Materials Sector Leads Market Decline as Mosaic Co and FMC Corp Struggle

During Tuesday’s afternoon trading, the Materials sector has taken a significant hit, experiencing a 1.8% decline. Within this sector, Mosaic Co (Symbol: MOS) saw a steep drop of 8.5%, while FMC Corp. (Symbol: FMC) lost 5.8%. For ETF investors, the Materials Select Sector SPDR ETF (Symbol: XLB) is tracking these materials stocks, declining 1.5% today. Year-to-date, XLB is up 9.71%. In contrast, Mosaic Co has fallen 26.45% this year, and FMC Corp. has decreased by 8.98%. Notably, these two companies constitute around 1.9% of XLB’s total holdings.

The Technology & Communications sector follows closely, recording a 0.9% decrease. Super Micro Computer Inc (Symbol: SMCI) and Western Digital Corp (Symbol: WDC) stand out with losses of 6.3% each. The Technology Select Sector SPDR ETF (Symbol: XLK), which tracks these stocks, remained stable today but boasts a 23.09% increase on a year-to-date basis. Year-to-date performance shows Super Micro Computer down 23.43%, while Western Digital Corp has gained 20.60%. Collectively, both companies make up approximately 0.3% of XLK’s holdings.

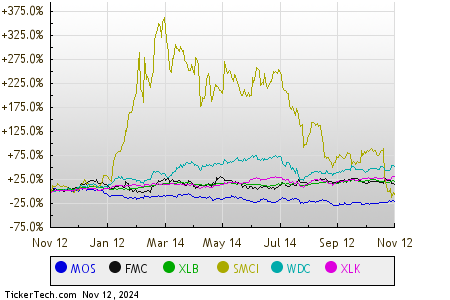

For a broader perspective, a chart detailing the recent performance of these stocks over the trailing twelve months is provided below:

A snapshot of the S&P 500 components across various sectors reveals that all sectors are in the red today, with nine sectors experiencing declines.

| Sector | % Change |

|---|---|

| Consumer Products | -0.2% |

| Services | -0.3% |

| Healthcare | -0.4% |

| Financial | -0.4% |

| Energy | -0.4% |

| Industrial | -0.7% |

| Utilities | -0.8% |

| Technology & Communications | -0.9% |

| Materials | -1.8% |

![]() 25 Dividend Giants Widely Held By ETFs »

25 Dividend Giants Widely Held By ETFs »

Also see:

• Top Ten Hedge Funds Holding WU

• ARMH Videos

• Funds Holding JUNR

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.