Key Inflation Metrics and Their Impact on Federal Reserve Rate Cuts

With Thanksgiving approaching in just under two weeks, many are gearing up for festive gatherings. A cherished tradition for the holiday is serving turkey during the feast.

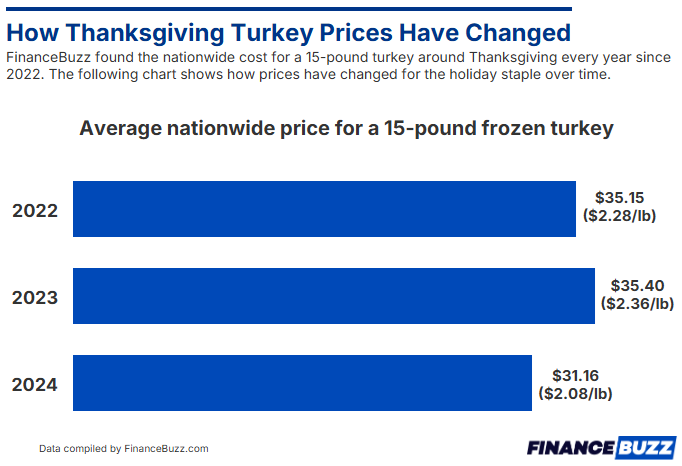

This year, the typical 15-pound turkey will set you back about $31, as reported by FinanceBuzz. This breaks down to approximately $2.08 per pound, marking a 12% decrease from last year and an 11% drop from 2022.

After years of rising prices, this decrease is certainly something to appreciate.

However, this raises an important question: are prices overall declining or at least stabilizing?

Fortunately, recent inflation reports provide insights. On Wednesday morning, the latest Consumer Price Index (CPI) report was released, followed by an updated Producer Price Index (PPI) report yesterday. This morning, the newest U.S. retail sales figures were also unveiled.

In today’s Market 360, we will analyze these reports and discuss their implications for the Federal Reserve’s decision on rate cuts next month, as well as how investors can navigate the upcoming uncertainty.

Understanding the Consumer Price Index (CPI)

The Bureau of Labor Statistics reported that the CPI rose by 0.2% in October and by 2.6% over the past year. This slight increase from the 2.4% annual gain in September aligns with economists’ expectations.

Core CPI, which leaves out food and energy prices, increased by 0.3% for the month and maintained an annual rise of 3.3%, consistent with September figures. Notably, core CPI has remained steady at 3.3% for three consecutive months.

One concerning development is the rise in Owners’ Equivalent Rent (OER) by 0.4% in October, compared to a smaller 0.2% increase in September.

Over the last year, shelter costs have surged by 4.9%, contributing to more than half of October’s inflation increase. This persistent rise has been a major factor keeping the CPI above 2% for an extended period.

Food prices also rose by 0.2%. Two likely factors for this increase include a recent recall of 80,000 pounds of butter by Costco Wholesale Corporation (COST) due to a labeling issue with the FDA, and an ongoing bird flu outbreak in Washington State, both of which are impacting food supplies.

Analyzing the Producer Price Index (PPI)

The PPI revealed a slight increase in wholesale inflation last month.

This index measures the prices producers receive for their goods and services. In October, it climbed by 0.2% and registered a 2.4% rise over the past year, consistent with economists’ projections. This compares to a modest 0.1% rise and a year-over-year increase of 1.9% in September.

The core PPI, which excludes food, energy, and trade, grew by 0.3% in October and saw a 3.1% increase over the past year, matching expectations. The previous month’s gains were 0.2% for October and an annual rate of 3.1%.

Diving deeper into the details, service prices rose by 0.3%, while final demand goods nudged up by 0.1%, recovering from two previous months of declines. Notably, transportation and warehousing costs increased by 0.5%, and trade services rose by 0.1%.

On a positive note, wholesale food prices fell by 0.2%, and energy prices dropped by 0.3%.

However, a point of concern is that wholesale inflation appears to be gaining momentum; in November 2023, the annual rate was 0.8%, while the latest reading stands at 2.4%. This detail is critical as PPI serves as a leading indicator for consumer price changes.

October Retail Sales Show Mixed Signals for the Economy

Overview of October Retail Sales Data

In October, retail sales increased by 0.4%, surpassing economists’ expectations of a 0.3% rise. Over the past year, retail sales have climbed 2.8%, which is barely outperforming inflation and may not indicate strong consumer demand.

Excluding vehicles and gas, retail sales recorded a modest growth of just 0.1% in October. However, there were positive developments as eight out of the 13 categories in the report showed gains.

Here’s a breakdown of the performance by sector:

- Electronics and appliance stores saw a significant jump of 2.3%.

- Car and car part stores increased sales by 1.6%.

- Spending at bars and restaurants rose by 0.7%.

- Miscellaneous store retailers experienced a decline of 1.6%.

Notably, the biggest story from this report is the revision of September’s retail sales, which were updated to a 0.8% increase from the previously reported 0.4%. While October’s figures seem lackluster, the positive revision for September may lead economists to adjust third-quarter GDP estimates upwards.

The Importance of Current Economic Reports

These retail sales reports are influencing predictions regarding a potential rate cut in December. A month ago, there was over an 80% likelihood of a 0.25% rate reduction, but that has now fallen to approximately 61%.

While opinions differ, I believe that a December rate cut is not guaranteed. Following Donald Trump’s recent election victory, Treasury yields surged significantly. The 10-year Treasury yield surged to 4.44%, up from 3.62% in mid-September. Although interest rates have since cooled slightly, they remain relatively high.

The Federal Reserve tends to follow market rates; earlier this year, when rates were decreasing, the Fed indicated it might cut its key rate by up to 1% this year and 0.75% next year. However, as rates have rebounded, this could alter the Fed’s expectations regarding future rate cuts.

During a press conference last week, Fed Chair Jerome Powell declared that Fed policy remains “restrictive,” suggesting a possibility for further key interest rate cuts. He also stated that the Fed is not “in any hurry” to make reductions, leaving the timing uncertain for both December and beyond.

Strategizing for Future Market Trends

A positive environment for stocks persists. The combination of an accommodating central bank and expected economic stimulation from Trump 2.0 positions the market well for growth and continues to show strong quarterly earnings.

Additionally, we’re entering a seasonally favorable period. Historically, markets tend to rally as Thanksgiving approaches, and this positive sentiment often extends into December.

Now is an optimal time to refine your investment portfolio. Tools like Quantum Cash can effectively identify strong stocks suited for this purpose.

If consistent income is a priority, Quantum Cash can deliver reliable payouts across all market conditions—whether bullish, bearish, or steady.

For those feeling the pressure to catch up on retirement savings or seeking to develop an additional income stream, I encourage you to watch my upcoming broadcast here.

Sincerely,

Louis Navellier

Editor, Market360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

Costco Wholesale Corporation (COST)