Loop Capital Gives Synopsys a Boost with ‘Buy’ Rating

Fintel reports that on November 11, 2024, Loop Capital initiated coverage of Synopsys (NasdaqGS:SNPS) with a Buy recommendation.

Analyst Price Forecast: Expect 18.31% Growth

As of October 22, 2024, the average one-year price target for Synopsys is $654.83 per share. The estimates vary, with a low of $501.08 and a high of $743.17. This average price target suggests an increase of 18.31% from its last closing price of $553.47 per share.

For those interested, check out the leaderboard featuring companies with the largest projected price increases.

Annual Revenue and Earnings Expectations

The projected annual revenue for Synopsys is $6,555 million, showing a modest increase of 1.10%. Non-GAAP earnings per share (EPS) are expected to be 11.85.

Evaluating Fund Sentiment

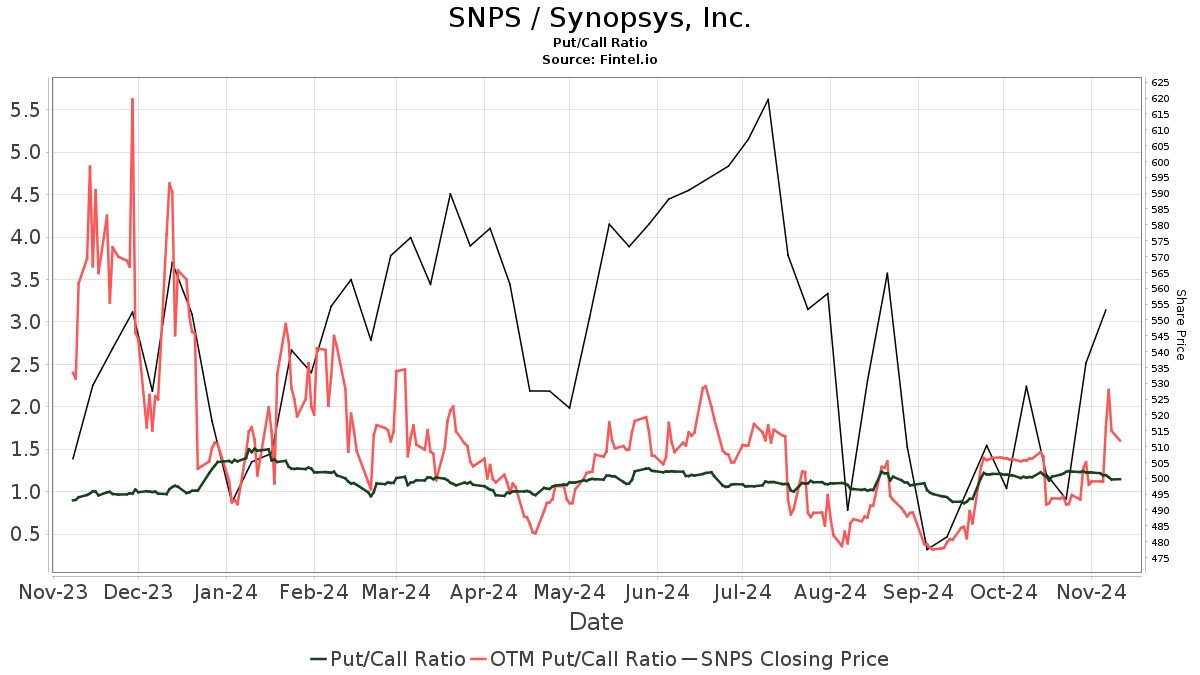

A total of 2,355 funds or institutions currently hold shares in Synopsys. This reflects a slight decrease of 36 owners, or 1.51%, over the last quarter. On average, the weight of all funds dedicated to SNPS is now 0.44%, which represents a growth of 5.42%. Institutional ownership has increased by 3.46% over the last three months, totaling 163,784K shares.  The current put/call ratio for SNPS is 1.17, signaling a bearish sentiment among investors.

The current put/call ratio for SNPS is 1.17, signaling a bearish sentiment among investors.

Institutional Moves: Who’s Buying and Selling?

Capital World Investors holds 7,395K shares, equivalent to 4.81% ownership of Synopsys. This is a slight increase from their previous filing of 7,370K shares, reflecting an increase of 0.34%. Over the last quarter, their portfolio allocation in SNPS rose by 2.94%.

Price T Rowe Associates owns 5,548K shares, which accounts for 3.61% of the company. Their prior filing showed ownership of 5,338K shares, signifying an increase of 3.79% and a 5.66% growth in portfolio allocation over the same period.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 4,840K shares, representing 3.15% ownership. They increased their shares from 4,795K, marking a 0.93% rise in ownership and a 2.20% increase in portfolio focus on SNPS.

JPMorgan Chase reported ownership of 4,054K shares, or 2.64%. However, this indicates a significant decrease of 45.96% from their previous 5,917K shares. Their commitment to SNPS also fell by 96.36% in their portfolio.

VFINX – Vanguard 500 Index Fund Investor Shares, with 3,915K shares, holds 2.55% ownership. This marked an increase from their prior 3,844K shares, reflecting a rise of 1.82% in their stake and a 0.40% uptick in portfolio allocation to SNPS.

About Synopsys

Background Information:

(This description is provided by the company.)

Synopsys is recognized as a Silicon to Software™ partner for companies advancing electronic products and software applications. As part of the S&P 500, it boasts a longstanding reputation as a leader in electronic design automation (EDA) and semiconductor IP. Synopsys offers a vast range of application security testing tools and services vital for designers of advanced semiconductors and software developers ensuring the creation of secure, high-quality code.

Fintel is a thorough investment research platform for individual investors, traders, financial advisors, and small hedge funds.

Our platform provides a wealth of information, including fundamentals, analyst reports, ownership data, fund sentiment, and more. Exclusive stock picks powered by backtested models are also available, aimed at enhancing profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.