Loop Capital Confirms Hold Rating on QUALCOMM Amid Increasing Institutional Interest

On November 11, 2024, Loop Capital began coverage of QUALCOMM (WBAG:QCOM) with a Hold recommendation.

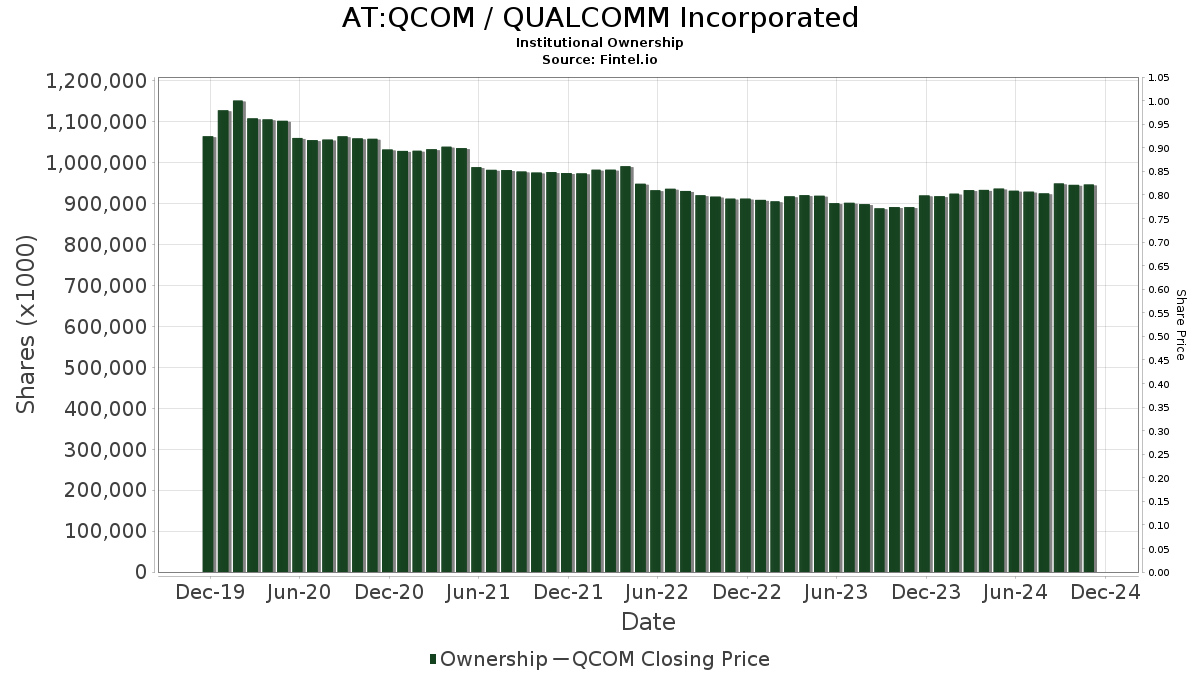

Institutional Ownership Trends

Currently, 4,161 funds and institutions hold positions in QUALCOMM, marking an increase of 85 new owners, or 2.09%, in the past quarter. The average fund allocation to QCOM now stands at 0.65%, up by 2.27%. Overall, total shares owned by institutions rose by 2.93% over the last three months, reaching 950,664K shares.

Active Shareholders and Portfolio Moves

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) now owns 35,262K shares, which is a 3.17% ownership stake in QUALCOMM. This reflects an increase from 35,071K shares reported previously, highlighting a 0.54% growth. VTSMX boosted its portfolio allocation by 15.03% last quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) holds 28,694K shares, representing 2.58% ownership. Previously, this firm reported holding 28,124K shares, experiencing a 1.99% increase. VFINX raised its allocation in QCOM by 13.63% in the last quarter.

Geode Capital Management now possesses 27,128K shares, making up 2.44% of the company. This is up from 25,139K shares, which signifies a 7.33% increase; however, they reduced their QCOM allocation by 55.49% over the quarter.

Invesco QQQ Trust, Series 1, holds 21,494K shares for a 1.93% ownership. In their previous filing, they had reported 20,919K shares, showing an increase of 2.68%. Their portfolio allocation in QCOM grew by 8.82% last quarter.

Norges Bank made a significant move, now holding 18,255K shares, which represents 1.64% ownership. Previously, they had no reported shares, indicating a 100.00% increase in their holdings.

Fintel provides extensive investing research tools for individual investors, financial advisors, and smaller hedge funds, offering a strong array of market insights.

This article was originally published on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.