Analysts Predict Growth for iShares U.S. Medical Devices ETF

By analyzing the ETFs in our coverage, we evaluated the trading prices of their holdings against average analyst 12-month forward target prices. For the iShares U.S. Medical Devices ETF (Symbol: IHI), the weighted average implied target price is $66.73 per unit.

Promising Outlook for IHI

Currently trading at approximately $60.44 per unit, IHI shows a potential upside of 10.41%, according to analysts’ forecasts for its underlying holdings. Three companies within the ETF are particularly notable for their expected growth: Paragon 28 Inc (Symbol: FNA), Alphatec Holdings Inc (Symbol: ATEC), and Tandem Diabetes Care Inc (Symbol: TNDM).

Stock Performance Highlights

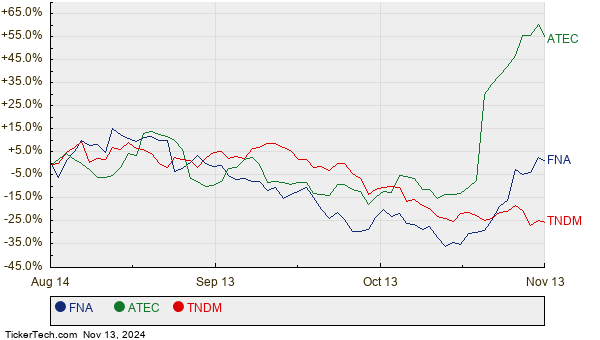

Paragon 28 Inc (FNA) recently traded at $7.50 per share, but analysts target a price of $14.40, indicating an impressive upside of 92.00%. Alphatec Holdings Inc (ATEC) is also expected to rise; its recent share price of $9.28 has a target of $17.17—representing an 84.98% increase. Meanwhile, Tandem Diabetes Care Inc (TNDM), currently at $31.10 per share, has a target price of $52.26, marking a 68.05% potential gain. Below you can see a twelve-month price history chart comparing the performance of these stocks:

Current Analyst Targets

The following table summarizes the analyst target prices for the ETF and its underlying stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares U.S. Medical Devices ETF | IHI | $60.44 | $66.73 | 10.41% |

| Paragon 28 Inc | FNA | $7.50 | $14.40 | 92.00% |

| Alphatec Holdings Inc | ATEC | $9.28 | $17.17 | 84.98% |

| Tandem Diabetes Care Inc | TNDM | $31.10 | $52.26 | 68.05% |

The Analyst Perspective

Are these targets a reasonable expectation or a sign of overly optimistic predictions? Investors should consider whether analysts’ price targets are justified by recent company developments or if they reflect outdated viewpoints. High target prices can signal optimism but may also imply the risk of downgrades later on. Thus, further research is essential for investors looking to understand these stocks better.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Past Earnings

• PTBD Videos

• HYZD YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.