Trump’s Plan to Eliminate EV Tax Credits Raises Concerns for Tesla Investors

Following the end of Joe Biden’s presidency, the incoming administration led by President-Elect Donald Trump is likely set to overhaul several policies, including the $7,500 electric vehicle (EV) tax credit featured in the Inflation Reduction Act (IRA). While Trump has signaled that he is not opposed to electric vehicles, he has made it clear he wants to cut back on subsidies that he deems excessive. This raises the question: Should investors consider selling shares of Tesla (TSLA) in light of this news?

Here are five reasons why many investors remain optimistic about Tesla:

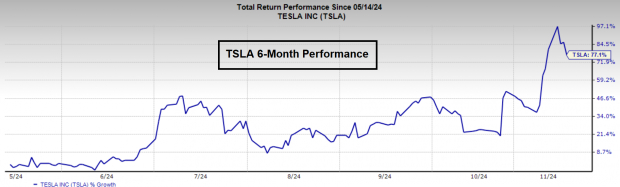

1. The Impact is Already Reflected in Stock Prices

Investors have been anticipating the removal of EV tax credits throughout Trump’s campaign. As a result, TSLA shares have previously surged by $100, suggesting that some adjustments in stock performance may have already occurred.

Image Source: Zacks Investment Research

2. Support from Elon Musk

Musk has advocated for removing subsidies not only for EVs but across all sectors. Since Tesla leads the EV market, the potential impact on competitors like Ford (F) and General Motors (GM).

3. Tariff Protection Against Foreigners

Trump has indicated plans for tariffs on countries that impose restrictions threatening American jobs. This could help Tesla by shielding it from foreign competition, particularly from Chinese companies like Nio (NIO) and Xpeng (XPEV).

4. The Livermore Rule in Action

According to Jesse Livermore’s rule, once a stock surpasses a crucial price point—like $300—there’s a good chance it will continue to climb higher. TSLA recently broke this barrier and remains above it.

5. Interest Rates are Decreasing

Tesla was significantly affected by the Federal Reserve’s stringent policies in 2022. However, as the Federal Reserve eases restrictions, consumers are expected to have increased access to funding.

Conclusion

Despite the announcement about the elimination of EV tax credits, which initially caused Tesla’s share prices to dip, many experts argue that this impact was anticipated, and several factors suggest reasons for continued optimism in the coming year.

Government Infrastructure Spending: 5 Stocks to Watch

Trillions of dollars have been allocated by the federal government to enhance America’s infrastructure. This funding will not only cover roads and bridges but will also significantly benefit sectors like AI and renewable energy.

In this environment, here are five noteworthy stocks positioned to gain from this upcoming surge in spending.

Download Your Free Guide on Profiting from the Infrastructure Boom Today.

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report

XPeng Inc. Sponsored ADR (XPEV) : Free Stock Analysis Report

Read this article on Zacks.com

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.