MetLife, Inc.: A Strong Player Despite Recent Earnings Headwinds

With a market cap of $57.2 billion, MetLife, Inc. (MET) stands as a major global financial services and insurance company. Headquartered in New York, it offers a broad spectrum of insurance, annuity, and asset management products to both individual consumers and institutions around the globe.

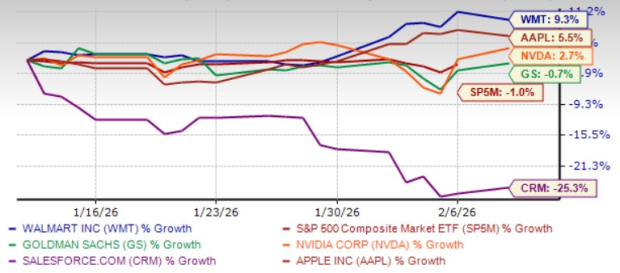

Stock Performance Outpaces the S&P 500

Over the past 52 weeks, MetLife has shown notable resilience, with MET increasing 34.6%, surpassing the broader S&P 500 Index ($SPX) which has gained 31.2%. So far in 2024, MET is up 25.9%, while the SPX shows a gain of 23.9% year-to-date.

Still Trailing Behind Financial Sector Peers

Despite these gains, MET has not kept pace with the Financial Select Sector SPDR Fund (XLF), which has achieved an impressive 43.9% return in the last year and 32.8% year-to-date.

Q3 Earnings Fall Short of Expectations

On October 30, shares of MetLife dipped by 5.7% after the company reported its third-quarter 2024 earnings, which fell below expectations. The adjusted operating earnings were $1.93 per share, and revenues reached $17.6 billion. Challenges included elevated expenses, which grew by 7.3% year-over-year due to higher interest credited to policyholder accounts. Additionally, specific segments struggled, particularly in Risk and Income Solutions (RIS) and Group Benefits, causing investor unease.

Future Earnings Look Promising

For the ongoing fiscal year ending in December, analysts estimate that MET’s EPS will rise by 14.3% year-over-year to $8.38. Historically, MetLife’s earnings surprises have been inconsistent, meeting or exceeding consensus estimates in half of the last four quarters.

Analysts Remain Optimistic

The consensus rating among the 16 analysts following MetLife indicates a strong endorsement, categorizing it as a “Strong Buy.” This is supported by 11 “Strong Buy” ratings, two “Moderate Buys,” and three “Holds.” This marks a more positive outlook compared to three months ago, which recorded only nine “Strong Buy” ratings.

Analyst Upgrades Signal Growth Potential

On November 14, Evercore ISI increased MetLife’s price target to $100 while maintaining an “Outperform” rating. Analysts point to the potential for growth in the life insurance sector, citing decreased risks from divestitures and advantageous market conditions following the election.

As of now, MET is trading under the average price target of $90.64. The highest price target of $101 suggests nearly a 22% upside from current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.