Advance Auto Parts: Investors Hope for a Turnaround Despite Poor Earnings

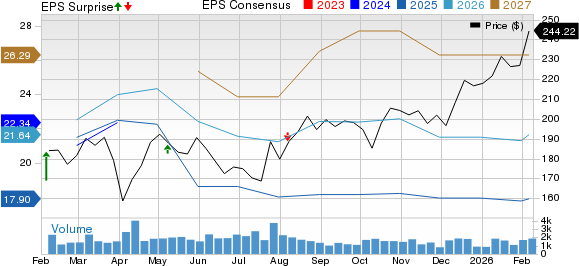

The stock of Advance Auto Parts, Inc. AAP is causing some confusion among investors. After the company released its earnings report on Thursday, the results fell well below expectations.

Financial Performance Falls Short

Advance Auto Parts reported a loss of four cents per share, significantly missing the anticipated profit of 49 cents. Moreover, its revenue of $2.15 billion also fell short of analyst predictions, which had forecasted $2.65 billion.

Understanding Operating Margin

Operating margin is a key figure analysts monitor to assess a company’s profitability. For instance, a 5% operating margin means the company earns five cents for every dollar of sales after covering all costs. A rise in operating margin indicates improved efficiency and profitability.

The management at Advance Auto predicts an operating margin of 2% to 3% by 2025, but expects this to increase to 7% by 2027. Despite the current losses, some investors are purchasing shares, hoping for a rebound and a favorable long-term outlook.

Chart Patterns and Potential Breakout

The stock appears to be on the verge of breaking out. Resistance occurs when a large number of sell orders cluster at or near a certain price, often stopping an upward trend in its tracks, as seen with Advance Auto in September.

What a Breakout Could Mean

If the stock surpasses this resistance, it’s a sign that sellers may have exited the market, potentially resulting in a supply shortage. New buyers could then struggle to find sellers, pushing the stock price upward as they compete for shares.

Wall Street often reflects a complex reality; the initial response to news can be misleading. In the case of Advance Auto Parts, the market may see a brighter future ahead.

Read Next:

• U.S. Stocks Settle Mixed Following Inflation Data: Investor Sentiment Improves, But Fear Index Remains In ‘Greed’ Zone

Photo: Refina via Shutterstock

Market News and Data brought to you by Benzinga APIs