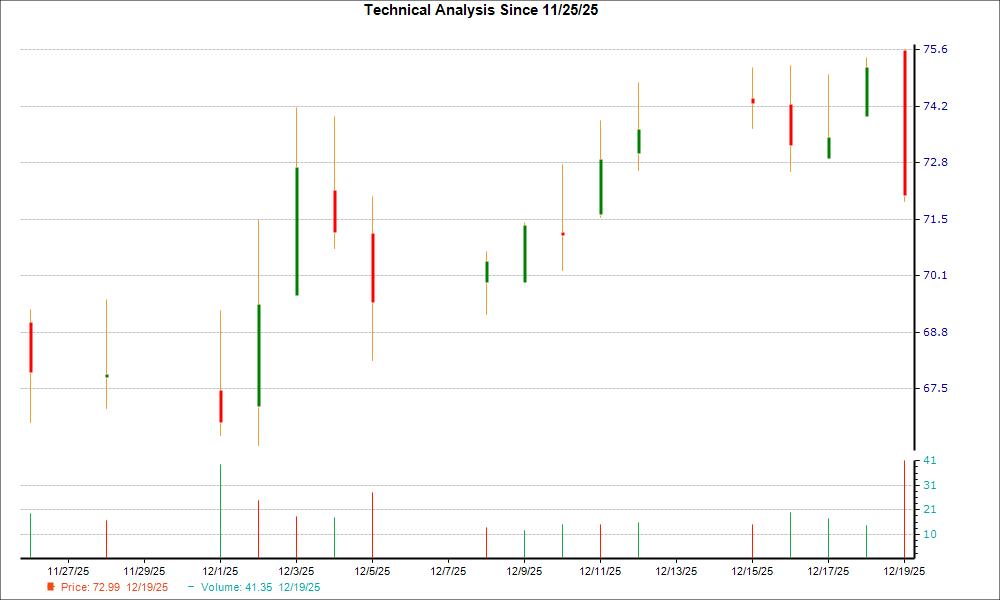

AbbVie Faces Setback as Emraclidine Trials Fail, Sparking Investor Concerns

AbbVie’s stock (NYSE: ABBV) dropped 12% on Monday, November 11, following the announcement that two mid-stage clinical trials for its schizophrenia treatment, Emraclidine, did not meet their primary endpoints. AbbVie had acquired Cerevel Therapeutics earlier this year for approximately $9 billion, banking on Emraclidine to become a blockbuster. This news was disappointing for AbbVie investors, while providing a boost to shares of its competitor, Bristol Myers Squibb (NYSE:BMY), which recently received FDA approval for its schizophrenia drug, Cobenfy.

Despite the recent decline, ABBV stock has performed notably well, gaining 90% since January 2021, rising from around $92 to approximately $175. This contrasts with a 60% increase for the S&P 500 and a 31% rise for the S&P 500 Healthcare index during the same timeframe. The stock’s rise can primarily be attributed to:

- A significant 60% increase in the company’s price-to-sales (P/S) ratio, now at 5.7x, compared to 3.6x in 2020. Investors have rewarded AbbVie for its increasing sales despite competition to its blockbuster drug, Humira;

- A 20% rise in revenue, which grew from $46 billion to $55 billion during this period. This was partly countered by;

- A minimal 0.5% increase in total shares outstanding.

Let’s delve deeper into these factors driving AbbVie’s stock growth.

1. The Factors Fueling AbbVie’s Revenue Growth

AbbVie’s revenue increased by approximately 20%, going from $45.8 billion in 2020 to $55.5 billion over the last twelve months. This growth has been largely fueled by the Allergan acquisition in 2020. While AbbVie is primarily recognized for its blockbuster drug Humira, which is used to treat conditions like rheumatoid arthritis and Crohn’s disease, its sales peaked at $21.2 billion in 2022 before falling by 32.2% year-over-year to $14.4 billion in 2023. For the nine months ending September 2024, Humira sales continued to decline, dropping 34% to $7.2 billion due to biosimilar competition following the loss of exclusive market rights.

To mitigate the loss from Humira’s declining sales, AbbVie has gained market share with newer drugs like Skyrizi and Rinvoq, which treat plaque psoriasis and rheumatoid arthritis. Together, these products generated $11.7 billion in sales during 2023, showing a substantial 53% growth year-over-year. Additionally, sales of the anti-depressant Vraylar surged 35% year-over-year to $2.8 billion in 2023. For the nine months ending September 2024, Skyrizi and Rinvoq’s market share grew even more, reaching over $12 billion with a 50% year-over-year increase.

AbbVie is also pursuing growth through acquisitions. Following its Allergan purchase, it acquired ImmunoGen for $10.1 billion early this year to gain rights to Elahere, an ovarian cancer treatment expected to peak at over $2 billion in sales. It also secured Cerevel Therapeutics for $8.7 billion—though the recent failure of Emraclidine will limit its potential. Currently, AbbVie is in the process of acquiring Aliada Therapeutics for $1.4 billion, primarily for an Alzheimer’s treatment currently in development.

2. How Are AbbVie’s Profit Margins Shaping Up?

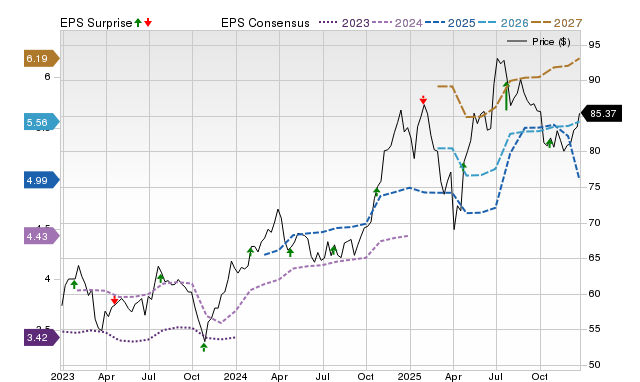

Even though AbbVie’s revenues have risen, its operating margin has slightly declined from 27.8% in 2020 to 26.1% currently. Contributing factors include higher expenses related to research, development, and milestone payments. For the full year of 2024, AbbVie anticipates its adjusted earnings per share to fall between $10.90 and $10.94, compared to $11.21 in 2023.

3. What’s the Financial Risk Outlook?

AbbVie’s cash reserves have decreased from $8.5 billion in 2020 to $7.3 billion now, while its total debt has declined from $86.1 billion to $71.1 billion. With cash making up 5.1% of its assets and debt representing 23.1% of equity, AbbVie appears to have a manageable level of financial risk.

4. Is There Room for ABBV Stock Growth?

ABBV stock has risen by 17% this year, lagging behind broader market gains, with the S&P 500 index up by 26%. Over a longer period, ABBV’s stock performance has been inconsistent, producing annual returns of 32% in 2021, 24% in 2022, and 0% in 2023. In contrast, the Trefis High Quality (HQ) Portfolio—composed of 30 stocks—has consistently outperformed the S&P 500 each year, indicating lower volatility and better returns.

Given the current uncertain economic environment, it is unclear whether ABBV will continue underperforming or experience a rebound in the next 12 months. From a valuation standpoint, the stock seems to have potential upside. Currently trading around $170, ABBV’s P/S ratio stands at 5.7x, compared to its average of 4.4x over the past three years. This increase in valuation seems justified by market share gains for newer drugs.

As AbbVie faces sales declines from Humira, drugs like Rinvoq and Skyrizi are positioned to support growth. Skyrizi, known as the “Humira 2.0,” could see peak sales of around $20 billion, while Rinvoq’s peak is expected to reach about $12 billion. Despite the challenges following Humira’s patent expiration, AbbVie appears capable of increasing sales and earnings, suggesting potential for a valuation increase. The recent drop in ABBV stock, following the Emraclidine news, presents a potential buying opportunity for long-term investors.

While ABBV stock has growth potential, it’s important to assess how AbbVie’s competitors stack up on key metrics. Comprehensive comparisons for other companies across different sectors can be found in our Peer Comparisons.

| Returns | Nov 2024 MTD [1] |

2024 YTD [1] |

2017-24 Total [2] |

| ABBV Return | -14% | 17% | 292% |

| S&P 500 Return | 5% | 26% | 168% |

| Trefis Reinforced Value Portfolio | 10% | 26% | 837% |

[1] Returns as of 11/12/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.