Investors can feel reassured as October’s inflation report aligned with economists’ forecasts, although the annual rate did tick up slightly from last month.

As expected, the Consumer Price Index (CPI) increased by 2.6% year-over-year in October, a rise from September’s 2.4%. This shift ends a series of six consecutive months of declines.

Core inflation, which excludes food and energy prices, has remained stable at 3.3% for the third month in a row. This persistent level underscores ongoing price pressures that continue to exceed the Federal Reserve’s 2% target.

In light of this data, market speculators have raised their odds for an interest-rate cut, now betting on a 25-basis-point decrease in December. Current market probabilities suggest a 79% chance of a rate cut that month, a significant rise from 58% prior to the CPI release, according to the CME FedWatch tool.

Following the report, Minneapolis Fed President Neel Kashkari expressed a positive outlook regarding inflation’s future, sharing his thoughts on Bloomberg TV: “I have confidence inflation is headed in the right direction.”

Earlier in the week, Kashkari had pointed out the potential for a rate pause in December if inflation surprises on the higher side. He remarked, “I am not yet seeing a lot of upside inflation risks; the bigger risk is getting stuck.”

Markets responded favorably to the news, with U.S. equity futures edging higher as Treasury yields and the dollar dropped, reflecting the heightened expectations for rate cuts.

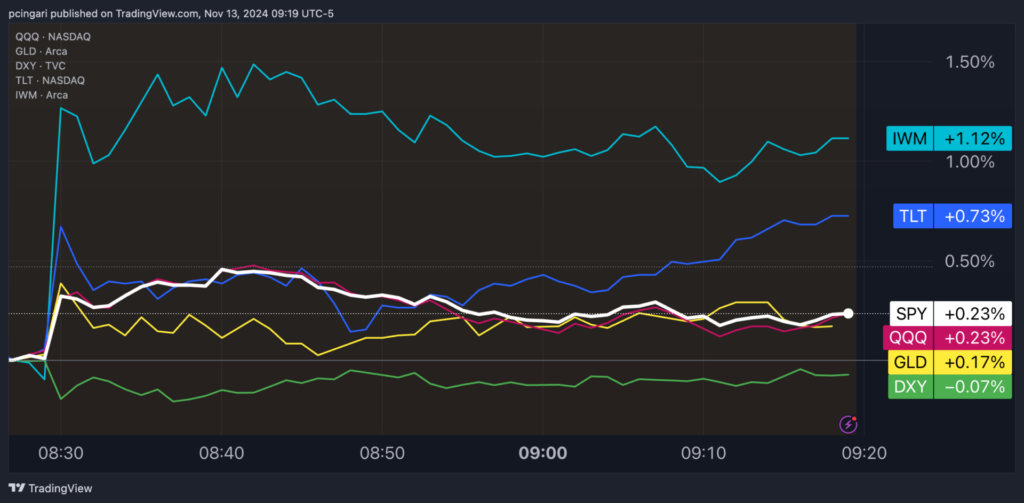

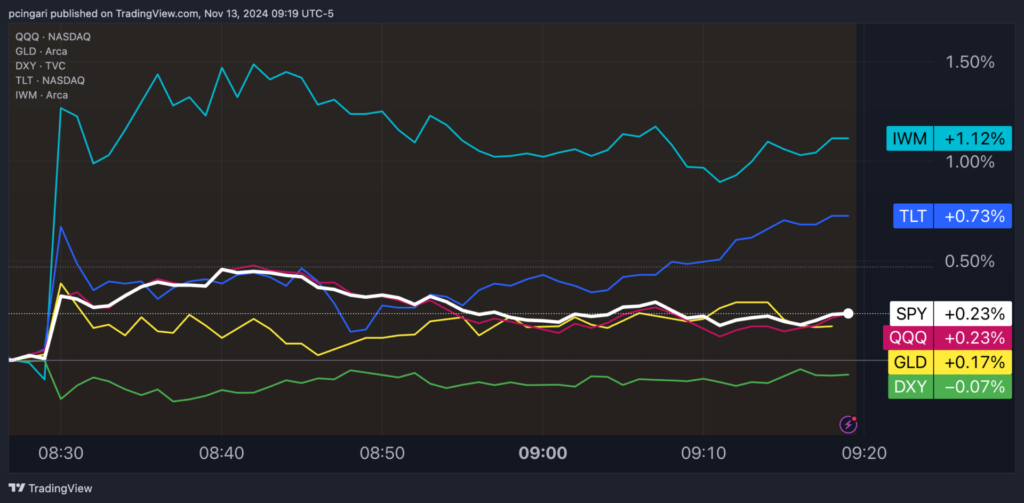

Market Movements

- The S&P 500, represented by the SPDR S&P 500 ETF Trust SPY, rose by 0.2%.

- The Nasdaq 100, tracked by the Invesco QQQ Trust, Series 1 QQQ, gained 0.15%.

- Small-cap stocks outperformed their larger counterparts, with the iShares Russell 2000 IWM climbing 1.1% just before the New York market opened.

- Among the top performers in premarket trading within the S&P 500 were Charter Communications Inc. CHTR, GE Vernova Inc. GEV, and Albemarle Corp. ALB, which rose by 5.7%, 4%, and 3.7%, respectively.

- On the downside, Skyworks Solutions Inc. SWKS, Fair Isaac Corp. FICO, and Bio-Techne Corp. TECH saw declines of 6.7%, 4.1%, and 2.8%, respectively.

- Gold prices increased by 0.3%, breaking a streak of three consecutive down days.

- The U.S. dollar index (DXY) fell slightly by 0.1%.

- Meanwhile, Treasury-linked ETFs gained, highlighted by the iShares 20+ Year Treasury Bond ETF TLT, which was up 0.7%.

Read Next:

Market News and Data brought to you by Benzinga APIs