Palantir Technologies: A Rising Star in AI Stocks

Shares of Palantir Technologies Inc. (PLTR) reached a record high of $63.39 on November 13, before settling slightly lower at $60.70. This impressive surge marks an increase of 180.3% over the past six months, significantly outpacing the industry’s 34.8% rise and the Zacks S&P 500 composite’s 14.1% growth.

Performance Over the Last Six Months

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Currently, the stock is trading above its 50-day moving average, indicating strong confidence from investors.

Trading Above the 50-Day Average

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Palantir’s stock performance reflects investor optimism, particularly in the fast-growing artificial intelligence (AI) sector. Other notable players in the AI market have also seen substantial gains: NVIDIA (NVDA) is up 55%, International Business Machines (IBM) has risen 25%, and Oracle (ORCL) gained 56% in the same timeframe.

Innovative Sales Strategy to Expand Customer Base

Focusing on tailored AI and machine learning (ML) services, Palantir attracts large corporate and government clients. Realizing the need for a more diverse customer base, the company has adopted a modular sales strategy. This allows clients to buy individual product components instead of the entire platform upfront, along with usage-based pricing to lower entry barriers. This approach has greatly increased the number of U.S. commercial clients.

Palantir’s Strategic Positioning in AI and Data Analytics

Palantir employs a comprehensive AI strategy by integrating its Foundry and Gotham platforms to promote AI adoption in both government and commercial sectors. The AI Platform (AIP) underpins these capabilities, enabling organizations to manage large datasets for real-time insights. Such adaptability is crucial for sectors like defense, healthcare, finance, and intelligence, where quick and efficient decision-making is vital.

In the government arena, Palantir aligns its AI strategy with U.S. defense needs. Projects like the Department of Defense’s Open DAGIR display its commitment to modernizing military operations through AI. Enhanced data interoperability and real-time decision-making reinforce Palantir’s integral role in defense.

In commercial markets, Palantir’s AIP boot camps have offered hands-on experience to over 1,000 companies, facilitating customer acquisition. These camps highlight the platform’s capabilities across various industries, including logistics and manufacturing.

In the third quarter of 2024, Palantir reported a 40% increase in U.S. government revenues year over year, fueled by a growing demand for its AI products. Meanwhile, U.S. commercial revenues soared by 54% thanks to AIP’s success. Moreover, the company saw a staggering 183% increase in operating income year over year and a rise of 900 basis points in adjusted operating margins, indicating improved cost management and higher-margin contracts.

Robust Financial Health

Highlighting Palantir’s financial strength, as of September 30, the company reported $4.6 billion in cash without any debt. This healthy cash flow enables it to explore new opportunities or acquisitions without financial concerns, bolstering its long-term growth prospects.

Gaining Momentum with S&P 500 Inclusion

Palantir joined the S&P 500 on September 23, following a strong financial track record with seven consecutive profitable quarters. This inclusion is anticipated to enhance share demand from index funds and ETFs, thereby expanding the company’s visibility and investor base.

Promising Earnings Projections

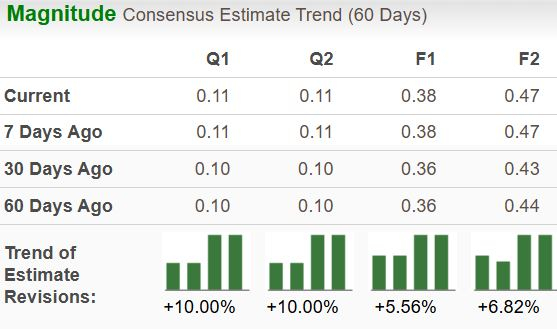

The Zacks Consensus Estimate for PLTR’s fourth-quarter 2024 earnings stands at 11 cents, reflecting a 37.5% increase from the same period last year. Earnings are projected to grow by 52% and 24.6% in 2024 and 2025, respectively, while the company expects a 28% revenue growth in the fourth quarter of 2024. For 2024 and 2025, sales are anticipated to rise by 26.6% and 24.5% year over year, respectively.

Analysts show strong confidence in Palantir, as evidenced by six upward revisions in earnings estimates for the fourth quarter of 2024 over the past 30 days with no downward changes. Similarly, estimates for third-quarter 2024 earnings increased by 10% in this period, and there were upward revisions for eight and seven estimates for 2024 and 2025, respectively.

Image Source: Zacks Investment Research

A Recommendation to Buy PLTR

Considering Palantir’s leadership in the AI sector, solid financial results, strong cash reserves, and a favorable earnings outlook, the stock appears to be a lucrative buy. Despite its recent gains, the ongoing demand for AI solutions and government contracts, along with its S&P 500 membership, indicate further growth potential. Investors seeking to benefit from AI advancements may find value in adding Palantir to their portfolios.

PLTR currently holds a Zacks Rank #2 (Buy). You can view the full list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free: 5 Stocks to Capitalize on Infrastructure Spending

With trillions of dollars in federal funding being allocated to improve and upgrade America’s infrastructure, this wave of investment will also extend to AI data centers and renewable energy sources.

This report highlights five unexpected stocks likely to benefit the most from the infrastructure spending that is just beginning.

Download the report “How to Profit from the Trillion-Dollar Infrastructure Boom” for free today.

If you want to stay updated with the latest recommendations from Zacks Investment Research, you can also access the report “5 Stocks Set to Double” at no cost.

International Business Machines Corporation (IBM): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Palantir Technologies Inc. (PLTR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.