Piper Sandler Adjusts Xeris Biopharma Holdings Outlook to Neutral

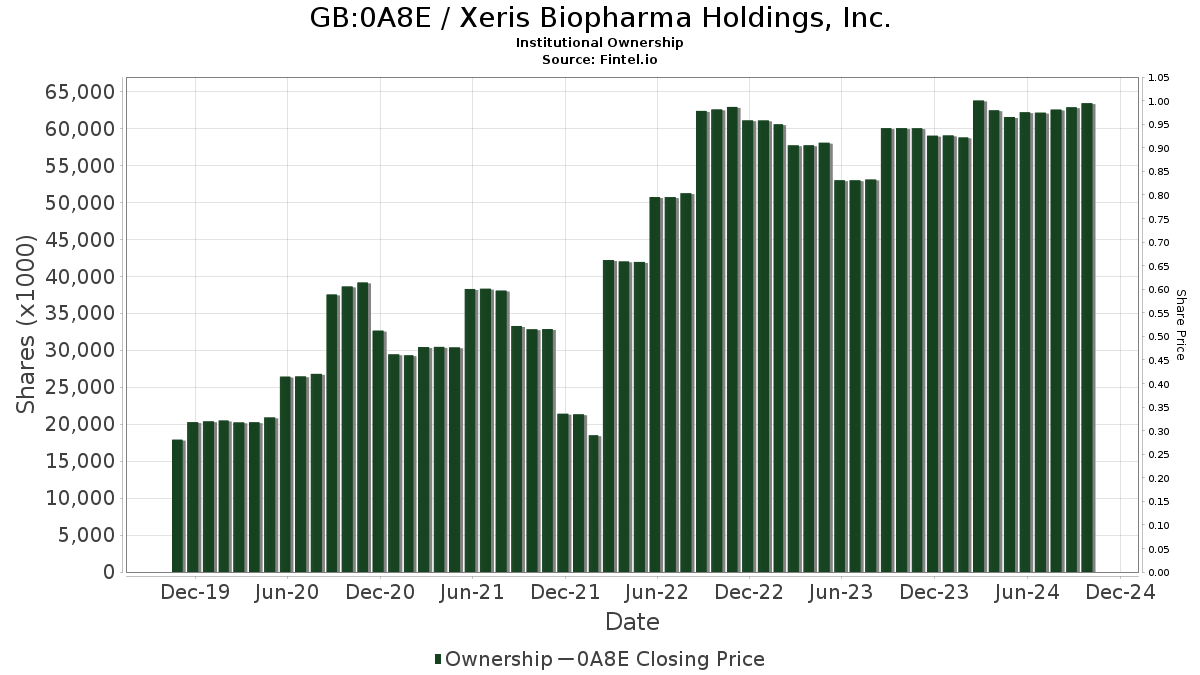

Market Sentiment and Institutional Ownership Trends

Fintel reports that on November 11, 2024, Piper Sandler downgraded their outlook for Xeris Biopharma Holdings (LSE:0A8E) from Overweight to Neutral.

Fund Ownership Dynamics

Currently, 249 funds or institutions hold positions in Xeris Biopharma Holdings, reflecting a decrease of 5 owners, or 1.97%, over the past quarter. The average portfolio weight of all funds invested in 0A8E stands at 0.28%, which is an increase of 5.41%. In total, institutional ownership fell by 0.47% in the last three months, now totaling 62,900K shares.

Changes in Significant Shareholdings

Caxton maintains 5,113K shares, indicating a steady 3.43% ownership of the company over the last quarter.

MPM Oncology Impact Management has increased its stake to 4,831K shares, which represents 3.24% ownership—up from 4,166K shares, showcasing an increase of 13.75%. Their portfolio allocation to 0A8E rose by 14.09% during the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) holds 4,255K shares, maintaining a consistent 2.86% ownership with no changes in the last quarter.

Geode Capital Management reported a rise in shares from 3,045K to 3,240K, now representing 2.17% ownership. This shows an increase of 6.02% in shares, with a 2.81% rise in portfolio allocation to 0A8E over the past quarter.

Conversely, iShares Russell 2000 ETF (IWM) saw a decrease in ownership from 3,273K to 3,127K shares, resulting in 2.10% ownership, reflecting a decline of 4.66%. However, their allocation to 0A8E has grown by 6.13% since the last quarter.

Fintel serves as a comprehensive research platform tailored for investors, traders, financial advisors, and small hedge funds. Their data spans various subjects, including fundamentals, analyst reports, ownership, fund sentiment, options sentiment, insider trading, and more. With advanced, backtested quantitative models, they aim to enhance investment profitability.

For more insights, click to learn more. This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.