For Immediate Release

Chicago, IL – November 15, 2024 – Today, Zacks Investment Ideas showcases AppLovin Corp. (APP), Nvidia (NVDA), Meta Platforms (META), and MasTec, Inc. (MTZ).

Investors Eye Rising Stars: AppLovin and MasTec Lead the Way

Since Donald Trump’s election win, the stock market—and bitcoin—have surged to record highs. Investors are optimistic, anticipating that reduced corporate taxes and less regulation will stimulate economic growth across sectors like technology, cryptocurrency, and infrastructure.

Stay Ahead with Zacks Earnings Calendar

Wall Street remains confident in expectations for earnings growth and the Federal Reserve’s interest rate reduction plans. While some profit-taking might occur after the recent market surge, a decline is expected to be short-lived. Historically, the November to January period is a particularly favorable time for the stock market.

Investors looking to strengthen their portfolios as 2024 comes to a close should consider top-performing stocks driven by impressive earnings forecasts.

Today, we shine a spotlight on AppLovin and MasTec, both of which have significantly outperformed the S&P 500 over the past year, earning Zacks Rank #1 (Strong Buy) status after delivering outstanding earnings reports.

AppLovin is set to gain from long-term growth in digital applications, bolstered by advancements in artificial intelligence (AI). Meanwhile, MasTec is positioned to grow alongside trends in energy transition and infrastructural development.

Can AppLovin Continue Its 620% Surge in 2024?

AppLovin Corp. is empowering companies and app developers to enhance user acquisition, retention, and overall marketing effectiveness through its expanding portfolio of machine learning and AI-driven technologies. Their solutions enable clients to reach target users across mobile devices, CTV, and other critical channels.

As digital competition intensifies, more companies are turning to AppLovin’s offerings to gain a competitive edge in the engaging world of mobile applications.

In 2023, AppLovin reported a 17% increase in revenue, with significant growth following a 93% revenue boost in 2021. On November 6, the company had another successful quarter, showing adjusted earnings growth of 316% year-over-year, with a 66% increase in Software Platform revenue and a 39% rise in total sales.

Earnings estimates for fiscal year 2025 soared from $4.16 to $5.75 per share after the third quarter report. Estimates climbed 160% for FY24 and 250% for 2025.

AppLovin is projected to increase its earnings per share (EPS) by 314% in 2024 and by 42% the following year, with expected sales growth of 40% in 2024 and 20% in 2025.

Since the start of this year, AppLovin shares have skyrocketed by 620% and have surged approximately 1,750% over the last two years, outpacing Nvidia, which gained 800%, and digital advertising giant Meta, which rose by 410%.

As the stock price rises, a period of profit-taking may be anticipated, potentially presenting new buying opportunities should shares pull back to their 21-day or 50-day moving averages.

MasTec: A Smart Bet on Infrastructure and Energy Innovation

MasTec, Inc. is a leading player in U.S. infrastructure construction, offering services that include engineering, installation, and maintenance. The company is experiencing growth aligned with key trends in electrification, grid enhancements, and infrastructure investments.

Additionally, MasTec stands to gain significantly from the ongoing AI boom. These trends are expected to persist, bolstered by policy shifts in a potential second Trump administration aimed at reshoring and other initiatives.

On Halloween, MasTec delivered strong results for the third quarter, reporting a record backlog of $13.9 billion—an increase of $1.4 billion year-over-year. CFO Paul DiMarco noted, “The macrotrends in our end markets remain favorable, and we will prioritize capital allocation to seize growth opportunities.”

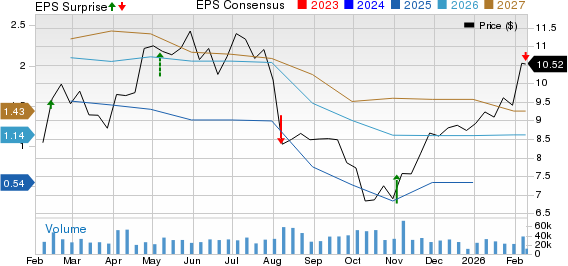

In 2023, MasTec achieved 23% sales growth, aided by its acquisition of Energy Alternatives, Inc. Forecasts predict a 2% revenue growth in 2024 and 9% growth in 2025.

Earnings estimates for 2024 and 2025 have risen by 20% since MasTec’s Q3 report, earning the company a Zacks Rank #1 (Strong Buy). The company is anticipated to boost adjusted earnings by 84% in 2024 and 45% in 2025.

Over the last 20 years, MasTec’s stock has increased by 1,600%, outpacing its heavy construction industry average of 575% and the S&P 500’s 435% growth. Following an 84% year-to-date surge, MTZ has reached fresh all-time highs.

Like AppLovin, MasTec may face some short-term adjustments after its impressive rally. Investors should be mindful of its 21-day moving average. Currently, MTZ trades approximately 9% below its average Zacks price target, with 11 out of 13 brokerage recommendations from Zacks classified as “Strong Buys.”

Discover Zacks’ Top Stock Picks

Since the year 2000, Zacks’ top stock-picking strategies have outperformed the S&P’s +7.0 average annual gain significantly. These strategies have generated average annual returns of +44.9%, +48.4%, and +55.2%.

You can access their live stock picks today with no cost or obligation.

See Stocks Free >>

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

https://www.zacks.com

Past performance is not indicative of future results. Investing carries risks, including potential loss, and this material is for informational purposes only. It should not be considered as investment, legal, or tax advice, nor a recommendation to buy, sell, or hold a security. The information provided was accurate as of the date of this release and may change without notice. Views expressed do not represent Zacks Investment Research’s overall stance.

Must-See: Solar Stocks Poised to Skyrocket

The solar industry is set to rebound as technology companies transition away from fossil fuels to support the growing demand for energy in the AI sector.

Analysts predict that trillions of dollars will flow into clean energy in the coming years, with solar expected to represent 80% of renewable energy growth. This shift presents numerous investment opportunities in the near term and beyond. Choosing the right stocks is crucial.

Explore Zacks’ top solar stock recommendations at no cost.

To stay updated with Zacks Investment Research’s latest recommendations, download 5 Stocks Set to Double today for free.

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

MasTec, Inc. (MTZ) : Free Stock Analysis Report

AppLovin Corporation (APP) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.