Morgan Stanley Upgrades Viking Holdings: What Investors Should Know

Fintel reports that on November 12, 2024, Morgan Stanley upgraded their outlook for Viking Holdings (NYSE:VIK) from Equal-Weight to Overweight.

Analyst Price Forecast Indicates Possible Decline

As of October 22, 2024, the average one-year price target for Viking Holdings stands at $38.25 per share. Forecasts vary, with a low of $29.29 and a high of $42.00. This average indicates a potential decrease of 16.63% from its latest closing price of $45.88 per share.

Financials and Revenue Projections

The anticipated annual revenue for Viking Holdings is projected to be $4,628 million, representing a decline of 6.17%. The expected annual non-GAAP earnings per share (EPS) is $1.27.

Fundamentals and Increased Institutional Interest

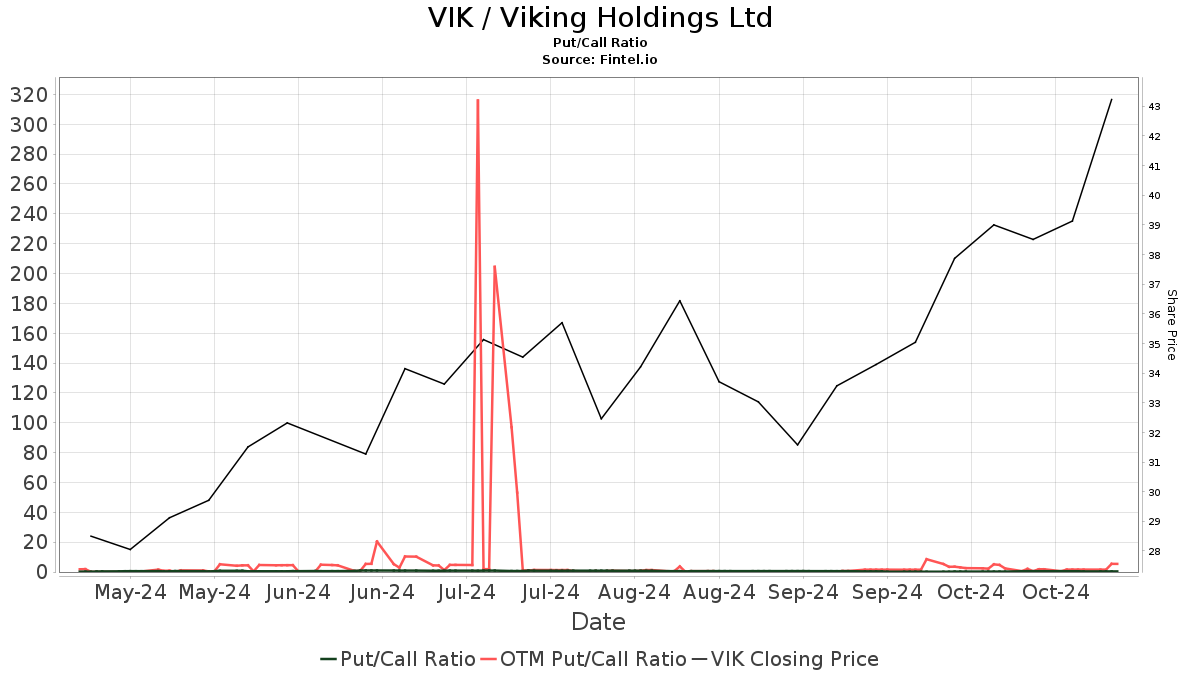

According to recent data, 193 funds or institutions have reported positions in Viking Holdings, a significant increase of 141 owners or 271.15% in the last quarter. The average portfolio weight of all funds dedicated to VIK is 0.47%, marking a rise of 130.48%. Over the past three months, total shares owned by institutions surged by 118.12% to 145,974K shares.  The put/call ratio for VIK is at 0.40, suggesting a bullish market sentiment.

The put/call ratio for VIK is at 0.40, suggesting a bullish market sentiment.

What Are Major Shareholders Holding?

The Canada Pension Plan Investment Board is the largest shareholder, holding 60,810K shares, which accounts for 20.01% of the company. Other significant investors include:

- Capital Research Global Investors – 6,845K shares (2.25%)

- Norges Bank – 6,177K shares (2.03%)

- T. Rowe Price Investment Management – 6,001K shares (1.98%)

- Wellington Management Group LLP – 5,279K shares (1.74%)

Fintel provides comprehensive research tools for individual investors, traders, financial advisors, and small hedge funds. Our resources encompass a wide range of data, including fundamentals, analyst reports, ownership statistics, and much more. Our exclusive stock options are powered by advanced models designed to aid investors in achieving better returns.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.