Is The Trade Desk Poised for a Comeback After Recent Setbacks?

The digital advertising market continues to thrive, projected to generate nearly $668 billion in revenue in 2024, up from $600 billion last year. This growth trend shows signs of persisting in the years ahead.

As reported by Oberlo.com, global investment in digital advertising is expected to reach around $871 billion by 2027. The Trade Desk (NASDAQ: TTD) has been capitalizing on this expanding market, enhancing its growth rate this year due to strong demand for its programmatic advertising platform.

So far in 2024, shares of The Trade Desk have risen by 73%. However, after the company released its third-quarter results on November 7, the rally experienced a downturn. The stock fell more than 5% following the report, despite exceeding expectations in both results and future guidance.

This prompts the question: Should investors consider purchasing The Trade Desk shares after this recent price dip, as the digital advertising market continues to expand?

Consistent Growth for The Trade Desk

In Q3, The Trade Desk reported revenue of $628 million, marking a 27% increase compared to the same quarter last year, when revenue grew by 25%. Non-GAAP earnings saw a 24% rise, reaching $0.41 per share. Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) also climbed 28% to $257 million. All figures surpassed The Trade Desk’s initial guidance of $618 million in revenue and $248 million in adjusted EBITDA.

The company credits its strong growth to the surging demand for connected TV (CTV) advertising, its fastest-growing segment. CEO Jeff Green highlighted during the earnings call how partnerships with platforms like Disney, NBCUniversal, Roku, Netflix, and LG are strengthening around the CTV opportunity.

CTV advertising involves ad delivery through internet-connected televisions, which enhances audience targeting and improves advertiser ROI. Notably, spending in this area is set to increase from $29.6 billion this year to $42.5 billion by 2028.

The Trade Desk is well-equipped to tap into this lucrative market. The company asserts access to over 120 million CTV devices via its programmatic ad platform, enabling advertisers to engage with more than 90 million households. With CTV and overall programmatic ad spending projected to grow at an annual rate of 23% through 2030, The Trade Desk is poised to maintain robust growth over the next few years.

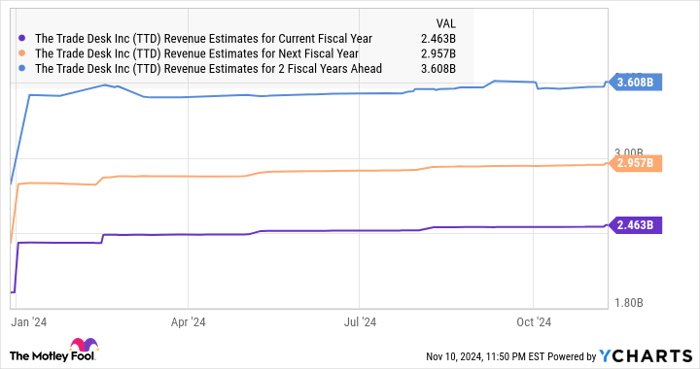

Analysts have revised their growth outlook upward, anticipating that the company will achieve at least 20% top-line growth in both 2025 and 2026.

TTD Revenue Estimates for Current Fiscal Year data by YCharts.

Promising Earnings Growth and a Valuation Concern

The uptick in The Trade Desk’s revenue is compelling and is expected to reflect positively on its earnings, as illustrated by the chart below.

TTD EPS Estimates for Current Fiscal Year data by YCharts.

Furthermore, earnings growth is anticipated to speed up in 2026, with consensus estimates suggesting a 25% annual increase over the next five years. The company is expected to conclude 2024 with adjusted earnings of $1.64 per share. Assuming a continued annual growth rate of 25%, adjusted earnings could escalate to $3.20 per share by 2027.

If The Trade Desk trades at 30 times the expected earnings at that time—similar to the tech-heavy Nasdaq-100 index’s forward earnings—it could see its stock price rise to approximately $96. However, this would mark a decline from current prices due to the elevated valuation.

Currently, The Trade Desk trades at 202 times trailing earnings and 97 times forward earnings, which likely explains the stock’s dip following the quarterly report. While its growth remains impressive, it does not compare to the accelerated growth of other tech stocks with more appealing valuations.

Pursuing additional shares of The Trade Desk may require a cautious approach. Investors should monitor the company’s progress in boosting its bottom line to validate its high multiples.

A chance to revisit a potentially rewarding investment

Do you feel you missed previous opportunities to invest in top-performing stocks? Here’s your chance to consider action.

Occasionally, our team of analysts issues a “Double Down” stock recommendation for companies they believe are on the verge of significant gains. If you’re concerned about missing your opportunity to invest, now might be the best time before any further developments.

- Amazon: $1,000 invested when we doubled down in 2010 would be worth $23,446!*

- Apple: $1,000 invested when we doubled down in 2008 would have grown to $42,982!*

- Netflix: $1,000 invested when we doubled down in 2004 would have skyrocketed to $428,758!*

Right now, we’re highlighting “Double Down” alerts for three exceptional companies that you won’t want to miss.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

Harsh Chauhan holds no positions in the stocks mentioned. The Motley Fool has positions in and recommends Netflix, Roku, The Trade Desk, and Walt Disney. The Motley Fool has a disclosure policy.

The views and opinions expressed herein reflect those of the author and do not necessarily align with those of Nasdaq, Inc.