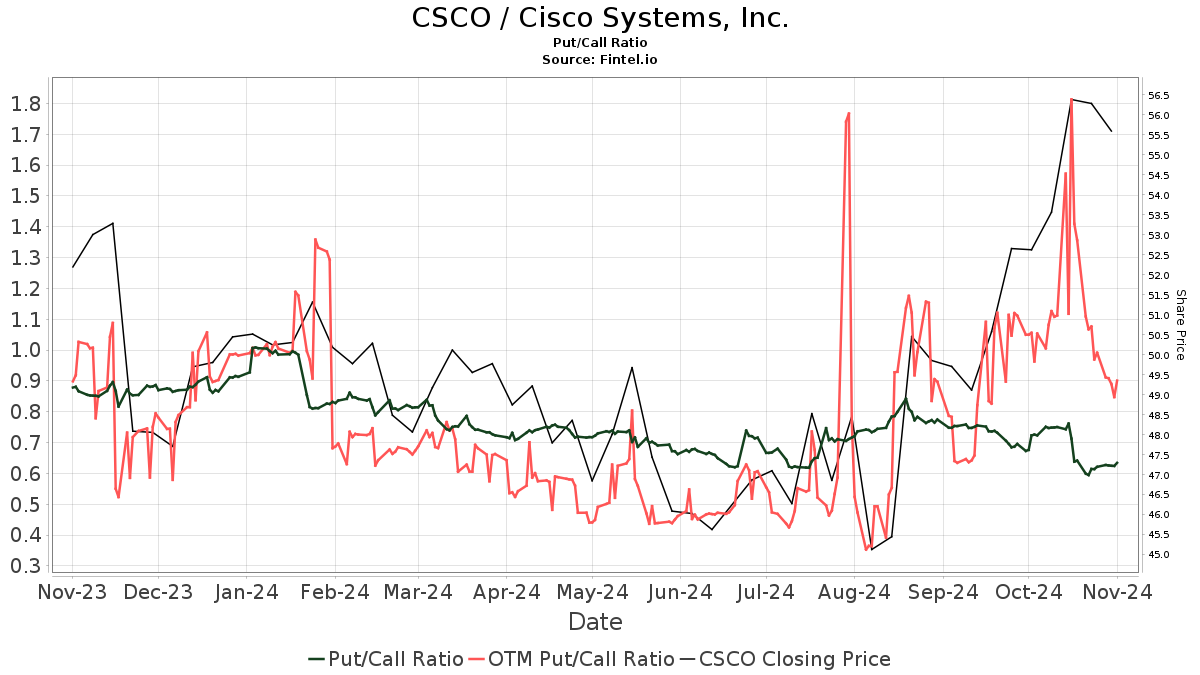

As of this report, 4,443 funds or institutions hold positions in Cisco Systems, a decrease of 36 owners, or 0.80%, in the past quarter. The average portfolio weight for all funds invested in CSCO is 0.58%, having increased by 4.40%. In total, institutions own 3,263,300K shares after a 3.10% rise over the last three months.  The put/call ratio stands at 0.65, indicating a positive market outlook.

The put/call ratio stands at 0.65, indicating a positive market outlook.

Institutional Shareholder Movements

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 115,085K shares, accounting for 2.88% of Cisco. This is up from 114,484K shares last reported, showing an increase of 0.52%. However, the firm decreased its allocation in CSCO by 6.95% over the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares now has 103,926K shares, representing 2.60% ownership. This is an increase from the previous 102,404K shares, or 1.46%. Yet, the firm’s portfolio allocation in CSCO has been reduced by 8.55% recently.

Geode Capital Management possesses 94,368K shares, equating to 2.36% ownership, an increase from their prior 91,886K shares by 2.63%. Despite this, they decreased their portfolio allocation in CSCO by a significant 51.56% over the last quarter.

Charles Schwab Investment Management owns 81,043K shares, amounting to 2.03%. This represents an increase from their earlier 77,850K shares (an increase of 3.94%), but they still reduced their CSCO allocation by 31.05% the past quarter.

Invesco QQQ Trust, Series 1 currently holds 77,595K shares, which is 1.94% of the company. They increased their holdings from 75,900K shares (an increase of 2.18%), though they cut back their portfolio allocation by 12.40% recently.

A Brief Overview of Cisco Systems

(This description is provided by the company.)

Cisco leads globally in the technology sector that powers the Internet. The company focuses on innovating applications, securing data, transforming infrastructure, and enabling teams for a more inclusive future.

Fintel serves as a comprehensive investment research platform for individual investors, traders, advisors, and small hedge funds, covering a wide array of data including fundamentals, analyst reports, and ownership sentiments.

Click to Learn More

This story initially appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.