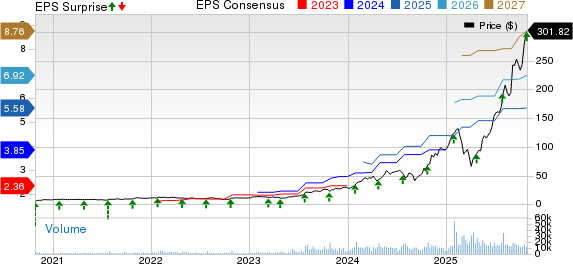

New Option Opportunities Emerge for C3.ai Inc Investors

Newly available options for C3.ai Inc (Symbol: AI) aimed at the July 2025 expiration give investors fresh choices. With 246 days left until expiration, these contracts allow potential for higher premiums compared to options expiring sooner. Stock Options Channel’s YieldBoost formula has identified one notable put and one call contract in the new July 2025 options chain.

Analyzing the Put Contract

The put contract at the $25.00 strike price has a current bid of $1.83. If an investor decides to sell-to-open this contract, they agree to buy the stock at $25.00 while collecting the premium. This results in a reduced cost basis of $23.17 per share (before broker commissions), making it a potentially appealing alternative to buying shares at the current price of $26.49.

This $25.00 strike represents a 6% discount to the current trading price, which indicates that the put is currently out-of-the-money. The odds of this contract expiring worthless are estimated at 68%. Stock Options Channel will monitor these probabilities and available data over time, offering updates on their website. If the contract does expire worthless, the premium would yield a 7.32% return on the cash commitment, equating to a 10.86% annualized return—a concept we refer to as YieldBoost.

Examining the Call Contract

On the calls side, the call contract at the $30.00 strike price is currently priced at a bid of $2.50. If an investor purchases AI shares at the present price of $26.49 and simultaneously sells-to-open this call contract as a covered call, they would agree to sell the stock at $30.00. This strategy could result in a total return of 22.69% if the stock is sold at expiration in July 2025, excluding dividends and before broker commissions. However, significant upside may remain if AI shares surge in value.

For context, the $30.00 strike is approximately 13% above the current trading price, making it another out-of-the-money option. The analysis indicates a 46% chance of the covered call expiring worthless. Thus, if it does expire worthless, the investor retains their shares and the premium collected, leading to a 9.44% additional return or a 14.01% annualized return—also categorized as YieldBoost.

Volatility Overview

Implied volatility for the put contract is 61%, while for the call contract, it’s at 59%. The actual trailing twelve-month volatility, taking into account the last 251 trading day closing values in addition to today’s price of $26.49, stands at 59%. For more insights on put and call options, visit StockOptionsChannel.com.

![]() Top YieldBoost Calls of the S&P 500 »

Top YieldBoost Calls of the S&P 500 »

Also see:

- ZE Videos

- SUG Split History

- PAF Videos

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.