Toyota Reports Disappointing Q2 2025 Earnings, Falling Short of Expectations

Toyota TM announced fiscal second-quarter 2025 earnings of $2.90 per share. This figure fell short of the Zacks Consensus Estimate of $4.39 and marked a significant decrease from last year’s earnings of $6.54 per share. The company recorded consolidated revenues of $76.9 billion, which also missed the consensus estimate of $79.7 billion and declined from $79.1 billion in the same quarter last year.

Stay informed with quarterly updates: Check out the Zacks Earnings Calendar.

As of September 30, 2024, Toyota held cash and cash equivalents totaling ¥7.63 trillion ($53.25 billion). The company’s long-term debt rose to ¥21.6 trillion ($150.8 billion), an increase from ¥21.15 trillion as of March 31, 2024.

Currently, TM holds a Zacks Rank #2 (Buy). Check out the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

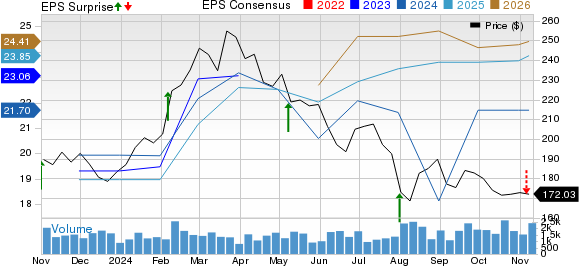

Toyota Motor Corporation: Price, Consensus, and EPS Surprise

Toyota Motor Corporation price-consensus-eps-surprise-chart | Toyota Motor Corporation Quote

Performance by Segment

The Automotive segment reported a 1.6% year-over-year drop in net revenues for the fiscal second quarter, amounting to ¥10.3 trillion ($69.4 billion), aligning with our expectations. Operating profit fell to ¥949.8 billion ($6.37 billion), down 27% compared to the previous year, but it surpassed our estimate of ¥874 billion.

In contrast, the Financial Services segment saw net revenues increase by 22.5% from the year-ago quarter to ¥1 trillion ($6.96 billion), exceeding our forecast of ¥863.9 billion. This segment’s operating income was ¥172.7 billion ($1.16 billion), a rise from ¥97.6 billion in the previous year’s second quarter, and well above our estimate of ¥95.8 billion.

Meanwhile, All Other Businesses generated net revenues of ¥337.6 billion ($2.26 billion) for the reported quarter, which is an increase from ¥319.2 billion a year prior and above our projection of ¥332.5 billion. However, the segment recorded an operating profit of ¥33.2 billion ($223 million), which represents a decrease from ¥39.5 billion from the same period last year, falling short of our estimate of ¥39 billion.

Fiscal Year 2025 Outlook

Looking ahead, Toyota forecasts total retail vehicle sales of 10.85 million units for fiscal 2025, down from 11.09 million units in fiscal 2024. Estimated sales for fiscal 2025 are projected to reach ¥46 trillion, an increase from ¥45 trillion recorded in the prior year. Operating income is expected to decrease by 18.8% year over year, totaling ¥4.3 trillion.

Pretax profit is anticipated to decline to ¥4.98 trillion, down from ¥6.96 trillion in fiscal 2024. Research and Development expenses are projected to increase to ¥1.3 trillion, up from ¥1.2 trillion spent in fiscal 2024. Capital expenditures are set to rise to ¥2.15 trillion from ¥2.01 trillion last year.

Quarterly Results from Competitors

Honda HMC reported second-quarter fiscal 2025 earnings of 43 cents per share, which fell short of the Zacks Consensus Estimate of 86 cents. The earnings also dropped from last year’s profit of $1.07 per share. Quarterly revenues reached $36.24 billion, surpassing the Zacks Consensus Estimate of $35.6 billion and the previous year’s figure of $34.5 billion. As of September 30, 2024, HMC’s consolidated cash and cash equivalents were ¥4.29 trillion ($29.97 billion), with long-term debt at approximately ¥6.25 trillion ($43.67 billion), an increase from ¥6.06 trillion as of March 31, 2024.

General Motors GM announced third-quarter 2024 adjusted earnings of $2.96 per share, exceeding the Zacks Consensus Estimate of $2.49 and rising from $2.28 in the year-ago quarter. Revenues of $48.75 billion beat the consensus estimate of $44.29 billion and grew from $44.13 billion recorded last year. As of September 30, 2024, General Motors had cash and cash equivalents of $23.7 billion, with long-term automotive debt amounting to $15.5 billion.

Ford F reported third-quarter 2024 adjusted earnings of 49 cents per share, matching the Zacks Consensus Estimate and improving from 39 cents in the year prior. Ford’s total automotive revenues were approximately $43.07 billion, above the Zacks Consensus Estimate of $41.2 billion and higher than the $41.18 billion from last year. Cash and cash equivalents for Ford stood at $23.4 billion as of September 30, 2024, with long-term debt, excluding Ford Credit, totaling $19.07 billion.

Free Report: 5 Clean Energy Stocks with Major Potential

Energy is vital to our economy. It’s a massive industry that has produced some of the world’s largest and most profitable companies.

Modern technology is driving the transition to clean energy, presenting new opportunities that could surpass traditional fossil fuels. Significant investments are already flowing into renewable energy initiatives, including solar and hydrogen.

Promising leaders in this sector may become some of the most valued stocks in your portfolio.

Download Nuclear to Solar: 5 Stocks Powering the Future to see Zacks’ top picks for free today.

Stay updated with Zacks Investment Research recommendations: download 5 Stocks Set to Double. Click to receive this report for free.

Ford Motor Company (F): Free Stock Analysis Report

Toyota Motor Corporation (TM): Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.