NVIDIA Gets a Boost: Redburn Atlantic Gives Buy Recommendation

On November 12, 2024, Fintel reported that Redburn Atlantic has started covering NVIDIA (BIT:1NVDA) with a strong Buy recommendation.

Analyst Price Forecast Indicates Potential Gains

As of October 22, 2024, NVIDIA’s average one-year price target is set at €139.87 per share. This figure represents a potential increase of 2.37% from its most recent closing price of €136.64. The predictions range widely, from a low of €70.07 to a high of €195.93.

Check out our leaderboard showing companies with the largest price target upside.

Revenue and Earnings Projections Highlight Company Trends

NVIDIA’s projected annual revenue stands at €94,037 million, reflecting a slight decrease of 2.36%. The expected non-GAAP earnings per share is €20.91.

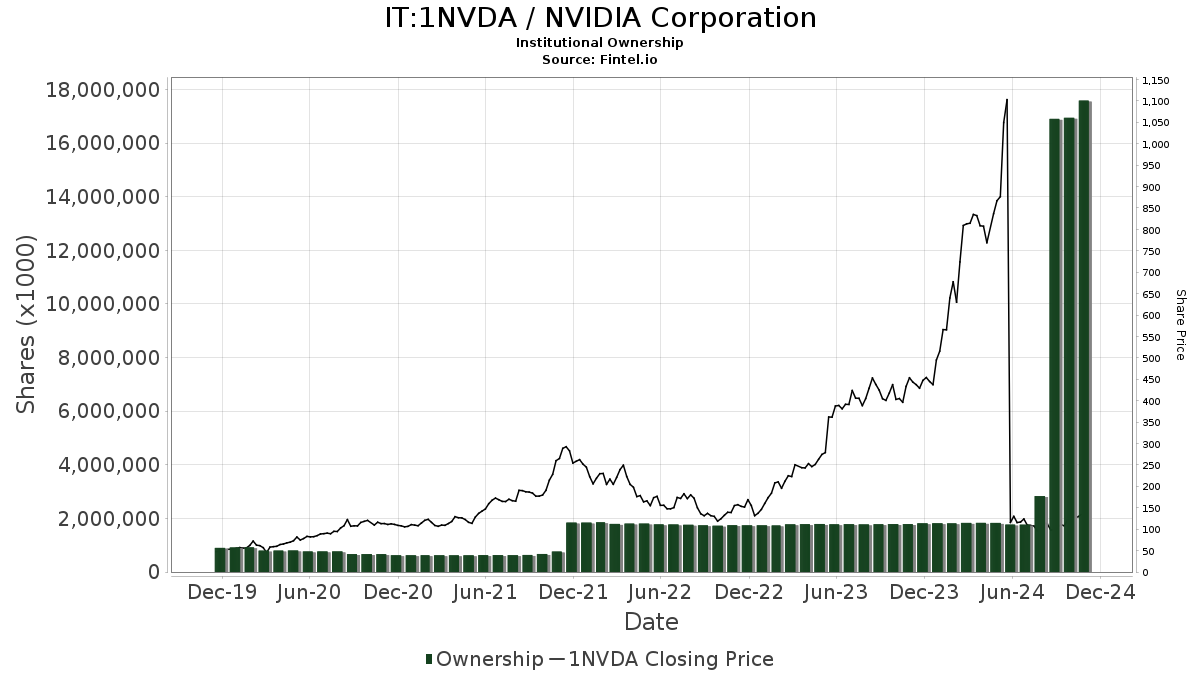

Institutional Investment Trends in NVIDIA

There are currently 6,549 funds or institutions holding positions in NVIDIA, marking an increase of 164, or 2.57%, compared to the previous quarter. The average weight of NVIDIA in these portfolios is 3.24%, which is a rise of 4.32%. Over the last three months, institutional shares owned have surged by 282.80%, reaching 17,583,505K shares.

What Other Major Shareholders Are Doing

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) has increased its holdings to 738,297K shares, accounting for 3.01% of NVIDIA. This is a significant jump from the previous 74,656K shares, an increase of 89.89%. The firm has raised its portfolio allocation in NVIDIA by 31.49% in the last quarter.

Vanguard 500 Index Fund Investor Shares (VFINX) now holds 631,333K shares, representing 2.57% ownership. Previously, it owned 62,245K shares, marking an increase of 90.14%. Its allocation to NVIDIA has also risen by 31.27% over the same period.

Geode Capital Management currently owns 546,079K shares, or 2.23% of the company. This reflects a modest increase of 2.11% from 534,554K shares previously held, though the firm cut its overall allocation in NVIDIA by 51.50% last quarter.

Price T Rowe Associates has boosted its stake in NVIDIA to 444,582K shares, representing 1.81% ownership. This is up from 46,150K shares, an increase of 89.62%. The firm’s portfolio allocation rose by 28.59% in the last quarter.

JPMorgan Chase holds 406,709K shares, making up 1.66% of the company. Previously, it had 390,779K shares, which reflects a 3.92% increase. However, the firm reduced its allocation in NVIDIA by 5.07% last quarter.

Fintel is a leading research platform catering to individual investors, traders, financial advisors, and smaller hedge funds.

Data from Fintel covers global market fundamentals, analyst reports, ownership, fund sentiment, options, insider trading, and unique stock recommendations based on advanced models to enhance profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.